Slowing growth coupled with price rises poses dilemma for policymakers

The Bank of Korea froze its key interest rate at 3.25 percent a year for a fourth consecutive month in October in a move that analysts said placed worries over growing external uncertainties ahead of inflation concerns.

A report by the central bank said at the time the downside risks to the economy were increasing due to worsening external factors such as the eurozone’s sovereign debt crisis and slowdowns in major countries.

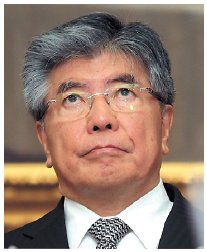

Announcing the widely-expected decision, however, BOK Governor Kim Choong-soo attempted to put a lid on expectations of high inflation.

“Our policy direction toward monetary normalization remains unchanged,” he said, adding that there was no discussion on rate cuts during a meeting of monetary committee members.

Consumer prices rose by an average of 4.5 percent for the first nine months of this year, exceeding the central bank’s target ceiling of 4 percent. In September, the consumer price index climbed by 4.3 percent, easing from 5.3 percent a month earlier. But analysts noted that the slower pace was attributed mainly to seasonal factors, saying the remainder of the year is likely to see upward pressure due to planned hikes in public service fees and higher import prices resulting from the weakening of the Korean won against the U.S. dollar.

They say it is not the time to lower the guard against inflation, with some predicting price hikes may hit 5 percent or higher in the coming months before showing signs of stabilization early next year.

Korea has seen prices increase at a steeper pace than other member states of the Organization for Economic Cooperation and Development. Core inflation, a measure of inflation which excludes certain items with volatile price movements, notably food and energy, rose 3.9 percent in September, compared to the OECD average of less than 2 percent.

What troubles central bank and government policymakers is that price hikes have been coupled with slowing growth. Figures from Statistics Korea show the year-on-year growth rate of the country’s real gross domestic product decreased from 8.5 percent in the first quarter of 2010 to 3.4 percent in the second quarter of this year. The GDP growth rate is estimated to have remained little changed in the third quarter, according to the Samsung Economic Research Institute. The growth rate for this year will likely miss the government target of 4.5 percent, which was revised down from the initial goal of 5 percent.

Private think tanks forecast Korea’s GDP growth will hover below its estimated growth potential of 3.8 percent next year as the global economy continues to weaken.

According to the SERI, Korea’s real GDP is projected to expand 3.6 percent in 2012. The LG Economic Research Institute and the Hyundai Research Institute estimated the growth rate will reach 3.6 percent and 4 percent, respectively. A foreign investment bank painted a more gloomy picture of Asia’s fourth-largest economy, predicting it will grow 2.8 percent.

Such forecasts have made the government’s prediction of 4.8 percent seem too rosy. Finance Minister Bahk Jae-wan has conceded persistent downside risks may lead the government to consider revising down its growth target.

Debate over stagflation

The prolonged coupling of inflation and sluggish growth has recently sparked a debate over whether the Korean economy is entering a phase of stagflation, which means low economic growth accompanied by high inflation.

Some experts have argued the economy is on the brink of stagflation or is already there.

“There is a high possibility that the economy could be entering stagflation,” said Lee Man-woo, professor of economics at Korea University. He said that while the global economic downturn and sluggish domestic demand will hold down growth, inflation pressure is likely to remain high as the weakening won makes imported goods more expensive. BOK figures showed the Korean won appreciated against the greenback at the steepest rate among 21 major currencies for months since the downgrading of the U.S. sovereign credit rating in August.

“Once the stagflation phase is set, it would continue for a considerable period of time, probably more than a year,” Lee said.

Kim Dong-hwan, research fellow at the Korea Institute of Finance, also argued in a recent report that the Korean economy could be hit by stagflation. He said the growth dynamics of export-oriented large corporations has reached its limit as the country’s producer goods prices are vulnerable to fluctuations in foreign exchange rates and demands from major export markets have been slumping. In these circumstances, a continuous increase in import prices would lead to the long-term coupling of low growth and inflation, he said.

The researcher believes the stagflation phase would not last long before causing deflation, a more serious threat to the economy.

Jun Sung-in, professor of economics at Hongik University, was firm in his view that the economy has already entered stagflation. He noted the growth rate has fallen below the growth potential while prices have surpassed the target ceiling, predicting the economic slump will continue for quite a long time.

But other analysts at private think tanks said it is too early to conclude stagflation has hit or is just around the corner.

