2Q16 OR reached KRW197.7bn (up 33.3%YoY) and OP KRW18.2bn (up 31.4%YoY, OP margin of 9.2%), which surpassed our OP estimate (KRW17.9bn).

Domestic sales up 29.5%, China sales up 32.4%

2Q16 domestic sales climbed 29.5%YoY, driven by: 1) increased new clients, such as Clio and Memebox and 2) growth in exports to global brands. Export margins are poised to ascend over the mid/long term, considering that: 1) the production of the same products for two to three years will likely lead to steady production costs and 2) automated production facilities enhance productivity. The Shanghai subsidiary grew 32.4%YoY on increased mobile client orders in Beijing and its NP margin came in at 7.3% (up 1.9%pYoY) on productivity gains.

Growth trend likely to continue in 3Q16 following 2Q16

3Q16 OR and OP are projected at KRW178.2bn (up 34.1%YoY) and KRW12.7bn (up 34.8%YoY), looking to sustain a lofty growth trend following 2Q16. Export earnings should further improve ahead as shipments to a new global client will likely be added in 2H16.

BUY kept with target price of KRW200,000

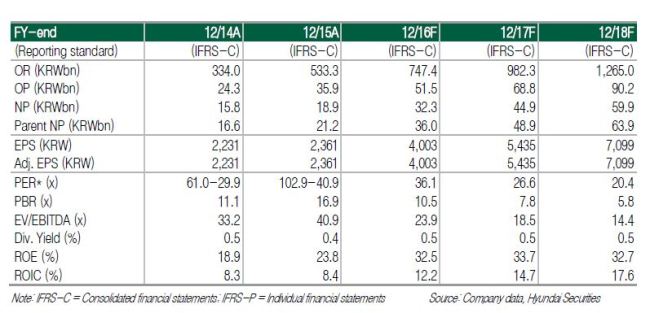

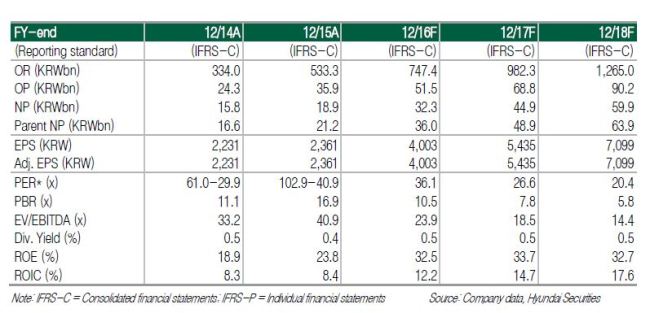

Based on 2Q16 earnings results, we adjust the company’s 2016-17 OP projections up 0.5% and 1.4%, respectively, and EPS projections down 1.2% and up 1.5%, respectively, according to upward revisions to the tax rate for domestic companies. With the earnings estimate revisions being minuscule, we keep BUY with a target price of KRW200,000 and choose COSMAX as our top pick.

Source: Hyundai Securities

Domestic sales up 29.5%, China sales up 32.4%

2Q16 domestic sales climbed 29.5%YoY, driven by: 1) increased new clients, such as Clio and Memebox and 2) growth in exports to global brands. Export margins are poised to ascend over the mid/long term, considering that: 1) the production of the same products for two to three years will likely lead to steady production costs and 2) automated production facilities enhance productivity. The Shanghai subsidiary grew 32.4%YoY on increased mobile client orders in Beijing and its NP margin came in at 7.3% (up 1.9%pYoY) on productivity gains.

Growth trend likely to continue in 3Q16 following 2Q16

3Q16 OR and OP are projected at KRW178.2bn (up 34.1%YoY) and KRW12.7bn (up 34.8%YoY), looking to sustain a lofty growth trend following 2Q16. Export earnings should further improve ahead as shipments to a new global client will likely be added in 2H16.

BUY kept with target price of KRW200,000

Based on 2Q16 earnings results, we adjust the company’s 2016-17 OP projections up 0.5% and 1.4%, respectively, and EPS projections down 1.2% and up 1.5%, respectively, according to upward revisions to the tax rate for domestic companies. With the earnings estimate revisions being minuscule, we keep BUY with a target price of KRW200,000 and choose COSMAX as our top pick.

Source: Hyundai Securities

![[Music in drama] Rekindle a love that slipped through your fingers](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/05/01/20240501050484_0.jpg&u=20240501151646)

![[New faces of Assembly] Architect behind ‘audacious initiative’ believes in denuclearized North Korea](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/05/01/20240501050627_0.jpg&u=20240502093000)