[KH Explains] Samsung, LG to make motor show debuts next month

With Hyundai Motor's absence, Korean tech giants to showcase their automotive ambitions at IAA Mobility in Munich

By Kan Hyeong-wooPublished : Aug. 15, 2023 - 14:57

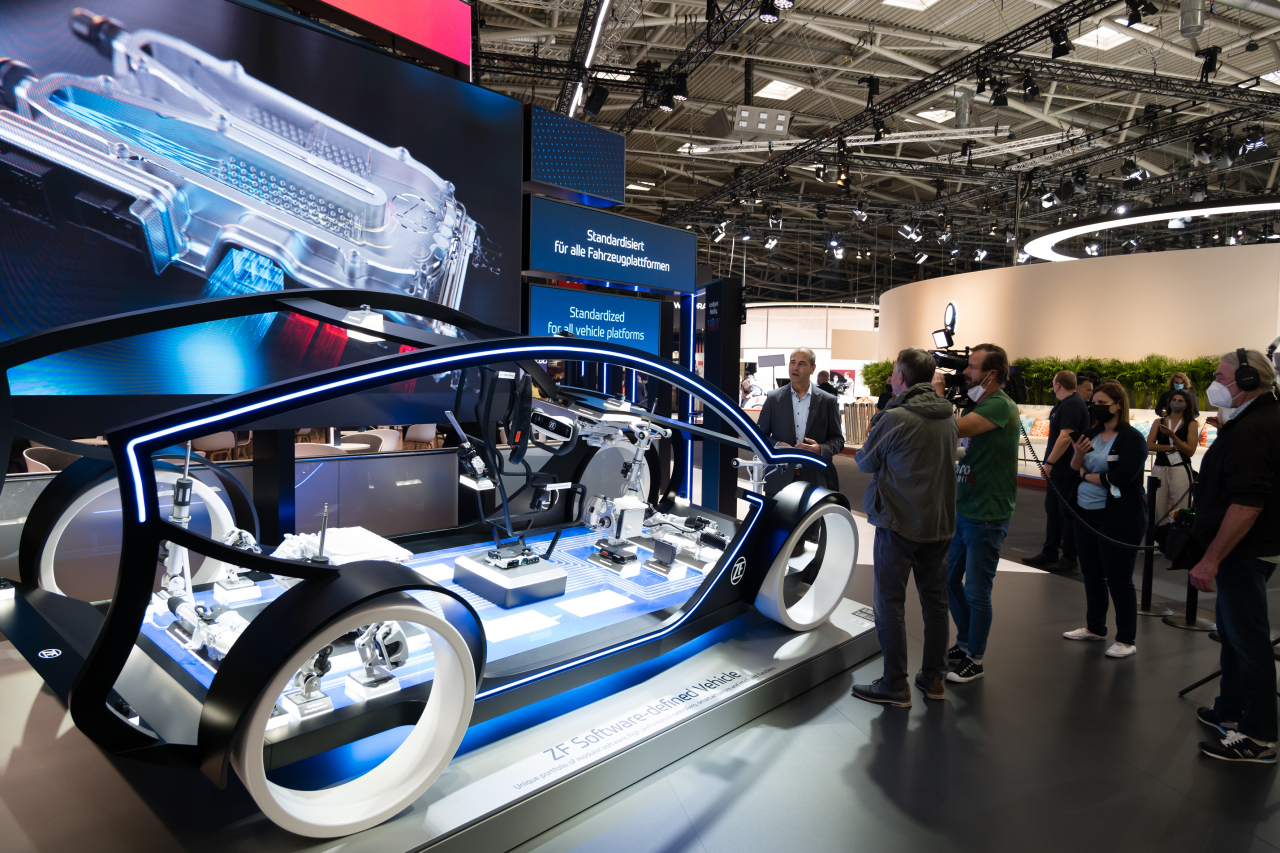

Samsung Electronics and LG Electronics will attend IAA Mobility 2023, a major global automotive fair, for the first time next month, signifying the South Korean electronics giants’ emphasis on the automotive electronic components market.

