Analysts see no rate hike through Q1 next year

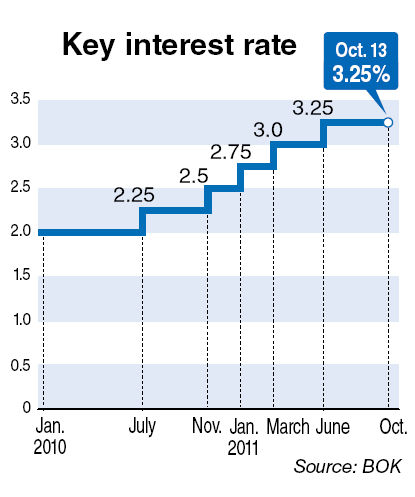

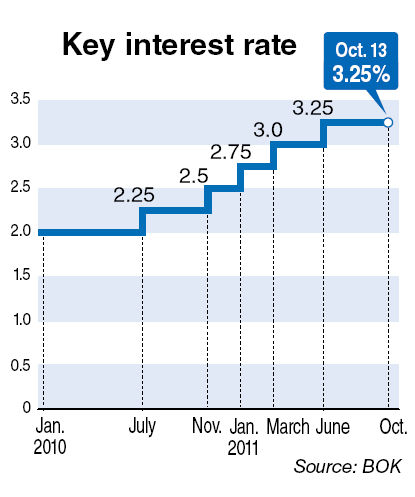

The Bank of Korea kept the key interest rate steady at 3.25 percent for the fourth straight month on Thursday, as worries over the weakening global economy outweighed concerns about the country’s high inflation.

“The global economy is forecast to stage a slow recovery, but the downside risks to growth have risen due to the possibility that the eurozone’s sovereign debt problem might spread further and the slowdown in major economies might deepen,” said BOK Gov. Kim Choong-soo, at a news conference on Thursday.

Kim and his monetary committee members unanimously agreed to freeze the benchmark seven-day repurchase rate at 3.5 percent, a move that was widely expected as the central bank found no breakthrough bar keeping still, stranded between prospects of slower growth abroad and high consumer prices at home.

The BOK has raised borrowing costs by 1.25 percent since last July to combat inflation risks, but switched to pause mode in June and kept the rate steady for four months in a row, sparking speculation about whether it has any will to normalize monetary policy and tame inflation.

“The central bank’s policy direction toward monetary normalization remains unchanged, but its timing will depend on foreign and domestic economic conditions,” Kim said in response to a question about the bank’s stance.

The eurozone debt problem is still unfolding in a way that makes investors jittery and the recession worries over the U.S. economy are growing. The global economy, according to the IMF World Economic Outlook, grew 3.7 percent in the second quarter, slowing from 4.3 percent in the first quarter.

The Korean economy, which depends heavily on exports for its growth, saw its current account surplus fall to a seven-month low of $401.3 million in August as exports lost momentum on slowing demand from advanced countries.

Consumer prices rose 4.3 percent in September, easing from 5.3 percent a month earlier, but the figure marked the ninth consecutive month in which it remained above the BOK’s target ceiling of 4 percent. Core inflation also reached 3.9 percent, and is expected to stay at or above the current level for a while.

“Inflation will be stabilized at a slow pace down the road but it might continue to be above the target,” Kim said, admitting that the central bank might miss the whole-year inflation target of 4 percent.

Analysts said that though consumer prices eased last month, it is too early to conclude that inflation concerns should be placed on the back burner of the central bank’s decision-making.

The slower growth of consumer prices in September was helped by seasonal factors, and the remainder of the year is likely to see upward pressure due to the planned hikes in gas prices and bus fares, and higher import prices resulting from the weakening of the Korean won against the greenback.

“Concerns about inflation still remain, possibly until the end of this year,” said Lee Chul-hee, economist Tongyang Securities. “The inflation might hit 5 percent or higher in November before stabilizing back to around 3 percent early next year.”

