[DECODED] Mixed outlook on Hyundai Glovis

Stock rallied on “owner premium” continues to fall amid uncertainties surrounding succession scenario growing

By Seo Jee-yeonPublished : July 4, 2016 - 16:30

[DECODED] Kim Se-yong, a marketing manager at a local energy conglomerate, feels sympathy for minority shareholders of Samsung SDS, an IT solution unit of Samsung Group. They have been protesting the company’s continued stock decline.

Its stock price has dropped from 429,500 won ($366) to 132,000 won last Friday due to growing uncertainties over its role in the succession of Samsung Group heir Lee Jae-yong. Lee is the largest individual shareholder of the company with a 9.2 percent stake.

“Like minority shareholders of Samsung SDS, I, as an investor of Hyundai Glovis, have been on a roller coaster ride emotionally due to the stock volatility for the past two years,” Kim said.

The stock of Hyundai Glovis, the logistics arm of Hyundai Motor Group, has been considered a “Chung Eui-sun share” as the group’s heir apparent and Hyundai Motor vice chairman Chung holds a 22.3 percent stake as of June. That is a much bigger stake than the 6.7 percent that his father and group chairman Chung Mong-koo holds.

Kim bought hundreds of Hyundai Glovis shares in June 2014, when the stock was on an upward trend on rumors that the automotive group would continue to boost the value of Hyundai Glovis, which would play a key role in raising funds for Chung’s succession.

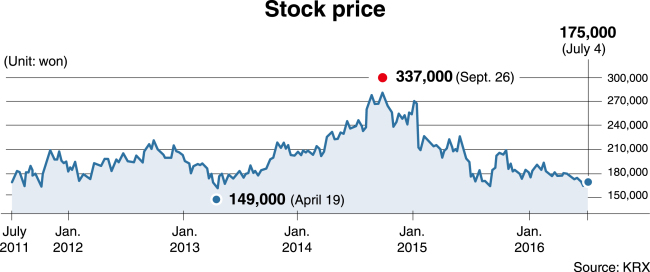

The stock continued to rise and peaked at 337,000 won in September on that year, but it nosedived when the group chairman and his son sold a combined 13.4 percent -- about 5 million shares --of the car-shipping affiliate in a block deal in February, 2015.

Hyundai Motor Group said the sudden stock deal was aimed at meeting a toughened government regulation on intra-group transactions, which bans business group owners and their family members from holding a stake of more than 30 percent in an affiliate that earns more than 20 billion won annually, or 12 percent of annual sales through intra-group dealings.

Despite the statement, shares of Hyundai Glovis have slumped since the top management’s stock sale, with growing uncertainties surrounding the group’s succession plan.

“The stock fell 40 percent from the price that I paid,” Kim said, adding he was not sure when would be the right time to let go of the stock.

Witnessing stock jitters related to the succession scenarios of conglomerates, some market watchers rang alarm bells about betting on those stocks.

“Foreign investors who have an understanding of family-controlled Korean conglomerates have already considered investments in those stocks as a risk rather than an opportunity,” professor Kim Woo-chan at Korea University Business School said.

Despite the professor’s warning, some of local stock brokerage firms continue to remain positive on investing in Hyundai Glovis, highlighting the recent cheap stock price of the fundamentally strong logistics company.

“There is a consensus in the market that operating profit of Hyundai Glovis is forecast to grow around 10 percent to 766.8 billion won this year from a year ago,” said Kim Dong-ha, a stock analyst of Kyobo Securities.

By Seo Jee-yeon (jyseo@heraldcorp.com)

![[K-pop’s dilemma] Can K-pop break free from ‘fandom’ model?](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/05/09/20240509050541_0.jpg&u=20240509173751)

![[News Analysis] Yoon's first 2 years marked by intense confrontations, lack of leadership](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/05/09/20240509050612_0.jpg&u=20240509233252)

![[Graphic News] Beer the most favored alcoholic drink by Koreans](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/05/09/20240509050765_0.gif&u=)

![[Today’s K-pop] NCT’s Mark to drop 1st solo album in February 2025](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=642&simg=/content/image/2024/05/10/20240510050597_0.jpg&u=)