2Q16 review: Below-consensus OP of W240.6bn (+15.6% YoY)

For 2Q16, AmorePacific reported preliminary consolidated revenue of W1.44tr (+20.7% YoY), operating profit of W240.6bn (+15.6% YoY), and OP margin of 16.7%.

While revenue was in line with expectations, operating profit missed our forecast and the consensus by 5.3% and 8.7%, respectively.

The lower-than-expected profitability was due to negative sales growth of the domestic hypermarket channel and rising costs related to overseas expansion.

Domestic cosmetics revenue grew 15.1% YoY to W927.3bn, meeting expectations.

Despite limited store additions, duty-free revenue grew a solid 39.8% YoY and contributed 42% (+7.4%p YoY) of total domestic cosmetics revenue.

However, revenue from the hypermarket channel continued negative growth, with revenue down 14.8% YoY.

We believe hypermarket traffic, which had already been declining, was further dragged down by recent safety issues of some household goods. The weak performance of hypermarkets led to an increase in cost ratio (+2%p YoY) and a decline in domestic profitability.

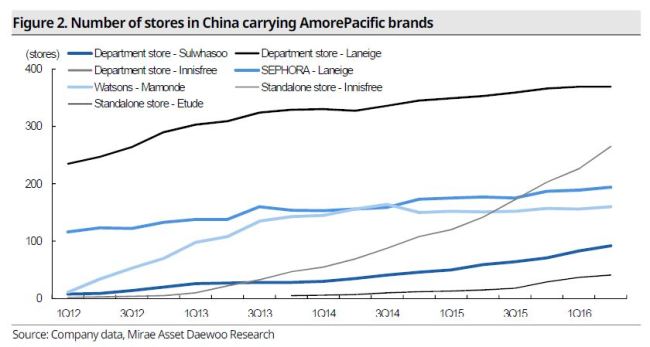

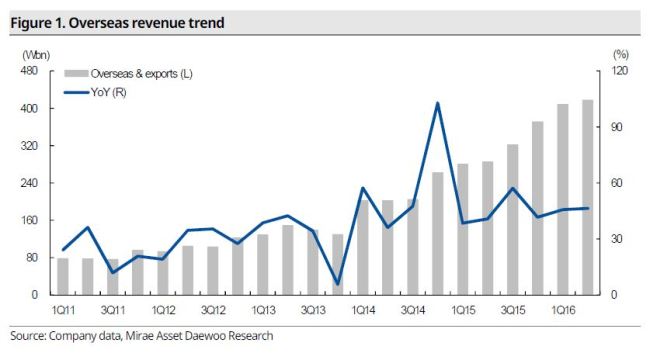

AmorePacific has dedicated itself to an aggressive overseas expansion strategy since last year. The company’s surging growth in Asia is a stark contrast to the stagnant growth of major global cosmetics players.

We believe the company’s strong performance reflects its ability to proactively identify and understand the preferences and needs of Asian consumers.

Accelerating overseas expansion and robust overseas performance should strengthen the company’s top-line growth, but also undermine its overall profitability.

The domestic business has limited growth potential, but high and stable profitability, backed by a rational cost structure.

As the revenue contribution of the overseas business continues to expand, profit growth will likely lag behind revenue growth.

That said, we note that top-line growth and margin stability often do not go hand in hand. We also believe AmorePacific’s strong top-line growth is what makes it stand out from the crowd.

Expectations are still high for Amorepacific’s long-term growth as it is rewriting the history of the consumer industry at home and abroad.

We reiterate our Buy call on AmorePacific with a target price of W580,000 and continue to recommend the stock as one of our top picks in cosmetics.

Source: Mirae Asset Daewoo

![[AtoZ Korean Mind] Does your job define who you are? Should it?](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/05/06/20240506050099_0.jpg&u=)