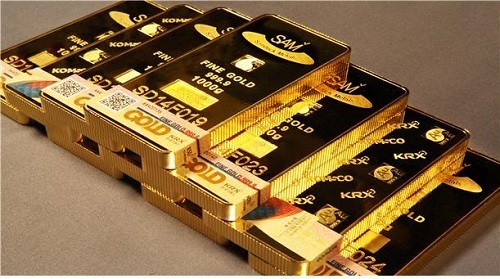

Gold zooms to 6-year high on new monetary measures

By Choi Jae-heePublished : April 15, 2020 - 16:43

Gold prices are hitting the roof in South Korea -- highest level in six years -- as investors are flocking to safe-haven assets amid escalating fears given market uncertainties, latest data showed Wednesday.

According to the Korea Exchange Gold Market, the price stood at 66,740 won ($54.90) per gram at Tuesday’s close, surging 2.4 percent from the previous session. The price had surged to 68,240 won the same day, the highest since March 2014 when the gold market first opened.

The accumulated transactions of gold also jumped to 144 kilograms, nearing the all-time high of 188 kilograms marked on Jan. 6. In addition, gold traded at a combined 5.8 billion won a day this week, doubling the number reported during the same period last year.

The surge in gold prices came as investors have increasingly turned to risk-free assets, gold in particular, after the Bank of Korea as well as foreign central banks embarked on supplying money to financial markets, arousing fears that both local and foreign currencies could lose value.

Earlier last week, the BOK funneled 5.2 trillion won to the financial markets through a repurchase agreement, whereby it purchases short-term bonds from financial institutions including banks and brokerages, which are then repurchased by them at a later date.

The central bank also plans to embark on an emergency relief package that extends loans to nonbanking institutions, further pumping money into local markets, officials said Sunday.

The bank’s quantitative easing operation is in line with that of the US Federal Reserve. Last month, it announced plans to purchase unlimited amounts of municipal bonds and expand corporate bond-buying programs to tackle financial damage from the novel coronavirus.

“Once money is pumped into financial markets, the value of real assets soar while that of currencies sharply plunge,” said an official at the Korea Exchange.

“The BOK’s rate has also led investors to rush to buy gold since there is no significant difference between pouring money into savings with low interest and gold, which bears no interest.”

The central bank slashed its policy interest rate to 0.75 percent on March 16, marking the first emergency rate cut in more than a decade.

By Choi Jae-hee (cjh@heraldcorp.com)

![[Today’s K-pop] Treasure to publish magazine for debut anniversary](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=642&simg=/content/image/2024/07/26/20240726050551_0.jpg&u=)