Measures announced by the government last week to curb the country’s soaring household debt showed the dilemma policymakers face in handling the local housing market.

The government plans to reduce the supply of new apartments and residential plots by the state-funded Korea Land and Housing Corp. in a bid to hold down mortgage loans seen as the main culprit for the rapid increase in household debt.

But it stopped short of implementing more effective and fundamental measures to cut borrowing by home buyers, such as tighter regulations on the loan-to-value and debt-to-income ratios.

The government plans to reduce the supply of new apartments and residential plots by the state-funded Korea Land and Housing Corp. in a bid to hold down mortgage loans seen as the main culprit for the rapid increase in household debt.

But it stopped short of implementing more effective and fundamental measures to cut borrowing by home buyers, such as tighter regulations on the loan-to-value and debt-to-income ratios.

Kim Deok-rye, an analyst at the Korea Housing Institute, described the government’s prescription as a mix of policies to “maintain demand and control supply.” He noted its effect would be felt in the market in two or three years, rather than in the immediate term.

Policymakers are concerned that curbing household debt too tightly would lead to dampening the property market and drawing the sluggish economy further into a slump.

This lukewarm approach, however, risks exacerbating the debt problem, which is viewed by many economists as a potential time bomb for Asia’s fourth-largest economy. Household debt jumped by 54 trillion won ($48 billion) in the first half of this year to reach an all-time high of 1,257 trillion won at the end of June, according to the Bank of Korea.

A Finance Ministry official said last week stronger steps could be taken “if the situation worsens.” But the market seemed to take little note of his warning.

Less stringent than expected, the latest package of measures to curb household debt is seen to have little negative impact on the market sentiment, at least for the time being, experts say.

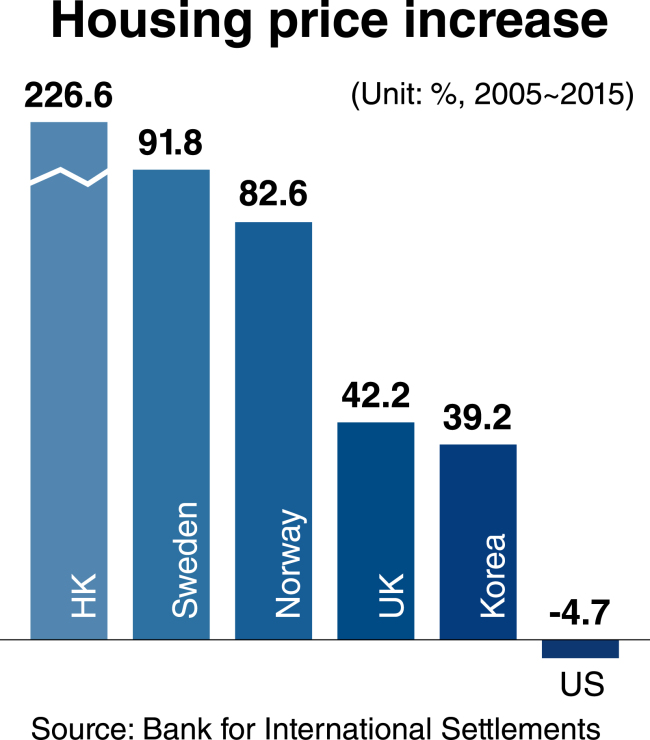

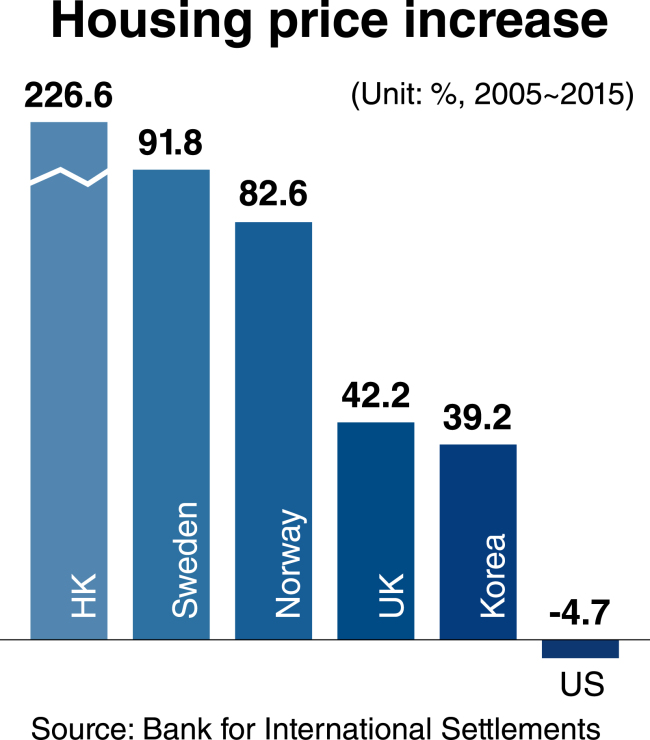

Household prices in the country, mainly underpinned by low interest rates, have forged ahead in recent years. What is notable is an increasing polarization between housing markets in Seoul and provincial cities.

