[ANALYST REPORT] Lotte Shopping: Momentum lost for beleaguered Lotte

By Korea HeraldPublished : June 21, 2016 - 17:45

1) Investment highlights

- We downgrade our rating on Lotte Shopping to Marketperform and cut our target price to KRW240,000.

- Uncertainties are swelling over the Lotte Group, as prosecutors expanded their investigation into the conglomerate’s alleged activities that include the creation of a slush fund through cross-affiliate transactions, illegal lobbying to build Lotte World Tower, preferential orders to affiliates, exaggerating sales, intra-family real estate transactions, etc.

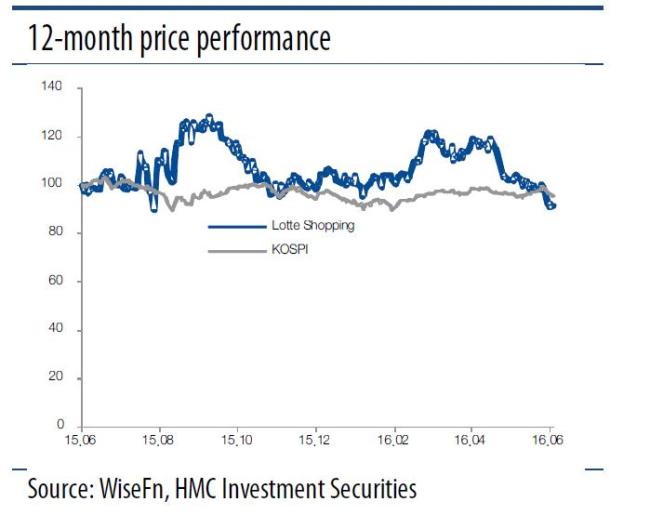

- Contrary to expectations, the family feud over managerial control may ensue again, making unclear the group’s ownership. This will erode confidence in the group’s owners and hamper the stock’s performance.

- Earnings performance is also sluggish. At present, we do not see any stock momentum.

2) Major issues and earnings outlook

- 2Q16 gross sales and operating profit will likely grow 4.5% and 16.1% YoY to KRW7.79tn and KRW234.8bn, respectively, the first increase since 1Q14. However, we do not see this in an overly positive light, because it has more to do with the low base (Sewol Ferry disaster and the MERS outbreak over the past couple of years) than with consumption recovery.

- Excluding department stores, the earnings recovery of all business divisions—hypermarkets, Himart, financial services, convenience stores, etc.—is also slowing. Furthermore, the Chinese business remains sluggish too. In all, the company is in dire need of continued restructuring.

- In reflection of the weak 1H16 earnings, we lower our operating profit forecast for 2016. However, we revise up our pretax profit and net profit estimates as we adjust up our non-operating income and expense forecasts. In all, we expect 2016 gross sales and operating profit to climb 4.9% and 4% YoY to KRW31.62tn and KRW887.8bn, respectively.

- Overseas, we do not believe the massive losses seen last year will repeat this year. However, earnings uncertainties will likely persist given the slowdown of the global economy. We think Lotte needs to shift its focus to the bottom line in markets such as China, Indonesia, and Vietnam.

3) Share price outlook and valuation

- The stock looks attractive based on liquidation value. However, in terms of earnings value, it does not, even after recent corrections. Shares currently trade at 16.8x 2016F P/E and 13.7x 2017F P/E.

Source: HMC Investment Securities http://www.hyundaimotorgroup.com/Affiliates/FINANCE/HMC-Investment-Securities.hub

-

Articles by Korea Herald

![[Robert J. Fouser] Social attitudes toward language proficiency](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/05/16/20240516050799_0.jpg&u=)

![[Graphic News] How much do Korean adults read?](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/05/16/20240516050803_0.gif&u=)

![[Herald Interview] Byun Yo-han's 'unlikable' character is result of calculated acting](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/05/16/20240516050855_0.jpg&u=)