CJ chief calls for rapid global expansion

CJ chairman’s LA meeting likely convened to emphasize investment in US, not China

By Kim Da-solPublished : Dec. 16, 2018 - 15:52

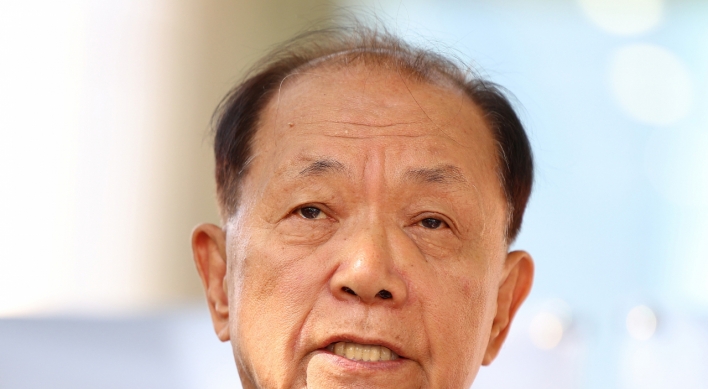

South Korean food-to-entertainment conglomerate CJ Group Chairman Lee Jay-hyun urged CJ retailers to work aggressively to expand their business globally, reiterating the corporate vision of becoming the world’s No. 1 lifestyle and culture company.

According to CJ, Lee presided over a meeting with the group’s CEOs on Friday in Los Angeles and asked them to seek a stronger presence in foreign markets with products encompassing CJ’s four business pillars: food, culture, bioindustry and logistics. The chairman did not mention specific investment targets or which specific markets he intended to target.

According to CJ, Lee presided over a meeting with the group’s CEOs on Friday in Los Angeles and asked them to seek a stronger presence in foreign markets with products encompassing CJ’s four business pillars: food, culture, bioindustry and logistics. The chairman did not mention specific investment targets or which specific markets he intended to target.

Saying CJ’s global business had shown less-than-impressive progress for the past 13 years, Lee told the audience there was no time to spare and that the new year would be a pivotal time for the conglomerate’s growth.

“The year 2019 is an important time for us, there’s no turning back. There should be strategies and innovation plans to execute with a sense of desperation,” he was quoted as saying by CJ representatives.

It was the first executive-level meeting held overseas in six years. In 2012, the group’s leaders met in Vietnam and China.

The meeting was attended by some 50 executives including CJ Group Vice Chairman Park Keun-hee, CJ Corporation CEO Kim Hong-ki, CJ CheilJedang CEO Shin Hyun-jae, CJ Logistics CEO Park Keun-tae and CJ ENM CEO Heo Min-hoi.

CJ has increasingly made inroads into the US market in recent years, after exploring markets in China and Vietnam.

In August, the group acquired a 90 percent stake in US logistics company DSC Logistics for 231 billion won ($203 million), pursuing its objective to become one of the world’s top five logistics companies.

Last month, CJ also acquired a majority stake in the Minnesota-based frozen food company Schwan’s, amounting to 80 percent of Schwan’s as well as subsidiaries that focus on retail foods, grocery channels and food-service venues.

The 2 trillion won acquisition was the group’s biggest M&A deal since the 1.8 trillion won buyout in 2011 of Korea Express, which gave birth to CJ Logistics.

The group also inked partnership deals between CGV and North American movie theater chain Regal Cinema to export its screen technology ScreenX.

Market watchers say the US market is essential for Korean retailers to win global recognition, particularly in light of the already saturated domestic retail market.

The US is considered one of the largest retail markets around the world, with local consumers’ average spending in November and December estimated at around $717 billion annually.

Industry insiders also point to the geographical significance of the US market, saying the US can serve as a test bed for expansion into neighboring countries such as Canada and Mexico.

The situation is similar for other Korean retail conglomerates.

Earlier this month, Shinsegae Group’s discount store chain, E-mart, acquired US-based Good Food Holdings for $270 million -- the company’s first acquisition of an overseas company.

E-mart said the goal of the acquisition was to stabilize its business operations in the US and expand its presence there.

In 2019 it plans to open a premium store-restaurant in LA called PK Market.

Shifting attention away from China has also played a part, according to experts.

Unlike in China, where external factors including politics have a significant influence on consumer sentiment, the US presents fewer risks and consumers there have enormous spending power, experts said.

After 20 years of operating in the Chinese market, Shinsegae decided last year to pull its business from China amid dwindling sales.

Although the company cited “various factors,” market watchers said the exit was fueled by continuing anti-Korean sentiment among Chinese consumers, following the intergovernmental row over the installment of an American anti-missile system in Korea.

By Kim Da-sol (ddd@heraldcorp.com)

![[KH Explains] No more 'Michael' at Kakao Games](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/28/20240428050183_0.jpg&u=20240428180321)

![[Herald Interview] Mistakes turn into blessings in street performance, director says](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/04/28/20240428050150_0.jpg&u=20240428174656)