[ANALYST REPORT] Korea’s growth to benefit from strong FDI

By Korea HeraldPublished : July 11, 2016 - 12:28

On July 4, Korea’s Ministry of Trade, Industry and Energy announced that foreign direct investment commitments in the first six months of this year increased by 18.6 percent from a year earlier to $10.5 billion, equal to 0.8 percent of 2015 GDP. This is credit positive for Korea (Aa2 stable) because, combined with government initiatives to restructure the Korean economy, these commitments will support economic growth, which has been negatively affected by dampened global demand.

Total FDI commitments of $10.5 billion are the second-highest on record after $12.0 billion in the second half of 2015 (see Exhibit 1). New FDI pledges to the services sector grew 13.7 percent year-on-year to $7.24 billion, while pledges to the manufacturing sector increased 159.6 percent to $2.85 billion. Most of the FDI committed to the services sector is in finance and insurance, business and real estate, which together constitute about 21 percent of nominal gross value added, and contributed 18 percent, on average, to overall real growth over the past 10 years.

By region, FDI commitments from the European Union increased 221.2 percent and account for 40 percent of total commitments. Although FDI commitments do not immediately translate into investment inflows, the correlation between committed and realized FDI is high. Balance-of-payments data from the past 10 years indicates that, on average, 70 percent of FDI commitments tend to be realized.

Higher FDI in the services sector supports the government’s policy objective of fostering productivity in order to move up the value-added chain and produce more profitable, higher-margin products. On July 5, the government unveiled its Service Sector Development Plan, which includes measures such as research and development investment tax credits, easing regulations on market entry and increasing financial support for services to 54 trillion won (US$ 47 billion) by 2020 from 39 trillion in 2015. The government estimates that its plan will add 0.1-0.2 percentage points to annual growth through 2020.

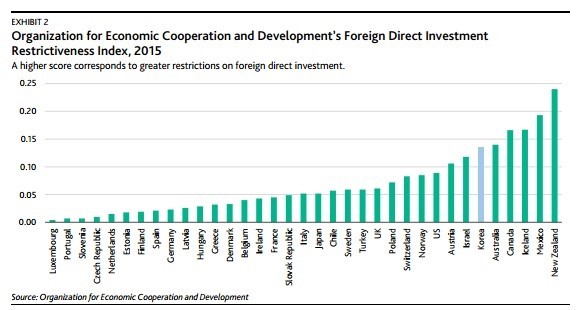

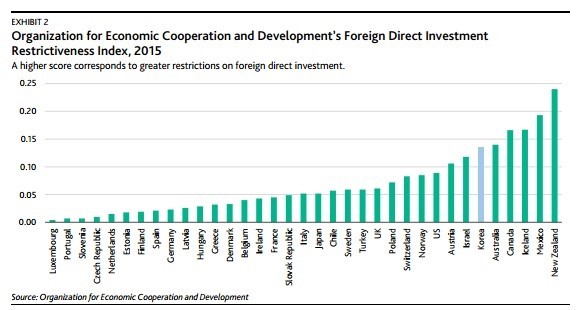

At the same time, the government has been working to reform regulations that limit FDI. In May 2015, the government announced measures that included reducing required documentation for foreign investors, temporarily removing limits to the number of foreign workers in a foreign-invested firm, and allowing 100 percent foreign ownership in the aviation industry, up from less than 50 percent previously. These measures are important because the Organization for Economic Cooperation and Development has stated that Korea’s existing FDI regulations rank among the most restrictive among OECD members (see Exhibit 2).

But the OECD also ranked Korea as the biggest reformer of its FDI policies between 1997 and 2010 among OECD members and key emerging economies including China, Brazil, Indonesia and India. Indeed, restrictions in some of the most heavily regulated sectors such as finance, insurance and retail have eased, and these are the sectors that have received the highest FDI commitments so far this year.

Source: Moody’s www.moodys.com

Total FDI commitments of $10.5 billion are the second-highest on record after $12.0 billion in the second half of 2015 (see Exhibit 1). New FDI pledges to the services sector grew 13.7 percent year-on-year to $7.24 billion, while pledges to the manufacturing sector increased 159.6 percent to $2.85 billion. Most of the FDI committed to the services sector is in finance and insurance, business and real estate, which together constitute about 21 percent of nominal gross value added, and contributed 18 percent, on average, to overall real growth over the past 10 years.

By region, FDI commitments from the European Union increased 221.2 percent and account for 40 percent of total commitments. Although FDI commitments do not immediately translate into investment inflows, the correlation between committed and realized FDI is high. Balance-of-payments data from the past 10 years indicates that, on average, 70 percent of FDI commitments tend to be realized.

Higher FDI in the services sector supports the government’s policy objective of fostering productivity in order to move up the value-added chain and produce more profitable, higher-margin products. On July 5, the government unveiled its Service Sector Development Plan, which includes measures such as research and development investment tax credits, easing regulations on market entry and increasing financial support for services to 54 trillion won (US$ 47 billion) by 2020 from 39 trillion in 2015. The government estimates that its plan will add 0.1-0.2 percentage points to annual growth through 2020.

At the same time, the government has been working to reform regulations that limit FDI. In May 2015, the government announced measures that included reducing required documentation for foreign investors, temporarily removing limits to the number of foreign workers in a foreign-invested firm, and allowing 100 percent foreign ownership in the aviation industry, up from less than 50 percent previously. These measures are important because the Organization for Economic Cooperation and Development has stated that Korea’s existing FDI regulations rank among the most restrictive among OECD members (see Exhibit 2).

But the OECD also ranked Korea as the biggest reformer of its FDI policies between 1997 and 2010 among OECD members and key emerging economies including China, Brazil, Indonesia and India. Indeed, restrictions in some of the most heavily regulated sectors such as finance, insurance and retail have eased, and these are the sectors that have received the highest FDI commitments so far this year.

Source: Moody’s www.moodys.com

-

Articles by Korea Herald

![[Weekender] Geeks have never been so chic in Korea](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/05/16/20240516050845_0.jpg&u=)

![[KH Explains] Why Korea's so tough on short selling](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/05/19/20240519050115_0.jpg&u=20240520081646)

![[News Focus] Mystery deepens after hundreds of cat deaths in S. Korea](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/05/17/20240517050800_0.jpg&u=)