IAA Mobility, which is set to take place in Munich, Germany, from Sept. 5 to 10, will draw not only some of the top global automakers such as BMW and Mercedes-Benz but also IT and chip giants like Amazon, Meta and Qualcomm. Hyundai Motor Group said it is not taking part this year as it has no new signature models to unveil yet.

As the sectors of electric vehicles and autonomous driving cars are forecast to continuously expand in the future, the demand for automotive electronic components such as cameras, communication devices, displays and sensors is poised to keep getting bigger.

The global automotive electronic components market is expected to reach $181 billion this year to surpass the smartphone parts market of $178 billion, according to eBest Investment and Securities, which analyzed data from market tracker Strategy Analytics. The automotive electronic components market is projected to see a compound annual growth rate of 14 percent through 2029.

The Samsung Electronics Device Solution division, which is in charge of chip businesses, will take part in IAA Mobility along with Samsung Display and secondary battery maker Samsung SDI.

Samsung Electronics plans to introduce its automotive chip vision centered on three areas -- autonomous driving, centralized computing and vehicle-to-everything communication -- at the motor event. Samsung Display will showcase its latest OLED panel technologies for automobiles.

Samsung has pinned the automotive sector as one of the three main applications of chips in 2030 along with the server and mobile sectors. The company has said it aims to overtake the current leader in the automotive memory market, Micron, by 2025. Samsung trails in second place with a 13 percent market share behind Micron's 45 percent.

Harman, Samsung’s audio and automotive component subsidiary, posted record earnings last year with annual sales of 13.2 trillion won ($9.87 billion) and an operating profit of 880 billion won, showing clear signs of the automotive industry’s overall growth. The upward trend continues this year as Harman logged 3.5 trillion won in sales in the second quarter, up 17 percent on-year, and 250 billion won in operating profit, a sharp increase of 150 percent on-year.

Harman looks to secure more orders in the areas of digital cockpit and car audio by utilizing Samsung's software capabilities to advance passenger experiences.

“We have established an industry-leading lineup based on distinguished products in the automotive market,” said Kim Jae-joon, executive vice president at Samsung Electronics, in a second-quarter earnings call in July.

"We will continue to cooperate with customers based on competitive products and strengthen leadership in the automotive market."

LG Electronics is also set to make an impression at the IAA with its CEO Cho Joo-wan gearing up to deliver remarks at a press conference to share LG’s vision for the future of the mobility ecosystem.

According to LG Electronics, the company’s automotive components business has grown at a compound annual growth rate of 30 percent over the past 10 years. LG’s automotive parts business has been focusing on in-vehicle infotainment systems, EV powertrains and in-vehicle lighting systems.

In the wake of vehicle automation and connective services, LG Electronics plans to search for new opportunities in future mobility sectors such as autonomous driving, software solutions and in-vehicle content.

The company’s Vehicle component Solutions, or the VS division, turned a profit last year for the first time since its establishment in 2013 with sales of 8.6 trillion won and operating profit of 167 billion won. LG expects to achieve 10 trillion won in sales this year and aims to double the figure by 2030.

“As cars evolve into new experience spaces from transportation, they are transforming into a space designed to fit various purposes,” said Cho in a press conference held last month.

“The VS division will actively respond to future vehicle trends and use the customer experiences and insights secured through (business-to-customer) businesses to grow into a global top-tier company in the future mobility market.”

LG Electronics’ order log of automotive components stands at over 80 trillion won. The company looks to bring up the number to 100 trillion won by the end of this year.

![[Music in drama] Rekindle a love that slipped through your fingers](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/05/01/20240501050484_0.jpg&u=20240501151646)

![[New faces of Assembly] Architect behind ‘audacious initiative’ believes in denuclearized North Korea](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/05/01/20240501050627_0.jpg&u=20240502093000)

![[Today’s K-pop] Stray Kids go gold in US with ‘Maniac’](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=642&simg=/content/image/2024/05/02/20240502050771_0.jpg&u=)