[Kosdaq Star] TissueGene’s epic debut represents bio boom

By Son Ji-hyoungPublished : Nov. 26, 2017 - 15:35

This is the 45th in a series of articles analyzing major companies traded on the tech-heavy Kosdaq market. -- Ed

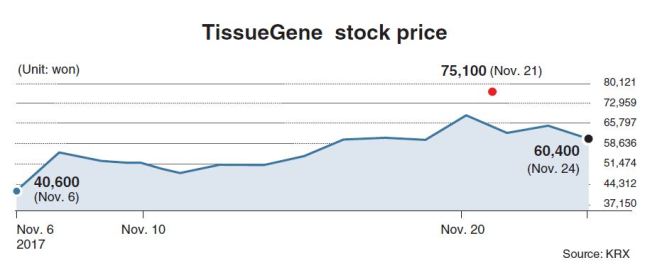

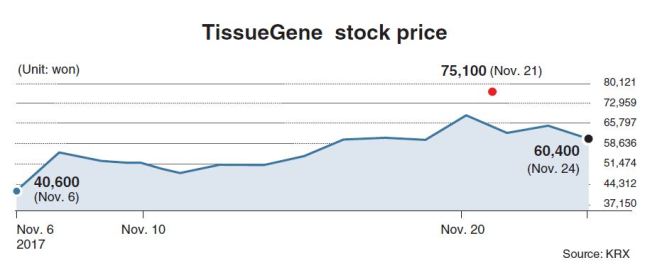

Mid-stage osteoarthritis treatment developer TissueGene’s market cap rose by more than 2 trillion won ($1.84 billion) within three weeks of making its debut, becoming the fifth-largest firm on South Korea’s second-tier Kosdaq market Friday.

The stock performance of the Maryland-headquartered firm reflects a market-wide biotech boom built on overheated investor anticipation for early-stage biopharmaceutical businesses.

Shares of TissueGene, a Kolon Corp. subsidiary, joined the Kosdaq mainstream by skyrocketing 123.7 percent as of Friday from its offered price of 27,000 won fixed in October, leading to a 2.04 trillion won increase in market cap.

About two weeks later, however, the closing price soared to 68,600 won Tuesday, contributing to biopharma momentum and a consequent 10-year high closing price in the Kosdaq sector.

On Friday, TissueGene sank 6.8 percent to 60,400 won, in sync with Kosdaq biotech sector sell-off seen in late afternoon trade, particularly among powerhouses such as Celltrion, Celltrion Healthcare, SillaJen and Medytox.

Investors appear to have pinned hopes on clinical trials of TissueGene’s only product Invossa in the United States, analysts noted.

Invossa is the first cell-mediated gene therapy for noninflammatory degenerative joint disease. The treatment does not require a surgery to regenerate joint tissues. An injection of Invossa would be effective within two hours, while its efficacy would last for two years, according to the firm.

After gaining state approval for treatment of Kellgren & Lawrence grade 3 osteoarthritis patients in Korea in July, Invossa made its drug market debut on Nov. 8, two days after TissueGene’s initial public offering. The therapy is not recognized as a disease-modifying osteoarthritis drug in Korea, meaning it can be used to relieve pain but not reverse or slow the progression of the disease.

Kim Yo-han, an analyst at Yuhwa Securities, said rather than domestic market performance, the outlook for development pipelines using Invossa in the United States buoyed investor sentiment.

“Pharmaceutical firms with new drug pipelines are valued on their prospects for the next 10 years,” Kim told The Korea Herald. “TissueGene’s performance relies on investor sentiment with bullish outlook for entry into the global landscape.”

Invossa is poised to embark on phase III clinical trials in the US in April 2018. If granted US approval, the firm expects the therapy to go on sale there in 2023.

Kim of Yuhwa Securities added that this factor contrasted TissueGene with Invossa’s marketer, Kolon Life Science, in regards to stock performance.

Kolon Life Science is seeking to increase market penetration by targeting patients suffering K&L grade 2 osteoarthritis. The firm said Thursday it had been granted permission to start trials. The K&L grades are set on the scale of zero to 4, with 4 being the most advanced. Despite the move, Kolon Life Science fell 5.7 percent over the past 15 trading days.

Mid-stage osteoarthritis treatment developer TissueGene’s market cap rose by more than 2 trillion won ($1.84 billion) within three weeks of making its debut, becoming the fifth-largest firm on South Korea’s second-tier Kosdaq market Friday.

The stock performance of the Maryland-headquartered firm reflects a market-wide biotech boom built on overheated investor anticipation for early-stage biopharmaceutical businesses.

Shares of TissueGene, a Kolon Corp. subsidiary, joined the Kosdaq mainstream by skyrocketing 123.7 percent as of Friday from its offered price of 27,000 won fixed in October, leading to a 2.04 trillion won increase in market cap.

About two weeks later, however, the closing price soared to 68,600 won Tuesday, contributing to biopharma momentum and a consequent 10-year high closing price in the Kosdaq sector.

