[AUTO & MOBILITY] Who drives electric vehicles in South Korea?

EVs a practical choice, no longer a fad for early adopters

By Jo He-rimPublished : June 21, 2021 - 16:08

The once-futuristic idea of a car running purely on electricity is no longer a dream. More and more battery-powered electric vehicles are being spotted on the road, as EVs or hybrid cars together form a chunk of new product launches from major automakers these days. .

Though their market share is still tiny, battery electric vehicles are widely expected to overtake conventional gas-fueled cars in the foreseeable future as governments and industries seek a transition to cleaner energy to cut carbon emissions.

According to EV Sales, the combined number of battery electric vehicles and plug-in hybrid cars sold around the globe from January to April this year was slightly over 1.51 million -- triple the number sold in the same period last year.

Some of the world’s largest automotive companies, including General Motors and Volkswagen Group, have already announced plans to migrate entirely to electric vehicles within the next decade. Others are presenting new EVs with decent driving ranges and convenient charging systems, heating up the competition in the market.

So in South Korea, who are the people buying these electric vehicles? What are the reasons of choosing them over more conventional ones?

‘EVs save money in long run’

For Lee Gun-hee, 29, an office worker in Seoul, electric vehicles have been a prime interest since the launch of the BMW i3 here in 2014. At the same time, he was skeptical.

“The idea of running a car purely with electricity was fascinating, but this was not reason enough to purchase one as EVs at the time were rather disappointing, with short driving ranges and weak charging infrastructure,” Lee told The Korea Herald.

The main obstacle was the uncertainty around how far one could drive an electric car without additional charging.

In 2014, the BMW i3 could run for up to 160 kilometers on a single charge, while Kia’s Soul could go 148 km.

It was not until a few years later that automakers began to introduce cars that could cross the country on a single charge. (A trip from Seoul to Busan is about 390 km.) A pioneering model was Tesla’s Model S, launched here in 2017 with a driving range of 426 km.

After years of cautious consideration, it only made sense for Lee to purchase Tesla’s Model 3 last year. While his limited budget was a concern, Tesla’s reputation for performance, along with the low maintenance costs, justified the decision.

“Above all things, Tesla is a cool brand with decent performance, high torque and new technologies such as the autonomous driving mode,” he said.

“But besides that, it also made sense to buy an EV, as it saves maintenance costs down the road and causes less environmental damage.”

The fact that his apartment was fully equipped with an EV charging station further encouraged the purchase, he added.

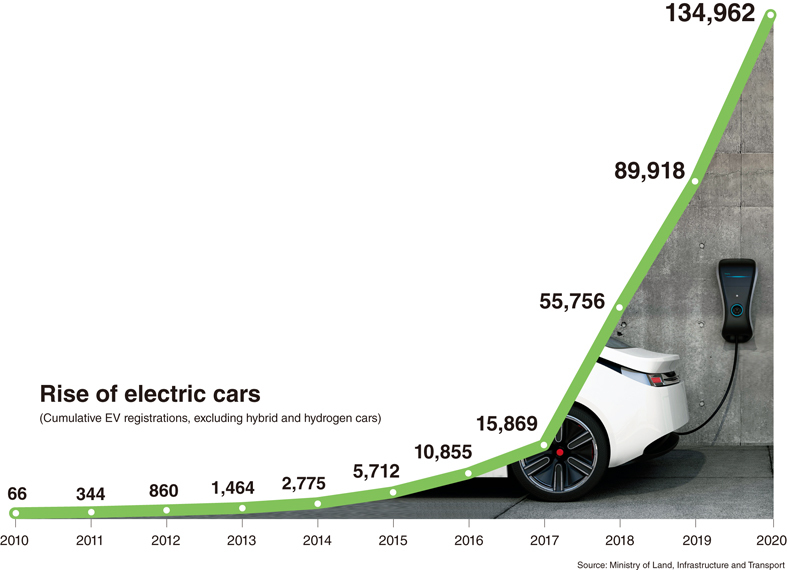

Lee is part of a fast-expanding group of EV users here. The number of registered EVs increased 48 times from 2014 to 2020 and is likely to set a record again this year.

In 2014, there were 2,775 registered EVs, making up 0.01 percent of all vehicles on the road, according to the Transport Ministry.

That number doubled year by year, and by the end of 2019 it had reached 89,918 vehicles.

At the end of 2020, the number was 134,962, with EVs accounting for 0.55 percent of all registered vehicles.

One driver of the fast growth was the generous subsidies offered by the central and regional governments to encourage drivers to choose zero-emission cars. Reflecting the growing popularity of EVs, many regional governments are expecting to see their subsidy budgets run out by the first half of the year.

