[Super Rich] Nexon founder likely to face summons

Prosecution is poised to question the online gaming billionaire over bribing a prosecutor and Naver CEO with unlisted stocks of Nexon in 2005

By KH디지털2Published : June 7, 2016 - 17:32

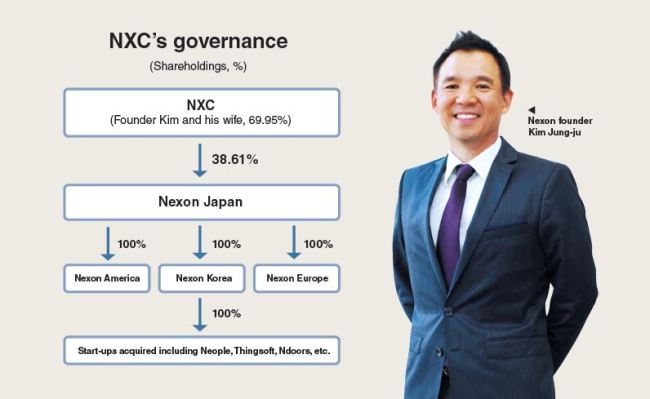

Kim Jung-ju, founder of the country’s biggest online gaming giant Nexon, is likely to be summoned by the Supreme Prosecutors’ Office soon in a probe to determine whether he paid kickbacks.

Kim, who founded Nexon in 1994 with his university friend Song Jae-kyng -- current CEO of XLGames -- is a new breed of superrich in Korea. He is a self-made billionaire, having accumulated wealth of 4.9 trillion won ($4.2 billion) by incubating Nexon and investing in start-ups at home and abroad in a variety of sectors ranging from gaming to future food and electric cars.

According to local news reports, the 48-year-old CEO of NXC, the de facto holding company of Nexon Group, is likely to be summoned following the firm’s confirmation Monday that it lent $1.1 million to three persons who were close to the founder in 2005 with no interest to help them purchase 10,000 unlisted shares each.

The three minority shareholders of Nexon, who hit the jackpot when the online gaming giant was listed on the Japanese stock market in 2011, are senior prosecutor Jin Kyung-jun, current Naver CEO Kim Sang-heon and former NXC auditor Park Sung-joon.

Jin and the Naver CEO are reported to have built a personal relationship with Kim when they studied together at the prestigious Seoul National University in the 1980s.

In an emailed statement Monday, Nexon said the transaction was aimed to secure trusted, long-term investors in preparation for hostile takeover bids during its initial days. It didn’t mention whether its founder was behind the deal or not.

But civic groups claimed the firm had no reason to lend corporate money to the minority investors to help them purchase its unlisted stocks without the involvement of top management.

“The offer of unlisted shares by the company itself is an advanced form of kickback as the public cannot easily buy those stocks,” said Yoon Young-dae from SpecWatch, a civic group monitoring speculative funds in the capital market.

“Nothing is different between the Nexon case and the previous cash-based corruption scandals between power elites in the legal and political sectors and the corporate sector.”

The civic groups also raised questions over Nexon’s late explanation for the loans to the three minority investors. The company, which had remained silent for a while, issued a statement Monday just after financial authorities announced they had found the involvement of Nexon in the course of a two-month investigation into the dubious deal with senior prosecutor Jin, who currently heads the Justice Ministry’s Korea Immigration Service, in 2005.

In April, Jin offered to resign when the news that he had pocketed huge capital gains through the sale of his shares of Nexon last year stirred the public.

According to a filing at the stock exchange, the high-ranking governmental official gained 12.6 billion won by selling about 800,000 shares of Nexon last year. It was later found that 10,000 shares dated back to 2005, when the company was unlisted.

The number of shares he bought from Nexon increased due to a stock split in 2011 when the online game developer was listed on the Japanese stock market.

Jin denied taking advantage of his public office or of any inside information when he bought the shares. Despite his denial, civic groups accused him of taking a kickback from Nexon in April.

“It doesn’t make sense at all that Kim Jung-ju didn’t know about the stock trading between Nexon and his close friends in June 2005, given he has controlled all details of the firm as a dominant shareholder,” an industry insider said.