Chung Jin-young, research fellow at the SERI, said the growth rate for next year, while remaining sluggish, is still expected to outpace inflation estimated to reach 3.4 percent. Shin Chang-mock, another research fellow at the institute, also noted it needs more caution to diagnose the current economic situation as entering stagflation.

“The growth is certainly slowing down but it does not mean the economy is in prolonged recession,” he said.

Lee Geun-tae, research fellow at the LG Economic Research Institute, expressed a similar view, saying that while the downside risks may grow, the economy is still some distance from recession.

External impact

Whatever position taken in the argument over stagflation, the current economic situation has left officials at the central bank and government with the policy dilemma of shoring up economic vitality without sending prices spiraling.

Concerns are mounting over the increasing impact of the global economic slowdown on the local economy. The performances of major companies, especially export-oriented businesses, sharply dropped in the third quarter, forcing them to scrap or cut down on investment plans.

A recent survey of executives at the 20 largest groups showed they expected the economy would not rebound by the third quarter of next year.

What worries corporate officials and economists here most is the slowdown in China’s economy. While the global economy is teetering on the brink of a double-dip recession, Korea has been doing relatively well as China’s growth engine has steamed ahead until recently. China’s proportion of Korea’s overseas trade volume increased from 9.4 percent in 2000 to 20.3 percent for the first nine months of this year.

Partly because of reduced exports to crisis-hit Europe, its largest export market, China saw its year-on-year GDP growth rate decline from 9.5 percent in the second quarter to 9.1 percent in the third quarter, the slowest pace for the world’s second-largest economy since early 2009. The growth rate is expected to fall below 9 percent, though experts agree China, with its huge foreign reserves, will be able to avoid a hard landing. Still analysts here note a 1 percent reduction in China’s growth translates into up to a 0.5 percent cut in Korea’s GDP expansion. Korea’s exports to China, which rose by an average of 17 percent for the eight months up to August from a year earlier, slowed down by 1.6 percentage points in September, according to figures from the Korea International Trade Association.

Proper policy mixture

Experts have made various suggestions on the proper mixture of policies to keep economic growth sustainable while containing price hikes.

Many expect and advise the central bank to leave the rate unchanged for the time being to cope with the downside risks posed by the global economic slowdown.

Analysts said the BOK’s decision to freeze the rate for four consecutive months reflects the dilemma it is facing in keeping inflation in check and yet taking into consideration that a rate hike at this point could undermine growth. Prolonged inaction of the central bank is also drawing complaints from consumers who see their livelihoods deteriorating.

But what further complicates the central bank’s decision is that rate hikes will create a heavier household debt burden, leading to a slump in the property market, which could bring in a long recession.

Household debt, which stood at 595.4 trillion won ($527.2 billion) in 2007, increased to 826 trillion won as of the end of June, according to BOK figures. A SERI report estimated households would have to pay 4.5 trillion won more annually to service their debt if rates increase at an average of 2 percent, leaving many unable to make repayments.

Professor Lee suggested the central bank act quickly to increase rates as soon as the economic situation shows signs of improvement to ease inflation pressure.

But some economists suspect the BOK may be pressured to cut the rates to stimulate the economy in the first half of next year if the growth falls short of the target. Under such circumstances, the ruling party will likely heighten pressure on the central bank and government policymakers to take measures to boost the economy as it competes with opposition groups in the parliamentary and presidential elections set for April and December, respectively.

Lee of the LGERI said it is not desirable to attempt to stimulate the economy to the point of hampering the government plan to achieve a balanced budget by 2012.

“For the coming period, we should endure a moderate economic slowdown,” he said.

Experts note measures should be taken to expand growth potential, increase industrial efficiency and lessen waste in the welfare system and other government expenditures.

Kim, the KIF researcher, suggested reducing the country’s reliance on exports by investing more in natural resources development, nurturing green industries such as alternative energy and supporting competitive small businesses in the field of new growth engines.

By Kim Kyung-ho (khkim@heraldcorp.com)

-

Articles by Korea Herald

![[KH Explains] No more 'Michael' at Kakao Games](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/28/20240428050183_0.jpg&u=20240428180321)

![[Weekender] How DDP emerged as an icon of Seoul](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/25/20240425050915_0.jpg&u=)

![[Herald Interview] Mistakes turn into blessings in street performance, director says](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/04/28/20240428050150_0.jpg&u=20240428174656)