[ANALYST REPORT] Tougher environmental regulations credit negative for KEPCO, subsidiaries

By Korea HeraldPublished : July 11, 2016 - 12:29

On July 5, the Korean government raised the minimum amount of electricity that generation companies should produce from renewable sources to 5 percent of each generator’s annual output for 2018, 6 percent for 2019 and 7 percent for 2020, a 0.5-1.0 percentage-point increase from its previous targets under the Renewable Portfolio Standard. The government also said that it aims to boost generators’ direct sales of renewable-sourced electricity to residential and industrial consumers.

These initiatives are credit negative for Korea Electric Power Corp. (Aa2 stable) and its six power generation subsidiaries because they will likely raise the companies’ costs and dilute KEPCO’s market position over the next three to five years.

We believe these initiatives are part of the government’s ongoing efforts to meet its commitments to reduce global greenhouse gas emissions pursuant to the Paris Agreement signed on 22 April, and its stated goal of reducing carbon emissions 37 percent by 2030 from the business-as-usual forecast level. As such, we expect that KEPCO and the gencos will be increasingly exposed to carbon transition risk, which we define as the credit effect of increased costs and business model adjustments associated with the goal of materially reducing global greenhouse gas emissions, including for carbon.

The six gencos are Korea Hydro and Nuclear Power Co., Korea South-East Power Co., Korea East-West Power Co., Korea Midland Power Co., Korea Western Power Co. and Korea Southern Power Co., all of which are rated “Aa2 stable.”

The government estimated that the 0.5-1.0 percentage-point increase from its previous targets (Exhibit 1) will require incremental capital expenditures of around 8.5 trillion won (US$7.4 billion) to develop an additional three gigawatts of renewable-power generation on top of the 10 gigawatts already planned from 2015 to 2020.

We forecast that KEPCO’s funds from operations (FFO)/debt, on a consolidated basis, will decrease by two to three percentage points in 2018-20 from our initial projection of 30-35 percent, assuming KEPCO and its gencos build the majority of the additional renewable energy generators. We expect KEPCO and the gencos to lead the government’s initiatives to expedite renewable development, given their role in implementing the government’s policies for the country’s power sector. However, the government likely will aim to boost the private sector’s investment in renewable development.

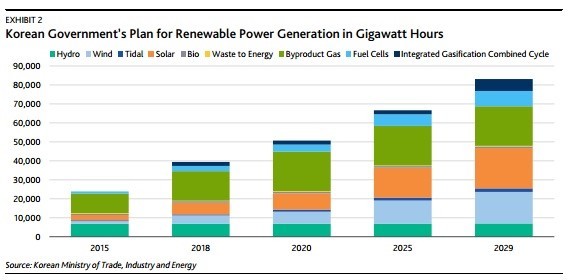

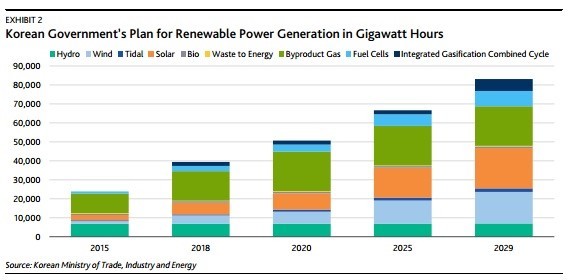

The government seeks to increase the proportion of renewable energy to around 8 percent of Korea’s total power generation volume by 2020 and to around 12 percent by 2029 from around 4 percent in 2015 (Exhibit 2). This target means a significant rise in the gencos’ power generation volume from renewables, such as new wind and solar farms and byproduct gas plants.

We believe KEPCO and the gencos face execution risk associated with the development of renewable energy sources, particularly given the limited availability of land on which to develop these projects. Execution risk includes delays in the start-up of new projects and cost overruns.

We expect that the government’s plan to boost direct sales between power companies that generate renewable energy and consumers will somewhat dilute KEPCO’s market position in the electricity retail sector and its policy role of supplying power. This plan, on top of the previously announced reform to gradually open KEPCO’s retail electricity sales operations to private companies, could signal a shift toward a more market-based and competitive environment. But KEPCO’s core operations of transmission and distribution, and electricity generation through its six gencos will remain largely unchanged over the next 12-18 months.

Source: Moody’s www.moodys.com

These initiatives are credit negative for Korea Electric Power Corp. (Aa2 stable) and its six power generation subsidiaries because they will likely raise the companies’ costs and dilute KEPCO’s market position over the next three to five years.

We believe these initiatives are part of the government’s ongoing efforts to meet its commitments to reduce global greenhouse gas emissions pursuant to the Paris Agreement signed on 22 April, and its stated goal of reducing carbon emissions 37 percent by 2030 from the business-as-usual forecast level. As such, we expect that KEPCO and the gencos will be increasingly exposed to carbon transition risk, which we define as the credit effect of increased costs and business model adjustments associated with the goal of materially reducing global greenhouse gas emissions, including for carbon.

The six gencos are Korea Hydro and Nuclear Power Co., Korea South-East Power Co., Korea East-West Power Co., Korea Midland Power Co., Korea Western Power Co. and Korea Southern Power Co., all of which are rated “Aa2 stable.”

The government estimated that the 0.5-1.0 percentage-point increase from its previous targets (Exhibit 1) will require incremental capital expenditures of around 8.5 trillion won (US$7.4 billion) to develop an additional three gigawatts of renewable-power generation on top of the 10 gigawatts already planned from 2015 to 2020.

We forecast that KEPCO’s funds from operations (FFO)/debt, on a consolidated basis, will decrease by two to three percentage points in 2018-20 from our initial projection of 30-35 percent, assuming KEPCO and its gencos build the majority of the additional renewable energy generators. We expect KEPCO and the gencos to lead the government’s initiatives to expedite renewable development, given their role in implementing the government’s policies for the country’s power sector. However, the government likely will aim to boost the private sector’s investment in renewable development.

The government seeks to increase the proportion of renewable energy to around 8 percent of Korea’s total power generation volume by 2020 and to around 12 percent by 2029 from around 4 percent in 2015 (Exhibit 2). This target means a significant rise in the gencos’ power generation volume from renewables, such as new wind and solar farms and byproduct gas plants.

We believe KEPCO and the gencos face execution risk associated with the development of renewable energy sources, particularly given the limited availability of land on which to develop these projects. Execution risk includes delays in the start-up of new projects and cost overruns.

We expect that the government’s plan to boost direct sales between power companies that generate renewable energy and consumers will somewhat dilute KEPCO’s market position in the electricity retail sector and its policy role of supplying power. This plan, on top of the previously announced reform to gradually open KEPCO’s retail electricity sales operations to private companies, could signal a shift toward a more market-based and competitive environment. But KEPCO’s core operations of transmission and distribution, and electricity generation through its six gencos will remain largely unchanged over the next 12-18 months.

Source: Moody’s www.moodys.com

-

Articles by Korea Herald

![[Weekender] Geeks have never been so chic in Korea](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/05/16/20240516050845_0.jpg&u=)

![[KH Explains] Why Korea's so tough on short selling](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/05/19/20240519050115_0.jpg&u=20240520081646)

![[News Focus] Mystery deepens after hundreds of cat deaths in S. Korea](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/05/17/20240517050800_0.jpg&u=)