[SUPER RICH] Fraternal war lurks in Lotte Group

Heirs compete to snap up stocks on slow business, lack of founder’s approval

By Korea HeraldPublished : July 14, 2014 - 21:12

The ruthless world of business has torn several wealthy families apart, and Lotte, South Korea’s fifth-largest conglomerate by assets, may become the latest victim of such feuds.

The second generation of the Shin Kyuk-ho clan is apparently vying to win control over the 87.5 trillion won ($87 billion) Lotte Group empire that is involved in everything from confectionary and retail, to construction and high-technology industries across Asia and the United States.

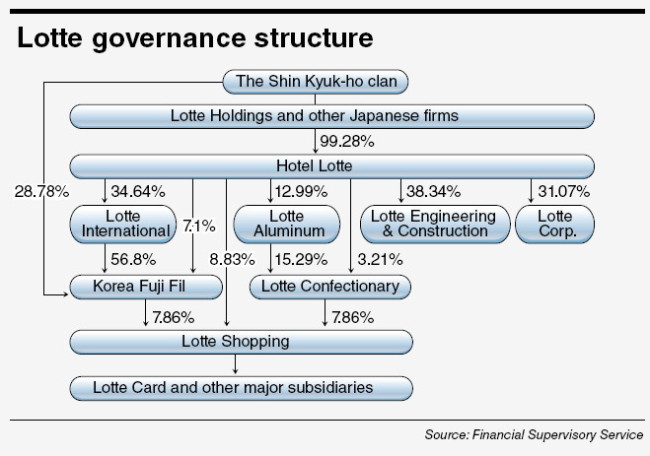

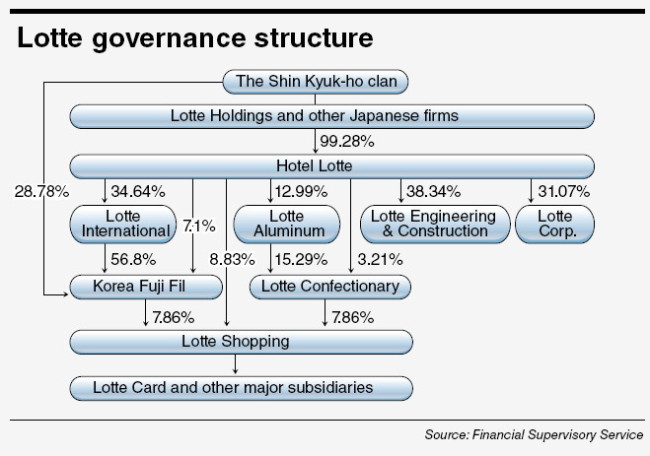

But due to Lotte’s complicated corporate governance structure, it is proving to be difficult for both Shin Dong-joo and Shin Dong-bin ― sons of Lotte founder and general chairman Shin Kyuk-ho ― to achieve their goals.

According to the Financial Supervisory Service, Shin Dong-joo, the eldest son of Shin Kyuk-ho and vice chairman of Lotte Holdings in Japan, purchased a total of 529 shares in Lotte Confectionary between June 25 and July 1 for 1 billion won. His June-July acquisition accounts for 0.04 percent of the total shares, bringing his holdings up to 3.89 percent of the company with a total of 55,226 shares.

Dong-joo is the fifth-largest shareholder following Lotte Aluminum, Lotte Foundation, his father and his younger brother Dong-bin, who is the current chairman of Lotte Group, having taken over the company. Since August 2013, the older of the two brothers has shelled out a total of 10 billion won to snap up Lotte Confectionary stocks.

The move was interpreted as a tit-for-tat response to Dong-bin’s earlier purchase of 6,500 shares in the snack maker last year to raise his stake from 4.88 to 5.34 percent. It also came as a surprise as Dong-joo had mostly stayed out of the limelight, choosing to live a reclusive life in Japan.

The second generation of the Shin Kyuk-ho clan is apparently vying to win control over the 87.5 trillion won ($87 billion) Lotte Group empire that is involved in everything from confectionary and retail, to construction and high-technology industries across Asia and the United States.

But due to Lotte’s complicated corporate governance structure, it is proving to be difficult for both Shin Dong-joo and Shin Dong-bin ― sons of Lotte founder and general chairman Shin Kyuk-ho ― to achieve their goals.

According to the Financial Supervisory Service, Shin Dong-joo, the eldest son of Shin Kyuk-ho and vice chairman of Lotte Holdings in Japan, purchased a total of 529 shares in Lotte Confectionary between June 25 and July 1 for 1 billion won. His June-July acquisition accounts for 0.04 percent of the total shares, bringing his holdings up to 3.89 percent of the company with a total of 55,226 shares.

Dong-joo is the fifth-largest shareholder following Lotte Aluminum, Lotte Foundation, his father and his younger brother Dong-bin, who is the current chairman of Lotte Group, having taken over the company. Since August 2013, the older of the two brothers has shelled out a total of 10 billion won to snap up Lotte Confectionary stocks.

The move was interpreted as a tit-for-tat response to Dong-bin’s earlier purchase of 6,500 shares in the snack maker last year to raise his stake from 4.88 to 5.34 percent. It also came as a surprise as Dong-joo had mostly stayed out of the limelight, choosing to live a reclusive life in Japan.

