CJ HelloVision downplays ISS report on merger plan

Proxy advisor speaks against bid to acquire CJ HelloVision

By 김영원Published : Feb. 25, 2016 - 17:39

SK Telecom faces another hurdle in its plan to merge the nation’s No. 1 cable TV operator CJ HelloVision with its own IPTV unit as a global corporate advisory firm has opposed the deal that is crucial for it to gain leadership in the paid TV market.

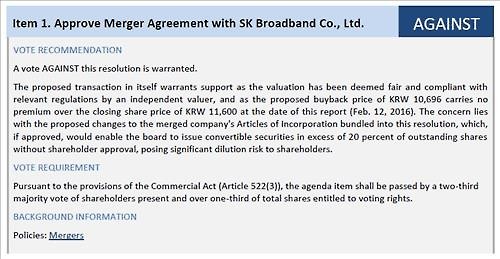

The Institutional Shareholder Services claimed Thursday the changes in corporate articles of the merged entity will pose “significant dilution risk” to shareholders of CJ Hellovision.

The Institutional Shareholder Services claimed Thursday the changes in corporate articles of the merged entity will pose “significant dilution risk” to shareholders of CJ Hellovision.

“The concern lies with the proposed changes to the merged company’s articles of incorporation bundled into this resolution, which, if approved, would enable the board to issue convertible securities in excess of 20 percent of outstanding shares without shareholders’ approval,” ISS said.

The firm said the additional stocks issued for CJ HelloVision could undermine the voting rights of the existing shareholders and cause a decrease in dividends.

CJ HelloVision, a unit of retail giant CJ Group, is scheduled to hold a shareholders meeting on Friday, when the company will put the merger plan to a vote. The company will change some of its corporate articles, including increasing the maximum amount of new securities that can be issued without shareholders’ approval from 40 billion won ($32.3 million) to 1 trillion won.

An SK Telecom official said that the changes of the articles would not necessarily mean the company would issue new convertible securities for the moment, and, if it does so in the future, measures to protect minority shareholders are already in place, such as guaranteeing appraisal rights.

As for the ISS’s claim that the proposed buyback price of CJ HelloVision’s shares at 10,696 won was undervalued compared to the closing price of 11,600 won on Feb. 12, the officer said the buyback price was based on the closing price posted on the day when SKT and CJ HelloVision publicly announced the merger plan.

“The two strategic partners made the announcement on Nov. 2 last year, and the share price has increased since then, signaling positive views of investors on the merger proposal,” he said, declining to be named.

Since the 1 trillion won merger plan became public last year, SKT’s competitors KT and LG Uplus and other market players have been opposing it, arguing that the deal goes against fair market principles and would wreak havoc on both pay TV and mobile network markets.

Displeased by what the company calls a shortsighted view of the ISS, SK Telecom countered that shareholders’ rights will be well protected, saying that many local investment firms have offered positive forecasts on the proposed merger plan.

Jung Yoon-mi, an analyst from Mirae Asset Securities, said in an investment report that “SKT and CJ HellVision would be able to create synergy, boosting the share price of the latter down the road.”

Daishin Securities has recently set the target share price of CJHV at 16,000 won, up from the previous 13,000 won.

SKT downplayed the serious impact of the ISS report, which is usually more influential among foreign investors, saying the shares owned by foreign nationals in CJHV stand at a tiny 7.81 percent.

London-headquartered investment management firm Barings Asset Management, which holds a 0.38-percent share in the local cable TV firm, announced that it would object to SKT’s merger scheme.

This is not the first time that ISS has opposed a merger deal between conglomerates in Korea.

Last year ahead of the merger between Samsung C&T and Cheil Industries, the firm recommended the former’s shareholders to vote against the deal, citing an unfavorable share-swap ratio. Despite the opposition, the deal ended successfully with the new entity, named Samsung C&T, becoming Samsung Group’s de facto holding company.

Some market officials often reprimand the ISS since the firm’s reports often fail to show the ins and outs of M&A deals due to inaccurate investment information of the nation’s corporations.

By Kim Young-won (wone0102@heraldcorp.com)

![[KH Explains] No more 'Michael' at Kakao Games](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/28/20240428050183_0.jpg&u=20240428180321)

![[Herald Interview] Mistakes turn into blessings in street performance, director says](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/04/28/20240428050150_0.jpg&u=20240428174656)