On Friday, TissueGene sank 6.8 percent to 60,400 won, in sync with Kosdaq biotech sector sell-off seen in late afternoon trade, particularly among powerhouses such as Celltrion, Celltrion Healthcare, SillaJen and Medytox.

Investors appear to have pinned hopes on clinical trials of TissueGene’s only product Invossa in the United States, analysts noted.

Invossa is the first cell-mediated gene therapy for noninflammatory degenerative joint disease. The treatment does not require a surgery to regenerate joint tissues. An injection of Invossa would be effective within two hours, while its efficacy would last for two years, according to the firm.

After gaining state approval for treatment of Kellgren & Lawrence grade 3 osteoarthritis patients in Korea in July, Invossa made its drug market debut on Nov. 8, two days after TissueGene’s initial public offering. The therapy is not recognized as a disease-modifying osteoarthritis drug in Korea, meaning it can be used to relieve pain but not reverse or slow the progression of the disease.

Kim Yo-han, an analyst at Yuhwa Securities, said rather than domestic market performance, the outlook for development pipelines using Invossa in the United States buoyed investor sentiment.

“Pharmaceutical firms with new drug pipelines are valued on their prospects for the next 10 years,” Kim told The Korea Herald. “TissueGene’s performance relies on investor sentiment with bullish outlook for entry into the global landscape.”

Invossa is poised to embark on phase III clinical trials in the US in April 2018. If granted US approval, the firm expects the therapy to go on sale there in 2023.

Kim of Yuhwa Securities added that this factor contrasted TissueGene with Invossa’s marketer, Kolon Life Science, in regards to stock performance.

Kolon Life Science is seeking to increase market penetration by targeting patients suffering K&L grade 2 osteoarthritis. The firm said Thursday it had been granted permission to start trials. The K&L grades are set on the scale of zero to 4, with 4 being the most advanced. Despite the move, Kolon Life Science fell 5.7 percent over the past 15 trading days.

Meanwhile, the rapid biotech sell-off in the hours leading up to Friday’s close highlighted investors’ need for risk management in the biotech sector.

“The latest biotech momentum was far beyond an appropriate level regarding expectations for improvement of fundamentals,” wrote Kim Yong-gu, an analyst at Hana Financial Investment, on Friday, citing that the Kosdaq bio sector index touched the Fibonacci retracement level above 0.0 percent. Touching the 0.0 percent level indicates that an uptrend in stock price or index is highly likely to reverse.

TissueGene trades as depositary receipt, instead of common stocks, barring the firm from inclusion in the benchmark Kosdaq 150 index.

TissueGene recorded an operating loss of some 3.3 billion won in the first half of this year, after an operating profit of 6 billion won in 2016, according to a regulatory filing.

TissueGene was founded in 1999 by Kolon Corp. Chairman Lee Woong-yeul despite executives’ opposition and negative outlook for business then. Lee currently owns 20.38 percent of TissueGene, while other major shareholders include Kolon Corp. and Kolon Life Science, with stakes of 31.16 percent and 14.37 percent, respectively.

Kolon Corp., traditionally considered a player in the local manufacturing sector, saw the net asset value of biotech-related affiliates -- TissueGene and Kolon Life Science -- take up nearly 50 percent that of the conglomerate, according to an estimate by Yoon Tae-ho, an analyst at Korea Investment & Securities.

By Son Ji-hyoung

(consnow@heraldcorp.com)

“The latest biotech momentum was far beyond an appropriate level regarding expectations for improvement of fundamentals,” wrote Kim Yong-gu, an analyst at Hana Financial Investment, on Friday, citing that the Kosdaq bio sector index touched the Fibonacci retracement level above 0.0 percent. Touching the 0.0 percent level indicates that an uptrend in stock price or index is highly likely to reverse.

TissueGene trades as depositary receipt, instead of common stocks, barring the firm from inclusion in the benchmark Kosdaq 150 index.

TissueGene recorded an operating loss of some 3.3 billion won in the first half of this year, after an operating profit of 6 billion won in 2016, according to a regulatory filing.

TissueGene was founded in 1999 by Kolon Corp. Chairman Lee Woong-yeul despite executives’ opposition and negative outlook for business then. Lee currently owns 20.38 percent of TissueGene, while other major shareholders include Kolon Corp. and Kolon Life Science, with stakes of 31.16 percent and 14.37 percent, respectively.

Kolon Corp., traditionally considered a player in the local manufacturing sector, saw the net asset value of biotech-related affiliates -- TissueGene and Kolon Life Science -- take up nearly 50 percent that of the conglomerate, according to an estimate by Yoon Tae-ho, an analyst at Korea Investment & Securities.

By Son Ji-hyoung

(consnow@heraldcorp.com)

![[Herald Interview] 'Amid aging population, Korea to invite more young professionals from overseas'](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/24/20240424050844_0.jpg&u=20240424200058)

![[KH Explains] Korean shipbuilding stocks rally: Real growth or bubble?](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/04/25/20240425050656_0.jpg&u=)