“There had been a tacit agreement between the brothers that Dong-bin’s stake would remain 1.4 percentage points higher than Dong-joo’s in order to allow the former to keep firm control over the company. At the same time Dong-joo was permitted a secure place in the company,” said an industry insider. “But it seems like Dong-bin’s sudden decision to ramp up his stake has made Dong-joo somewhat perturbed.”

He added that should Dong-joo attempt to narrow the 1.4 percentage point gap, there could be a spat between the brothers.

Lotte Group, however, denied such speculations. “All we can say is that Dong-joo is making a personal investment,” said Han Bo-young, a PR officer at Lotte Group.

Rights to Lotte Confectionary

The reason the market is watching the situation so closely is because of Lotte Confectionary’s significance as the start of the Lotte empire. The company, founded in 1968 as a chewing gum manufacturer, is also a critical part of Lotte’s cyclical shareholding structure, which is said to be the most complicated in the country.

Broken down, Lotte Confectionary owns 7.86 percent of Lotte Shopping, which owns 92.54 percent of the unlisted Lotte Card, which owns around 1.5 percent of Lotte Chilsung Beverage, which in turn owns 3.93 percent of Lotte Shopping. Lotte Shopping also owns 12.05 percent of Lotte Aluminum, which holds a 15.29 percent stake in Lotte Confectionary.

According to the Fair Trade Commission, Lotte has 51 such cyclical shareholding structures within the group that form an intricate web for controlling about 80 affiliates and 120 related businesses.

“There is no doubt that Lotte Confectionary is one of the most important businesses in Lotte, both in terms of the business and the governance structure,” said Lee Kyung-ju, an analyst at Korea Investment and Securities.

“The snack maker has 71.1 billion won in capital, and has issued only 1.42 million stocks, which are traded at 1.92 million won a share as the most expensive stock here. It means the business is small but a very effectively working organization. Given such a background, we can see why Lotte Confectionary stocks have been at the center of the market’s attention,” she added.

Fraternal rivalry

Market watchers suggest that Shin Dong-bin was prompted to purchase more Lotte Confectionary shares due to anxiety over a possible rivalry with his brother Dong-joo.

This is because Lotte is still heavily influenced by its Japan-based sister company Lotte Holdings, which is controlled by the elder brother.

According to the FTC, Lotte Hotel, which serves as Lotte Group’s de facto holding company, is almost entirely owned by Japanese enterprises including Lotte Holdings.

Lotte Hotel, in turn, owns about 35 percent of Lotte International, 56.8 percent of Korea Fuji Film, 8.83 percent of Lotte Shopping, 12.99 percent of Lotte Aluminum, 3.21 percent of Lotte Confectionary, 38.34 percent of Lotte Engineering and Construction, and 31.07 percent of Lotte Holding Company.

What all these figures mean is that while Dong-bin may be the crown prince of Lotte in Korea, he could and may be brought to terms by Dong-joo in Japan.

To make matters worse, a slew of incidents in South Korea have reportedly put the Lotte heir in hot water.

For starters, former Lotte Shopping CEO Shin Heon ― who had been Dong-bin’s right-hand man ― along with 23 other executives, were indicted in a graft scandal in April. “Everything I had worked so hard for has tumbled down,” the chairman reportedly said in an executive meeting.

The delayed construction of the second Lotte World in the Jamsil area of Seoul, based on dreams his father had, is also turning out to be a headache. Mishaps, including the deaths of two construction workers combined with concerns of possible damage the 123-story high-rise is inflicting on Jamsil’s natural environment, have caused the government to be hesitant about giving the building its blessing.

The opening date of the complex has already been postponed, and a second deadline is also likely to be missed, insiders say.

The firm’s overseas businesses also have been far from stellar. Lotte Shopping in the first quarter of this year posted a 55 billion won deficit overseas.

Winning paternal approval

Aside from all the business matters, what is really irking Shin Dong-bin, industry watchers say, is that his father has yet to transfer the business to him.

The 92-year-old general chairman has reportedly bequeathed about 90 percent of his wealth to his children, leaving the Japanese businesses to his older son Dong-joo, who still has enough authority to sway things in Korea. The Korean business ― about 10 times larger than that in Japan ― has been given to Dong-bin, but the elderly Shin still calls the shots over the local Lotte business.

“The general chairman is still reportedly directly placing orders with the CEOs, and he has yet to talk about how he would be dividing up the 10 percent he has in the company, including a 6.83 percent share in Lotte Confectionary. How the stake is handled could be a deal breaker for the Lotte clan,” an observer said.

By Bae Ji-sook (baejisook@heraldcorp.com)

Korea Herald interns Lee Ji-eun and Kim Min-sik contributed to this article. ― Ed.

-

Articles by Korea Herald

![[Weekender] Korean psyche untangled: Musok](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/05/02/20240502050841_0.jpg&u=)

![[Eye Interview] 'If you live to 100, you might as well be happy,' says 88-year-old bestselling essayist](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/05/03/20240503050674_0.jpg&u=)

![[Herald Interview] Director of 'Goodbye Earth' aimed to ask how we would face apocalypse](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/05/03/20240503050732_0.jpg&u=)