Ediya says its coffee beans better than Starbucks'

Homegrown coffee franchise plans to open first overseas branch in Bangkok in 2017, aims for 1 trillion won in sales by 2020

By Sohn Ji-youngPublished : March 31, 2016 - 16:18

Despite intensifying competition from foreign brands, South Korea’s homegrown coffee franchise Ediya Coffee on Wednesday expressed “high confidence” in its ability to stay ahead of the game, highlighting the exclusive quality of its coffee beans.

“Ediya Coffee uses better quality coffee beans than those used by Starbucks,” Ediya Coffee president and CEO Moon Sung-ki told reporters in a press conference in Seoul to mark the company’s 15th anniversary.

Whereas Starbucks Korea imports coffee beans roasted in the U.S. prior to delivery to Korea, Ediya -- which purchases its beans from local coffee manufacturer Dongsuh Foods -- roasts its coffee beans locally, delivering fresher quality coffee, Moon claimed.

“Ediya Coffee uses better quality coffee beans than those used by Starbucks,” Ediya Coffee president and CEO Moon Sung-ki told reporters in a press conference in Seoul to mark the company’s 15th anniversary.

Whereas Starbucks Korea imports coffee beans roasted in the U.S. prior to delivery to Korea, Ediya -- which purchases its beans from local coffee manufacturer Dongsuh Foods -- roasts its coffee beans locally, delivering fresher quality coffee, Moon claimed.

“Dongsuh Foods ranks around fifth place in the world’s coffee bean market, as a maker of high-quality coffee beans,” said the Ediya CEO, displaying a high level of trust in its supplier.

Founded in 2001, Ediya is considered Korea’s most successful homegrown coffee franchise, operating the largest number of outlets here. It has been growing by about 20 percent annually since 2012, with sales reaching 132.5 billion won ($116 million) as of last year.

Its unique strategy of opening small shops in subprime locations -- as opposed to running large-scale stores in city centers as do most established coffee chains -- has enabled the brand to offer premium coffee at lower prices, appealing to customers on a tighter budget.

Looking ahead into the future, Ediya is aiming to record 1 trillion won in sales by 2020 and cement its position in Korea’s increasingly competitive coffee franchise market.

To do so, it plans to expand its outlets in and out of Korea, upgrade its product quality through research and communication with customers and to strengthen its marketing strategies over the next five years.

The coffee franchise, which now operates around 1,800 stores in Korea, is looking to drive up this number to 3,000 outlets by 2020 and to embark onto global markets starting from 2017.

Ediya’s first overseas branch will likely open in Bangkok, perceived as a strategic location for the brand’s future expansion in the Southeast Asian market. The firm plans to enter Bangkok entirely on its own, putting forward 100 percent of the necessary investment.

“Bangkok is a large city in which we could potentially open more than 100 coffee shops. It is also connected by land to countries like Vietnam and Cambodia,” he said. “It’s also an English-speaking location, which would later help us enter the U.S. market.”

As for Ediya’s potential entry into China, Moon said “that would come after success in the U.S.” Given Chinese cities require high rental fees and large spaces for new stores, China is a “difficult market,” he said.

Through continued overseas expansion, Ediya is hoping to capture about 100 billion won in overseas sales by 2020.

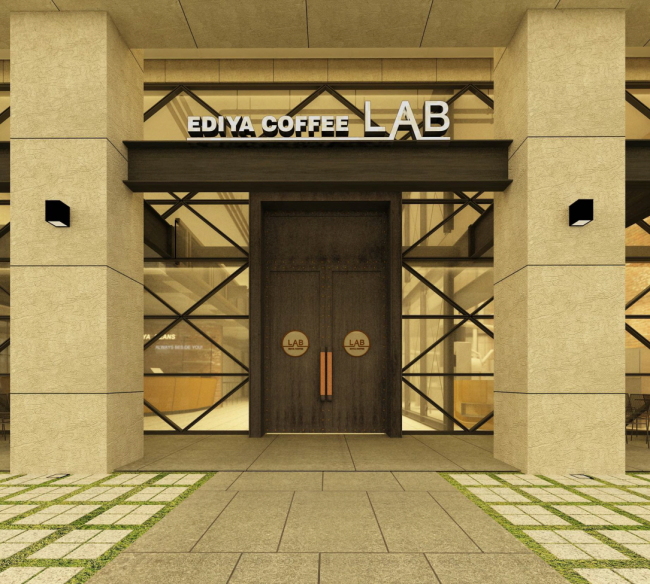

The company has also opened the “Ediya Coffee Lab” on the first floor of its new headquarters in Gangnam. The space will serve as both a new coffee research and development center as well as a specialized Ediya cafe, offering premium coffee and baked goods for customers.

“Though some perceive our Coffee Lab as a move to enter the high-end coffee franchise market, Ediya plans to continue being a brand that offers quality coffee at reasonable prices,” Moon said.

Ediya holds high prospects for its self-developed instant ground coffee brand Beanist as well, with aims to more than triple its sales from just 3 billion won last year to 10 billion won by the end of this year.

“We will continue to lead Korea‘s coffee consumption culture as a home-grown brand that does not pay out royalties abroad,” Moon said.

By Sohn Ji-young (jys@heraldcorp.com)

![[Weekender] How DDP emerged as an icon of Seoul](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/25/20240425050915_0.jpg&u=)

![[Music in drama] An ode to childhood trauma](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/25/20240425050929_0.jpg&u=)

![[Herald Interview] Mistakes turn into blessings in street performance, director says](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/04/28/20240428050150_0.jpg&u=20240428174656)