[News Focus] Gasoline prices set to bounce back amid reduced output

By Kim Yon-sePublished : Feb. 19, 2019 - 12:48

SEJONG -- The nation’s gasoline prices have seen a sharp drop over the past few months, and to a certain extent this eased the financial burdens of ordinary people and small business owners amid economic difficulties.

After peaking at 1,690.31 won ($1.50) per liter on Nov. 4, gasoline prices fell below 1,350 won on Jan. 12 before sinking to 1,342.24 won on Feb. 15. This month’s low marked a 20.5 percent drop from three months earlier and the lowest level seen in 35 months. Gasoline prices posted 1,341.69 won on March 10, 2016, data from the Korea National Oil Corp. showed.

Research analysts attribute the price drop to a surplus in crude inventory throughout the world.

But from Feb. 16 to 18, gasoline prices reflected the recent rebound in international crude prices, inching up for a third consecutive trading day.

After peaking at 1,690.31 won ($1.50) per liter on Nov. 4, gasoline prices fell below 1,350 won on Jan. 12 before sinking to 1,342.24 won on Feb. 15. This month’s low marked a 20.5 percent drop from three months earlier and the lowest level seen in 35 months. Gasoline prices posted 1,341.69 won on March 10, 2016, data from the Korea National Oil Corp. showed.

Research analysts attribute the price drop to a surplus in crude inventory throughout the world.

But from Feb. 16 to 18, gasoline prices reflected the recent rebound in international crude prices, inching up for a third consecutive trading day.

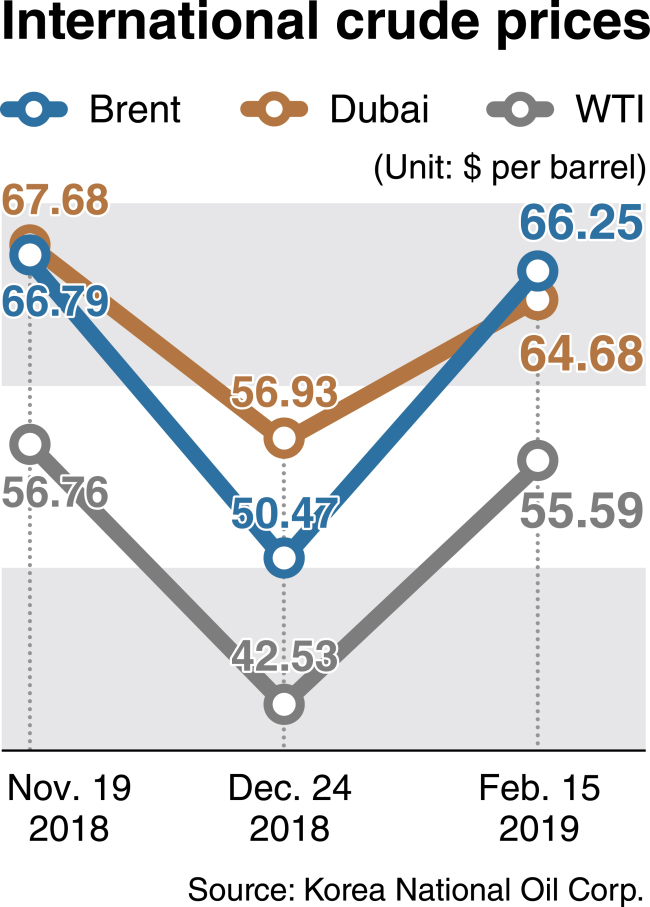

Brent crude hovered around $66.57 per barrel during the Feb. 18 trading session, having risen 31.9 percent since Dec. 24, when it was $50.47 per barrel. West Texas Intermediate crude recorded a 32.0 percent surge during the same period, from $42.53 to $56.15.

Prices of Dubai crude, which accounts for the largest portion of South Korea’s oil imports, climbed more than 20 percent for the first seven weeks of this year and hovered around $64-65 as of Feb. 18.

All three major products showed a V-shaped bounce back during the November 2018-February 2019 period.

The short-term spike in crude prices is the result of a cut in output among members of the Organization of Petroleum Exporting Countries.

In particular, the largest producer and the OPEC chair, Saudi Arabia, slashed its daily crude oil production by 797,000 barrels in January, compared with the previous month. The country is reportedly planning further cuts in March.

Goldman Sachs has revised its outlook for Brent crude prices. While the investment bank predicted in January that they would remain at $62.50 per barrel on average this year, it later released an estimate of up to $67.50 for the second quarter.

Bank of America predicted in a recent report that Brent crude would be traded at an average of $70 this year.

As oil prices bounce back, local industries appear to be paying closer attention.

Air carriers, which suffered worsening profitability between 2016 and 2018 due to continuous crude price hikes, were expecting a turnaround after the fourth quarter of 2018.

“We were reinvigorated by the price plunge in late 2018 and early 2019. But we are again keeping a close eye on daily crude prices due to the rebound,” said a managing director in the air carrier industry. Nevertheless, he added, oil prices in the near term are unpredictable despite the supply cuts some analysts predict.

Kiwoom Securities research analyst Ahn Ye-ha was quoted by a news organization as saying, “There is little chance that (an output) reduction among Middle Eastern countries will cause a spike in international crude prices. This is because the US is increasing the supply of crude.”

Ahn forecast that prices would stabilize between $50 and $60 this year.

Korea’s major industries, including oil refiners and overseas plant builders, generally gain profitability when crude prices go up. “However, stable profitability and favorable effects on the nation’s overall economy are possible when oil prices are stabilized at around $50,” said a brokerage analyst in Yeouido, Seoul.

If the prices break through the psychological barrier of $65, refiners and other oil-sensitive industries will see their profit margins deteriorate, he said. “In past decades, any surge in oil prices (inevitably led to) a spike in raw material import prices, which posed a heavy burden on the economy.”

A senior official based at the Central Government Complex in Sejong City said ordinary households, based on common sense, would not welcome rising gas and diesel prices due to the growing burden of fuel costs.

By Kim Yon-se (kys@heraldcorp.com)

![[Weekender] How DDP emerged as an icon of Seoul](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/25/20240425050915_0.jpg&u=)

![[Music in drama] An ode to childhood trauma](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/25/20240425050929_0.jpg&u=)

![[Herald Interview] Mistakes turn into blessings in street performance, director says](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/04/28/20240428050150_0.jpg&u=20240428174656)