According to industry sources, the number of home transactions in regional areas declined by nearly 25 percent from a year earlier to 118,486 in the May-July period of this year. The decrease was partly attributed to the measure in May to apply strengthened guidelines for bank lending, which had been put into practice in Seoul and the vicinity, across the country.

By contrast, the housing market in the Seoul metropolitan area has been heating up, with the average home price in Seoul exceeding 500 million won this month.

Experts have expressed differing views on the future course of home prices in the country.

Some argue that Korea’s house prices will continue on an upward trend as supply still remains short of meeting demand.

According to analysis by Chae Sang-wook, a researcher at Hana Financial Investment, the number of homes per 1,000 people in Korea stands at 364, compared to 410 in the US, 439 in the UK and 473 in Japan. It’s as low as 347 in Seoul.

In keeping with the growing number of single- or two-person households, the number of households in Korea, which stood at 17.35 million in 2010, is projected to increase by an annual average of 196,000 until 2035, pushing up demand for homes.

Chae said pessimistic views of the housing market have misled many people into renting homes and missing opportunities to buy homes, then struggling with soaring rent prices.

Oh Jung-geun, a professor of finance at Konkuk University in Seoul, cautioned that measures to reduce the supply of homes would result in further increasing rents.

Experts with more cautious views say house prices in the country will fall over the long run, probably beginning in 2019, though not at a steep pace.

Song In-ho, a researcher at the Korea Development Institute, a state-run think tank, noted household assets composition and demographic structure in Korea shows a pattern of changes similar to that of Japan in the 1990s when its home prices began falling.

The proportion of real estate and other nonfinancial assets among Korea’s households has decreased since 2012, when it peaked at 75 percent.

The country’s population aged 15-64 is also projected to begin declining next year after reaching its highest number of 37.04 million this year.

“A shrinking proportion of working-age population should be seen as meaning the number of home buyers is falling and home prices are entering a period of downward trend,” Song said.

By Kim Kyung-ho (khkim@heraldcorp.com)

Policymakers are concerned that curbing household debt too tightly would lead to dampening the property market and drawing the sluggish economy further into a slump.

This lukewarm approach, however, risks exacerbating the debt problem, which is viewed by many economists as a potential time bomb for Asia’s fourth-largest economy. Household debt jumped by 54 trillion won ($48 billion) in the first half of this year to reach an all-time high of 1,257 trillion won at the end of June, according to the Bank of Korea.

A Finance Ministry official said last week stronger steps could be taken “if the situation worsens.” But the market seemed to take little note of his warning.

Less stringent than expected, the latest package of measures to curb household debt is seen to have little negative impact on the market sentiment, at least for the time being, experts say.

Household prices in the country, mainly underpinned by low interest rates, have forged ahead in recent years. What is notable is an increasing polarization between housing markets in Seoul and provincial cities.

According to industry sources, the number of home transactions in regional areas declined by nearly 25 percent from a year earlier to 118,486 in the May-July period of this year. The decrease was partly attributed to the measure in May to apply strengthened guidelines for bank lending, which had been put into practice in Seoul and the vicinity, across the country.

By contrast, the housing market in the Seoul metropolitan area has been heating up, with the average home price in Seoul exceeding 500 million won this month.

Experts have expressed differing views on the future course of home prices in the country.

Some argue that Korea’s house prices will continue on an upward trend as supply still remains short of meeting demand.

According to analysis by Chae Sang-wook, a researcher at Hana Financial Investment, the number of homes per 1,000 people in Korea stands at 364, compared to 410 in the US, 439 in the UK and 473 in Japan. It’s as low as 347 in Seoul.

In keeping with the growing number of single- or two-person households, the number of households in Korea, which stood at 17.35 million in 2010, is projected to increase by an annual average of 196,000 until 2035, pushing up demand for homes.

Chae said pessimistic views of the housing market have misled many people into renting homes and missing opportunities to buy homes, then struggling with soaring rent prices.

Oh Jung-geun, a professor of finance at Konkuk University in Seoul, cautioned that measures to reduce the supply of homes would result in further increasing rents.

Experts with more cautious views say house prices in the country will fall over the long run, probably beginning in 2019, though not at a steep pace.

Song In-ho, a researcher at the Korea Development Institute, a state-run think tank, noted household assets composition and demographic structure in Korea shows a pattern of changes similar to that of Japan in the 1990s when its home prices began falling.

The proportion of real estate and other nonfinancial assets among Korea’s households has decreased since 2012, when it peaked at 75 percent.

The country’s population aged 15-64 is also projected to begin declining next year after reaching its highest number of 37.04 million this year.

“A shrinking proportion of working-age population should be seen as meaning the number of home buyers is falling and home prices are entering a period of downward trend,” Song said.

By Kim Kyung-ho (khkim@heraldcorp.com)

-

Articles by Korea Herald

![[Weekender] Korean psyche untangled: Musok](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/05/02/20240502050841_0.jpg&u=)

![[Eye Interview] 'If you live to 100, you might as well be happy,' says 88-year-old bestselling essayist](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/05/03/20240503050674_0.jpg&u=)

![[Herald Interview] Director of 'Goodbye Earth' aimed to ask how we would face apocalypse](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/05/03/20240503050732_0.jpg&u=)