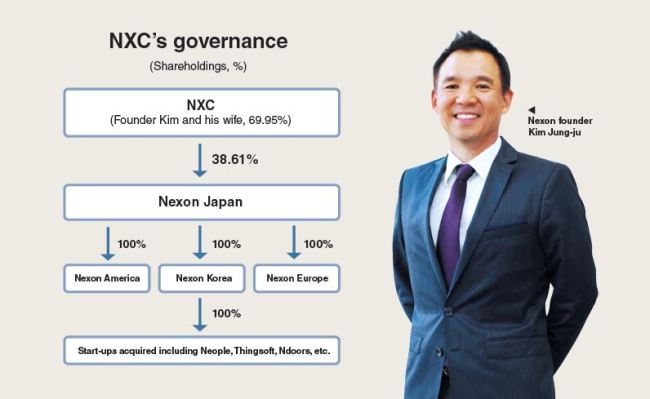

Nexon Group is under the control of Kim and his wife, as they have about 70 percent stake in holding company NXC.

By Seo Jee-yeon (jyseo@heraldcorp.com)

Kim, who founded Nexon in 1994 with his university friend Song Jae-kyng -- current CEO of XLGames -- is a new breed of superrich in Korea. He is a self-made billionaire, having accumulated wealth of 4.9 trillion won ($4.2 billion) by incubating Nexon and investing in start-ups at home and abroad in a variety of sectors ranging from gaming to future food and electric cars.

According to local news reports, the 48-year-old CEO of NXC, the de facto holding company of Nexon Group, is likely to be summoned following the firm’s confirmation Monday that it lent $1.1 million to three persons who were close to the founder in 2005 with no interest to help them purchase 10,000 unlisted shares each.

The three minority shareholders of Nexon, who hit the jackpot when the online gaming giant was listed on the Japanese stock market in 2011, are senior prosecutor Jin Kyung-jun, current Naver CEO Kim Sang-heon and former NXC auditor Park Sung-joon.

Jin and the Naver CEO are reported to have built a personal relationship with Kim when they studied together at the prestigious Seoul National University in the 1980s.

In an emailed statement Monday, Nexon said the transaction was aimed to secure trusted, long-term investors in preparation for hostile takeover bids during its initial days. It didn’t mention whether its founder was behind the deal or not.

But civic groups claimed the firm had no reason to lend corporate money to the minority investors to help them purchase its unlisted stocks without the involvement of top management.

“The offer of unlisted shares by the company itself is an advanced form of kickback as the public cannot easily buy those stocks,” said Yoon Young-dae from SpecWatch, a civic group monitoring speculative funds in the capital market.

“Nothing is different between the Nexon case and the previous cash-based corruption scandals between power elites in the legal and political sectors and the corporate sector.”

The civic groups also raised questions over Nexon’s late explanation for the loans to the three minority investors. The company, which had remained silent for a while, issued a statement Monday just after financial authorities announced they had found the involvement of Nexon in the course of a two-month investigation into the dubious deal with senior prosecutor Jin, who currently heads the Justice Ministry’s Korea Immigration Service, in 2005.

In April, Jin offered to resign when the news that he had pocketed huge capital gains through the sale of his shares of Nexon last year stirred the public.

According to a filing at the stock exchange, the high-ranking governmental official gained 12.6 billion won by selling about 800,000 shares of Nexon last year. It was later found that 10,000 shares dated back to 2005, when the company was unlisted.

The number of shares he bought from Nexon increased due to a stock split in 2011 when the online game developer was listed on the Japanese stock market.

Jin denied taking advantage of his public office or of any inside information when he bought the shares. Despite his denial, civic groups accused him of taking a kickback from Nexon in April.

“It doesn’t make sense at all that Kim Jung-ju didn’t know about the stock trading between Nexon and his close friends in June 2005, given he has controlled all details of the firm as a dominant shareholder,” an industry insider said.

Nexon Group is under the control of Kim and his wife, as they have about 70 percent stake in holding company NXC.

By Seo Jee-yeon (jyseo@heraldcorp.com)

![[Hello India] Hyundai Motor vows to boost 'clean mobility' in India](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/25/20240425050672_0.jpg&u=)