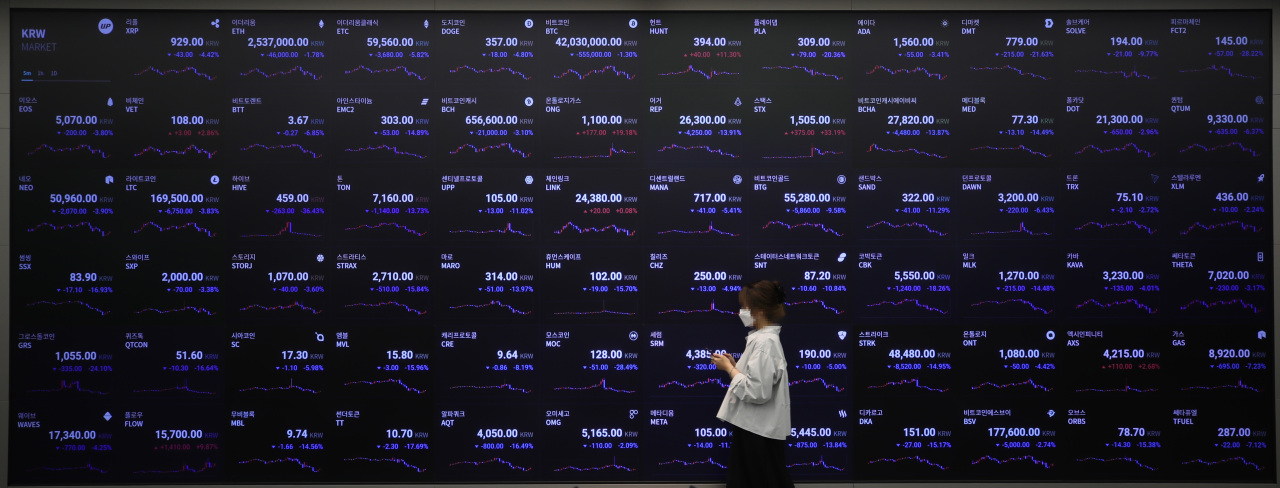

Cryptocurrencies on downward spiral amid tightening regulations

By Park Ga-youngPublished : May 24, 2021 - 16:06

Cryptocurrencies extended a dayslong loss Monday in South Korea before recovering some of their losses in the afternoon, as investors and businesses reacted to strict regulations recently introduced in China and the US.

The price of the largest cryptocurrency Bitcoin stood at about 44 million won ($39,058) in late afternoon trading, losing almost half of its value from only a month ago, according to Upbit, South Korea’s largest crypto exchange by transaction volume. It fell below 40 million won early Monday morning.

Ethereum, the second-largest by market cap, also halved its value from only two weeks ago to 2.5 million won as of 2:00 p.m.

The downward movement of Bitcoin and altcoins, referring to all digital coins other than Bitcoin, began in earnest on May 9, when Bitcoin was worth about 71 million won and Ethereum was at about 5.4 million won, according to Upbit data.

The recent plunge, which appears to be triggered by Tesla and its founder Elon Musk’s reversal on the digital coin in the second weekend of May, continued its downward momentum as financial regulators across the world tightened their grips on cryptocurrencies.

On Friday, Chinese authorities once again called for a crackdown on cryptocurrency mining and trading. A statement from China’s State Council meeting chaired by Vice Premier Liu He said that tighter regulation is needed to protect the country’s financial system. The meeting also banned Bitcoin mining and trading in the country.

In an apparent response to China’s clampdown, crypto exchange Huobi said that it scaled back or suspended some of its services and products including some futures contract trading services and leveraged investment products, according to CoinDesk on Sunday. The company, founded in China and now based in Seychelles, also suspended miner hosting services in China, where much of the energy-consuming Bitcoin mining is carried out for cheap.

Friday’s statement came only a few days after China’s financial authorities and associations jointly announced a warning against cryptocurrency investments.

Joining China’s moves, the US Department of Treasury, said on Thursday that it will require any cryptocurrency transfers worth $10,000 or more to be reported to the tax agency.

Musk, whose remarks in the past had a significant impact on the cryptocurrency markets, failed to stop the downward movement when he said on Twitter on Saturday that he supported cryptocurrencies over fiat currency. He made such comments in his reply to a question about people who are angry at Musk because of cryptocurrencies.

In the second weekend in May, Musk appeared on TV and said Dogecoin, an altcoin that he supported, was a hustle, which dealt a blow to investors that bet on the digital coin.

Tesla further piled on market pressure when it said on May 12 it had halted its plan to accept Bitcoin as payment for its products, citing environmental concerns.

By Park Ga-young (gypark@heraldcorp.com)

![[KH Explains] No more 'Michael' at Kakao Games](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/28/20240428050183_0.jpg&u=20240428180321)

![[Herald Interview] Mistakes turn into blessings in street performance, director says](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/04/28/20240428050150_0.jpg&u=20240428174656)