The subsidy runout could have an impact on EV sales in the second half, but how big that hit will be remains to be seen.

EVs cost roughly 10 million won ($9,000) more than their gas-fueled counterparts with similar specifications. Government subsidies are available for EVs that are priced less than 90 million won. Subsidies also apply to registration fees, electricity fees and parking fees.

EV enthusiasts say even without the car purchase subsidy, electric cars are still a cost-effective choice.

“I bought an EV for my first car, and I spent nothing on fuel during my 20,000-km ride with the car. I paid to refill the window washer fluid twice, and to replace the cabin air filter,” a user posted on a major online community for EV drivers. In South Korea, electricity is far cheaper than gasoline or diesel.

People in their 50s are top buyers of EVs

While one might assume that all the technology that goes into electric vehicles may make drivers skew young, recent data indicates what matters most is the depth of one’s pockets.

Of the 14,917 EVs produced by South Korean automakers and sold here in 2020, people in their 50s were the biggest purchasers, accounting for about 20 percent of all sales -- 2,991 vehicles -- according to data from the Korea Automobile Manufacturers Association.

Those in their 40s were next on the list, buying 2,627 EVs, and those in their 60s purchased 2,013. People in their 30s bought 1,772 EVs, and buyers in their 20s were the smallest segment, purchasing only 466 -- fewer than people in their 70s. Corporate purchases amounted to 4,497 vehicles, or 30.1 percent of the total.

People in their 40s were the biggest buyers of imported EVs, purchasing 600 of the 3,357 imported EVs sold here in 2020, according to the Korea Automobile Importers and Distributors Association. The data did not include Tesla, which sold 11,826 vehicles in 2020, as the company is not a member of the association.

Those in their 30s purchased 503 imported EVs, while those in their 50s were third on the list with 337 imported EV purchases. Buyers in their 20s were second to last with 69 imported EV purchases, followed by 40 imported EV purchases by people over 70.

“From our previous analysis, we thought our major consumer group for EVs would be those in their 30s and 40s. But we do see there are also older customers who have experienced our brand and want to try our electricity-powered vehicles as well,” an official from Mercedes-Benz told The Korea Herald.

The first customer to receive a Mercedes-Benz EQC was an entrepreneur in his 50s for whom it was his second Mercedes, according to the official.

“When the market expands and becomes more stable, there will be more people choosing EVs based on their personal preferences -- on the brand, the design and performance,” she added.

Customer base will diversify with more choices

For now, the EV market is divided roughly by price range, but is soon set to become more diverse in terms of car segment, price and design, as carmakers are adding full momentum to their EV business this year, industry watchers said.

Also, the conventional gap between EVs and internal combustion engine vehicles will continue to narrow, they said.

According to a survey released this month by the KEPCO Research Institute, a corporate research and development subsidiary of the state-run Korea Electric Power Corp., the average monthly mileage for EVs was 1,984 km -- almost double the figure for internal combustion engines, which was 1,053 km.

Of the 1,000 respondents, 65.9 percent used their EVs to commute to work and 38.9 percent drove between 300 and 400 km on a single charge.

Those driving over 400 km on a single charge accounted for 34.4 percent of the total, and those who drove between 200 and 300 km made up 14.7 percent.

EV users charged their cars about 11.6 times a month on average, and the average charging fee was 34,078 won, the survey showed.

“The utility for EVs is getting closer to that of conventional internal combustion engine vehicles, as their driving range and charging infrastructure are increasing,” the research institute said.

“The EV market is in the process of expanding. While EVs may have been an item in a niche market for early adopters, it is now becoming a more common means of transportation, and it will be able to target the mass market soon.”

Hyundai Motor Group’s two auto brands, Hyundai Motor and Kia, released their latest EVs earlier this year and witnessed a record number of preorders.

On Feb. 25, the same day it launched the Ioniq 5, Hyundai Motor received orders for 23,760 of the EVs and as of now has contracts to deliver 40,000, according to the automaker.

Kia received orders for 21,016 of its EV6 model on the day of its launch March 31 -- almost double what the carmaker aimed to produce this year. The starting prices of the Ioniq 5 and the EV6 are 49.8 million won and 49.5 million won, respectively, and both models are eligible for government subsidies of up to 8 million won.

By Jo He-rim (herim@heraldcorp.com)

![[Today’s K-pop] BTS pop-up event to come to Seoul](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/17/20240417050734_0.jpg&u=)

![[KH Explains] Hyundai's full hybrid edge to pay off amid slow transition to pure EVs](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/04/18/20240418050645_0.jpg&u=20240419100350)