High-end hotels in large U.S. cities are attracting buyers from Hong Kong, China and Singapore seeking to cater to a growing number of affluent Asians traveling abroad.

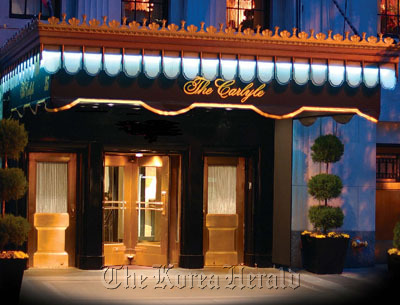

Acquisitions by Asian investors probably will climb to the “low double digits” of all U.S. hotel deals this year, said John Strauss, a managing director for investment sales at Jones Lang LaSalle Hotels in Los Angeles. They accounted for about 8 percent in 2010, according to the brokerage. The most recent transaction came last week, when the family of Hong Kong billionaire Cheng Yu-Tung purchased five luxury properties, including Manhattan’s Carlyle, for $570 million.

Acquisitions by Asian investors probably will climb to the “low double digits” of all U.S. hotel deals this year, said John Strauss, a managing director for investment sales at Jones Lang LaSalle Hotels in Los Angeles. They accounted for about 8 percent in 2010, according to the brokerage. The most recent transaction came last week, when the family of Hong Kong billionaire Cheng Yu-Tung purchased five luxury properties, including Manhattan’s Carlyle, for $570 million.

As U.S. hotel investors and operators, including Starwood Hotels & Resorts Worldwide Inc., turn to Asia for expansion, buyers from China and other countries in the region with fast- growing economies are seeking trophy properties in the U.S. to hedge against inflation and capitalize on a growing and increasingly mobile Asian middle class.

“It is driven by the combination of the strength of the Chinese economy and the relative strength of their currency to the dollar,” Alan Reay, president of Atlas Hospitality Group in Irvine, California, said in a telephone interview. “They obviously see the travel industry as a growth industry, especially with the growing middle class in China, which is increasingly traveling to other parts of the world.”

The Cheng family completed its acquisition of the five hotels from Maritz, Wolff & Co. and Rosewood Corp. on July 29. The purchase included Rosewood Inn of the Anasazi in Santa Fe, New Mexico, and Rosewood Crescent Hotel and Rosewood Mansion on Turtle Creek, both in Dallas. The other property was Rosewood Little Dix Bay in the British Virgin Islands.

That deal followed an agreement in June for a unit of New World Development Co., controlled by the Cheng family, to buy hotel manager Rosewood Hotels & Resorts for $229.5 million from Los Angeles-based Maritz Wolff and Rosewood Corp. Rosewood Hotels, based in Dallas, operates 19 properties including the Carlyle and Rosewood Mansion on Turtle Creek.

Shenzhen New World Group Co., a Chinese property investor, bought the Sheraton Universal Hotel in Los Angeles for $90 million in January, less than a year after paying $63 million for the Marriott Los Angeles Downtown, according to Jones Lang.

“At a local level, Chinese investors are No. 1, Koreans are No. 2, but other Asian investors have really stepped things up,” said James Butler, a partner at Jeffer Mangels Butler & Mitchell LLP. The Los Angeles-based law firm formed a Chinese investment group in July to help hotel investors from that country make purchases in the U.S.

“This is possibly one of the biggest explosions of demand from that part of the world I’ve seen in my career,” he said.

The U.S. lodging industry has been improving after the recession depressed demand in 2009 and 2010. Hotel occupancies in the top 25 U.S. markets climbed to 65 percent in January through May from 62 percent a year earlier, according to Hendersonville, Tennessee-based Smith Travel Research Inc.

During the real estate boom, hotel prices peaked at about $153,000 per room in 2006 then plunged 36 percent to a low two years ago, according to New York-based research company Real Capital Analytics Inc.

“There’s been a perception that the U.S. is on sale as a result of the downturn,” said Strauss of Jones Lang. “There will definitely be an increased interest from Asian investors, particularly in the top three to five U.S. urban markets.”

China’s economy, the biggest in Asia, is forecast to grow twice as fast as the entire world this year. It probably will expand 9.4 percent, according to the median estimate of economists in a Bloomberg survey, compared with the International Monetary Fund’s projection for 4.3 percent global growth as Europe and the U.S. try to reduce budget deficits.

The Chinese yuan rose 5.2 percent against the U.S. dollar in the 12 months through July, while the Taiwanese dollar jumped 11 percent. The Thai baht climbed 8.3 percent, and the Singapore dollar increased 13 percent, the most among major Asian currencies.

The New World transaction “demonstrates the advantage for Asian investors willing to use their relatively lower cost of capital and longer-term investment horizon to acquire strategic investments here in the U.S.,” Flip Maritz, co-founder of Maritz Wolff, said in a telephone interview.

The Cheng family also owns the Beverly Wilshire, a Four Seasons hotel in Beverly Hills, California, and once owned a stake in the Four Seasons Hotel New York.

(Bloobmerg)

![[Music in drama] Rekindle a love that slipped through your fingers](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/05/01/20240501050484_0.jpg&u=20240501151646)

![[New faces of Assembly] Architect behind ‘audacious initiative’ believes in denuclearized North Korea](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/05/01/20240501050627_0.jpg&u=20240502093000)

![[Today’s K-pop] Stray Kids go gold in US with ‘Maniac’](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=642&simg=/content/image/2024/05/02/20240502050771_0.jpg&u=)