[News Focus] Ruling against Netflix signals impact on digital content market

Netflix likely to continue legal battle over network usage fees; attention likely to turn to Google’s position, net neutrality

By Yang Sung-jinPublished : June 29, 2021 - 18:26

The court’s decision confirmed that the streaming service has an obligation to negotiate with mobile carriers over the payment of network usage fees.

The legal battle traces back to November 2019, when internet service provider SK Broadband filed a complaint with a local telecommunications regulator as the global video streaming giant refused to pay network usage fees, citing the principle of net neutrality, which is applied to carriers and content providers in South Korea.

Although Netflix, shortly after the court ruling, said it would continue to work with SK Broadband, it is speculated that the streaming powerhouse might appeal the case.

“After reviewing the court ruling, we will clarify our position including on the appeal,” a Netflix official told a Korean IT media outlet.

If the court ruling eventually increases Netflix’s costs, it might increase the price for its streaming video service here to reflect that. Netflix raised its subscription fees in the US and Japan in October, but has not changed its rates in Korea.

Netflix, however, is trimming down its promotions for Korean viewers. In April this year, it shuttered the 30-day free trial, a major marketing tool that attracted Korean users in the past five years.

Netflix greatly benefited from the influx of users last year when a growing number of people stayed indoors and worked from home due to the COVID-19 pandemic. The monthly active users of Netflix in Korea peaked at 8.99 million in January and began to slide to 8.78 million in February, 8.24 in March and 8.08 in April. The latest MAU for May edged down to 7.91 million, below the 8 million mark.

But it is unclear whether Netflix will increase subscription fees soon. Even though it faces the possibility of higher costs, the streaming giant is likely to keep a wait-and-see approach until it gets a clearer picture of the competition in Korea after the debut of its streaming rival Disney Plus.

Questions on level playing field

Disputes have long plagued the digital content and internet market in Korea, as the related government regulations remain complicated and are not universally applied to all domestic and foreign players.

While global content providers pay relatively small network usage fees or bypass the obligation altogether, domestic internet companies and content providers are forced to pay more than they should, industry sources argue.

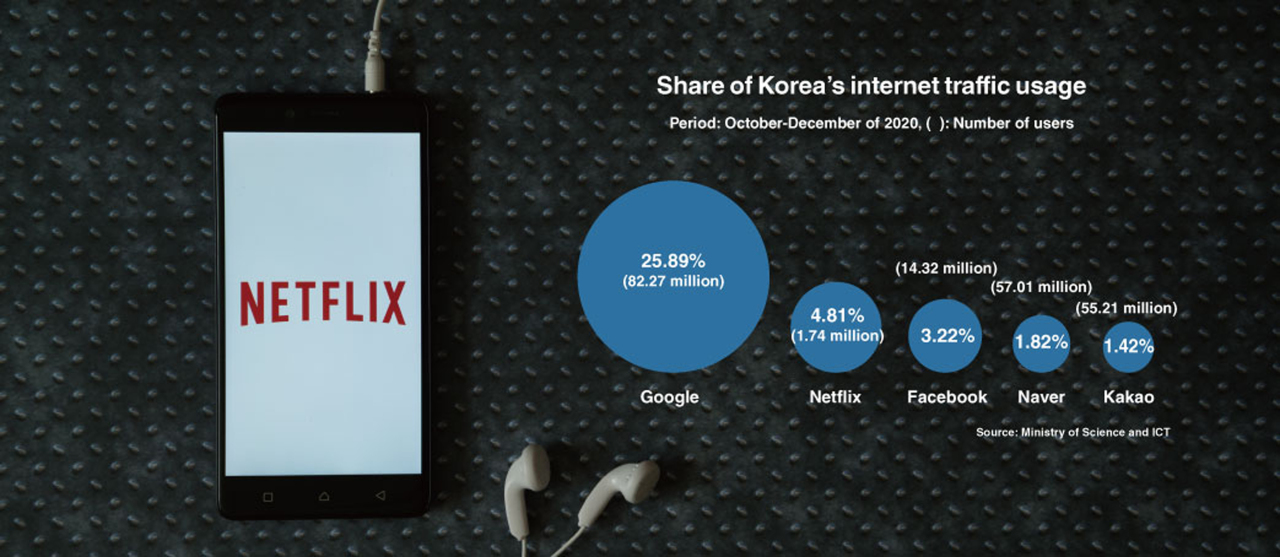

As of late 2020, Google accounted for 25.89 percent of Korea’s internet traffic, followed by Netflix with 4.81 percent and Facebook with 3.22 percent, according to data from the Ministry of Science and ICT. As for network usage fees, Facebook is believed to have paid some 15 billion won to KT each year for using the carrier’s network, but there is no detailed payment data for Google, whose YouTube video service generates a huge amount of data traffic.

At a National Assembly hearing in 2018, then Google Korea CEO John Lee was asked about net usage fees, but he just said he would check with Google headquarters about whether it could disclose such data.

Meanwhile, Naver, whose share of internet traffic is 1.82 percent, reportedly paid 73.4 billion won in network usage fees and Kakao forked over 30 billion won. Korea’s major game developers NCSoft and Netmarble also paid about 10 billion won each, and AfreecaTV, a local video streaming service, paid 15 billion won.

Local observers pointed out the disadvantages facing local internet companies in terms of higher network usage fee, as global content providers manage to avoid paying the full network cost and keep “free-riding” by setting up cache servers and changing their data routes.

Obstacles for local video platforms

Back in the mid-2000s, there were a host of Korean video platforms. Pandora TV, for instance, started services in 2004. The market showed signs of growth as new video streaming entrants such as Mgoon and MNCast joined the fray.

In the following years, however, most of those video startups closed their services, due to the higher network usage fees. While foreign companies paid nominal amounts, fledgling home-grown video service providers were forced to cover the surging fees from increased traffic, resulting in deep losses. It turned out that the network fee system prevented small video startups from running at a profit.

In contrast, Google’s YouTube is reportedly using the local network at a far lower cost. Some said the global video giant is virtually free-riding on the Korean network, but this claim was not confirmed as Google remains silent about the related business details.

What’s certain is that Google is benefiting from the past contract it struck with Korean carriers. Under the contract, local operators installed Google Global Cache, which allows internet service providers to run Google content within their own networks, thereby easing congestion of data traffic. In 2011, the country’s three major carriers set up GGC at their data centers as they were focused on stabilizing their data networks to meet the skyrocketing traffic demand for Google services. As a result, Google is now getting deep discounts or fee exemptions regarding network-related costs.

But whether Google and other global players will be able to keep their advantage is unclear, as Korean regulators are stepping up their oversight on IT platform service providers.

In December last year, the Ministry of Science and ICT introduced what is called “Netflix Law,” which allows the Korean government to ask online content providers to offer stable services and foreign providers to have local representatives and proper payment systems. The law applies to online firms that account for 1 percent or more of the country’s average daily data traffic or those with more than 1 million daily users.

Despite the latest court ruling, the legal confrontation is not over yet. As Netflix may continue its legal fight against SK Broadband, more disputes are expected over whether the net neutrality principle and obligatory network usage fees are fair and legitimate for both Korean and global tech firms.

![[Today’s K-pop] Treasure to publish magazine for debut anniversary](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=642&simg=/content/image/2024/07/26/20240726050551_0.jpg&u=)