Lee said the central bank will leave the rate unchanged through the first quarter of next year, a view that is increasingly shared by other analysts, and even a rate cut aimed at stimulating the economy might come at the beginning of the second quarter if the preceding quarter turned out to be far worse than expected.

Analysts said the rate decision on Thursday reflects the dilemma facing the BOK: its primary job is to keep inflation in check, but it cannot help taking into considerations that a rate hike at this point could undercut the local economy’s growth; at the same time, prolonged and widely expected inaction of the BOK is sparking complaints from consumers who see their quality of life deteriorating.

The BOK said it will closely monitor the financial and economic risk factors both at home and abroad, and implement monetary policy while focusing on both price stability and economic growth.

By Yang Sung-jin (insight@heraldcorp.com)

The Bank of Korea kept the key interest rate steady at 3.25 percent for the fourth straight month on Thursday, as worries over the weakening global economy outweighed concerns about the country’s high inflation.

“The global economy is forecast to stage a slow recovery, but the downside risks to growth have risen due to the possibility that the eurozone’s sovereign debt problem might spread further and the slowdown in major economies might deepen,” said BOK Gov. Kim Choong-soo, at a news conference on Thursday.

Kim and his monetary committee members unanimously agreed to freeze the benchmark seven-day repurchase rate at 3.5 percent, a move that was widely expected as the central bank found no breakthrough bar keeping still, stranded between prospects of slower growth abroad and high consumer prices at home.

The BOK has raised borrowing costs by 1.25 percent since last July to combat inflation risks, but switched to pause mode in June and kept the rate steady for four months in a row, sparking speculation about whether it has any will to normalize monetary policy and tame inflation.

“The central bank’s policy direction toward monetary normalization remains unchanged, but its timing will depend on foreign and domestic economic conditions,” Kim said in response to a question about the bank’s stance.

The eurozone debt problem is still unfolding in a way that makes investors jittery and the recession worries over the U.S. economy are growing. The global economy, according to the IMF World Economic Outlook, grew 3.7 percent in the second quarter, slowing from 4.3 percent in the first quarter.

The Korean economy, which depends heavily on exports for its growth, saw its current account surplus fall to a seven-month low of $401.3 million in August as exports lost momentum on slowing demand from advanced countries.

Consumer prices rose 4.3 percent in September, easing from 5.3 percent a month earlier, but the figure marked the ninth consecutive month in which it remained above the BOK’s target ceiling of 4 percent. Core inflation also reached 3.9 percent, and is expected to stay at or above the current level for a while.

“Inflation will be stabilized at a slow pace down the road but it might continue to be above the target,” Kim said, admitting that the central bank might miss the whole-year inflation target of 4 percent.

Analysts said that though consumer prices eased last month, it is too early to conclude that inflation concerns should be placed on the back burner of the central bank’s decision-making.

The slower growth of consumer prices in September was helped by seasonal factors, and the remainder of the year is likely to see upward pressure due to the planned hikes in gas prices and bus fares, and higher import prices resulting from the weakening of the Korean won against the greenback.

“Concerns about inflation still remain, possibly until the end of this year,” said Lee Chul-hee, economist Tongyang Securities. “The inflation might hit 5 percent or higher in November before stabilizing back to around 3 percent early next year.”

Lee said the central bank will leave the rate unchanged through the first quarter of next year, a view that is increasingly shared by other analysts, and even a rate cut aimed at stimulating the economy might come at the beginning of the second quarter if the preceding quarter turned out to be far worse than expected.

Analysts said the rate decision on Thursday reflects the dilemma facing the BOK: its primary job is to keep inflation in check, but it cannot help taking into considerations that a rate hike at this point could undercut the local economy’s growth; at the same time, prolonged and widely expected inaction of the BOK is sparking complaints from consumers who see their quality of life deteriorating.

The BOK said it will closely monitor the financial and economic risk factors both at home and abroad, and implement monetary policy while focusing on both price stability and economic growth.

By Yang Sung-jin (insight@heraldcorp.com)