[SUPER RICH] Korea vs. U.S.: Executive salary gap

Big discrepancies found in bottom-line figures and structure of pay packages

By Korea HeraldPublished : April 14, 2014 - 20:21

The companies recently reported on the annual salaries paid to these executives based on laws calling for disclosure for those who are registered on the corporate board and receiving 500 million won ($481,000) or more.

Most of the population seemed to think that these executives were getting paid too much.

This is likely because most felt deprived vis-a-vis the hefty payrolls.

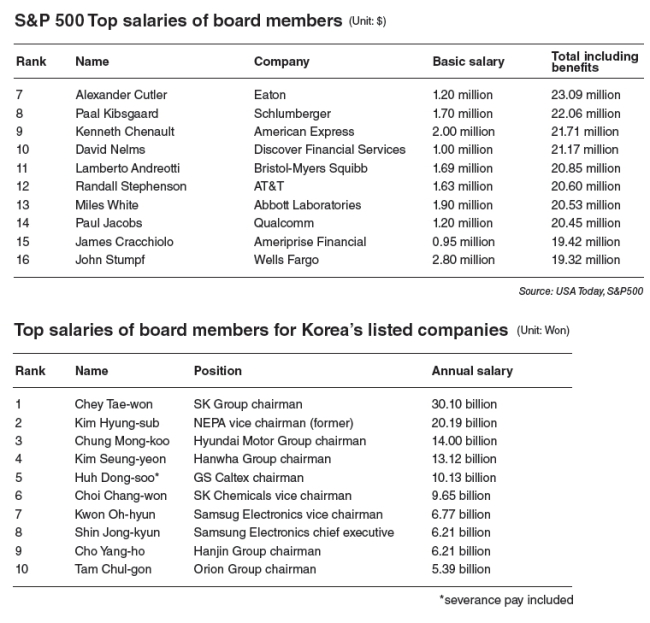

Recently, USA Today analyzed data on the salaries of S&P500 companies based on data compiled between January and March this year at 202 of the top 500 U.S. companies listed on the U.S. bourse.

The following is a comparison between the top-paid executives of the two nations.

Big gap in the bottom line

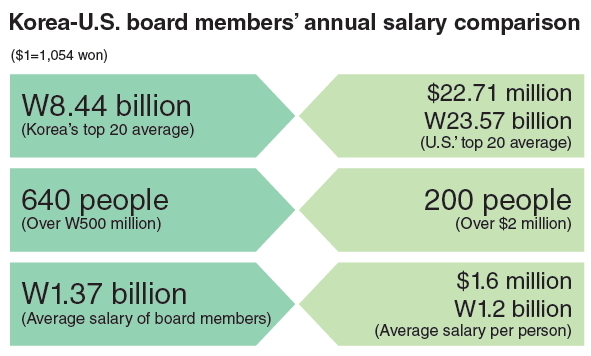

Among the U.S. companies, 200 executives were paid more than $2 million annually. Their pay packages included not only monthly salaries, but bonuses and stock options as well.

Out of the 200, the average pay package of the highest-paid 20 executives reached $22.71 million.

Back in Korea, the highest-paid 20 executives out of the 640 who were obligated to reveal their salaries were found to be receiving an average 8.44 billion won.

This shows that the U.S. executives were paid about three times the amount of their Korean counterparts.

But a closer look revealed lesser-known factors that can tip the scale.

The most significant fact is that the U.S. salaries were based mainly on performance, so that they received bonuses or stock options that at times were up to 10 times their basic salary.

As a result, the basic salaries of the executives at the 202 U.S. companies reached only about an average $1.16 million per person.

In Korea, the 640 executives were receiving a similar amount of 1.3 billion won per executive.

The difference was in the basic salary. In Korea, there were few whose bonuses and stock options surpassed their basic salary. At most, it was about twice the amount. Only the Samsung Electronics executives were found to be receiving bonuses three or four times larger than their basic salaries.

U.S., strictly performance-based

Higher bonuses also mean that a stockholder-based management system is well in place.

The intent is to reward board members according to how much profit they have raised for shareholders.

For instance, Philippe Dauman, chairman of Viacom, had the largest annual salary at $37.18 million, yet his basic salary stood far less at $3.5 million.

Likewise, the basic salary for Randall Stephenson of AT&T, the second-largest wireless carrier in the United States, was $1.6 million, but he received $20.5 million including performance-based pay and other bonuses. AT&T recorded operating profits of over 32 trillion won in 2013.

Ha Sung-min, chief executive of SK Telecom, Korea’s No. 1 mobile carrier, received a basic salary and bonuses of roughly 630 million won each ― a far cry from Dauman’s salary. SK Telecom’s operating profits in 2013 were about 2 trillion won.

On the other hand, reducing the salaries of board members who perform poorly is also the “American way.”

Of the 202 companies, board members from approximately 60 of them experienced a salary cut from the previous year.

John Donahoe of eBay, for instance, earned 53 percent less than the year before.

Korea’s salary system appears less influenced by performance.

Although better results yield higher compensation, poor results do not necessarily mean a minus.

In the case of Kumho Petrochemical, the firm recorded a net loss of 42.7 billion won last term, yet its chairman, Park Chan-koo, still received 4.2 billion won ― 1.8 billion won in benefits ― for having achieved profits worth some 200 billion won the year before.

Also in Korea, the bulk of top salaries is paid to company owners.

In the United States, management executives obtain higher pay while the owners just profit through dividends. As a result, board members with the largest salaries naturally have just one affiliated firm as their main source of income.

Corporation owners in Korea, however, often earn money from multiple companies.

SK Group chairman Chey Tae-won, for instance, received a salary from the holding company C&C as well as its various subsidiaries such as SK Innovation, SK Hynix and SK Corp.

Hyundai Motor Group chairman Chung Mong-koo similarly reaped multiple salaries from Hyundai Motor and Hyundai Steel, while Hanjin Group chairman Cho Yang-ho was paid by Korean Air, Hanjin and the Korea Airport Service.

U.S. reveals car rental fees

U.S. companies appeared to be more meticulous about revealing expenses, with firms disclosing detailed salary breakdowns of their five highest-paid executives, regardless of whether or not they are registered.

Korea, however, only reveals the salaries of registered board members without giving details.

Some family members of company owners are left out of the disclosure, which creates more suspicions and doubts among the public.

The highest-paid executives ― Chey Tae-won of SK Group and Kim Seung-yeon of Hanwha Group ― recently resigned from their posts as registered board members, meaning they are no longer required to disclose their salaries starting next year.

It is also important to note that, in Korea, no clear standards for determining salaries and incentives are made public.

Korean firms do not specify any details regarding board members’ salaries, such as how much of it comes from what type of bonuses and incentives.

Hyundai Motor Group, for example, merely states that “wages for board members will be determined in accordance with company regulations.”

Meanwhile, U.S. companies, executives and board members are required to state in the annual reports even the airfare, car rental fees and financial consulting fees incurred by the company.

By The Korea Herald Special Report Team

(jhk@heraldcorp.com)

-

Articles by Korea Herald

![[KH Explains] How should Korea adjust its trade defenses against Chinese EVs?](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/15/20240415050562_0.jpg&u=20240415144419)

![[Today’s K-pop] Stray Kids to return soon: report](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=642&simg=/content/image/2024/04/16/20240416050713_0.jpg&u=)