[SUPER RICH] Pharma king shakes up superrich rankings

By Korea HeraldPublished : Nov. 17, 2015 - 18:28

There is a new entrant in the ranks of Korean superrich.

Hanmi Pharmaceutical founder and chairman Lim Sung-ki became a prominent superrich as the company signed licensing agreements with several global pharmaceutical companies this year, including Belgium-based Janssen Pharmaceutica and France-based Sanofi.

The multibillion-dollar licensing agreements caused the shares of Hanmi Pharmaceutical and its parent company Hanmi Science to skyrocket. Stocks of Hanmi Pharmaceutical closed at 755,000 won ($645) per share on Tuesday.

With the deal, Hanmi Pharmaceutical’s total market capitalization rose to 8.43 trillion won, surpassing that of LG Electronics at 8.31 trillion won.

Lim’s assets also increased to 3.68 trillion won as of Nov. 9, crowning him the king of the Korean pharma industry.

The value of Lim’s assets has been steadily increasing over the past few years. He owns a major stake in Hanmi Science -- 36 percent in the 2012 fiscal year. As stock prices of Hanmi Science rose, the value of his shares rose from 272.4 billion won in 2013 to 3.27 trillion won this July, a 1,100 percent increase.

As of Nov. 9, Lim became the sixth-richest stock billionaire in Korea, following Samsung Group chairman Lee Kun-hee (12.13 trillion won), AmorePacific chairman Suh Kyung-bae (9.67 trillion won), Samsung Group vice chairman Lee Jae-yong (8.24 trillion won), Hyundai Motor Group chairman Chung Mong-koo (4.91 trillion won) and SK Group chairman Chey Tae-won (4.30 trillion won).

Members of Lim’s family also saw their assets increase. The estimated value of their shares totaled around 6.30 trillion won as of Nov. 6, surpassing that of the LG Group family, whose shares were worth an aggregate 5.77 trillion won. Prior to Hanmi’s pharmaceutical deals, Forbes had recorded the LG Group family as the third-richest family in Korea after the Samsung Group family and Hyundai Group family.

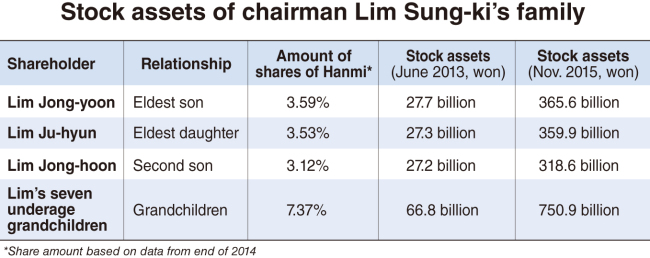

Lim’s family members have seen their stock assets expand tenfold within the last two years. His eldest son Lim Jong-yoon, copresident and director at Hanmi Pharmaceutical, owns 3.59 percent of shares and saw the value rise 1,200 percent since June 2013, reaching 365.6 billion won.

Lim Sung-ki’s daughter and Hanmi Pharmaceutical senior executive director Lim Ju-hyun, who has a 3.53 stake, saw her assets increase 1,218 percent in the same period to 359.9 billion won, and younger son Lim Jong-hoon, CEO of Hanmi Medicare, with 3.12 percent stake saw his assets rise to 318.6 billion won.

Additionally, Lim’s seven underage grandchildren became billionaires. The seven grandchildren, the eldest being 12 years old, had their total assets estimated at 750.9 billion won in Nov. 6, an amount that rivals the market price of a midsized firm.

Along with the soaring prices also came suspicion. Prosecutors have been investigating whether several asset management companies have found out about Hanmi’s development and export deals on immunization disease drugs in advance to make quick profits.

However, the secret behind Hanmi Pharmaceutical’s rising stock prices could be in its heavy investment in research and development. Lim, who started out as a pharmacist, is has professed a commitment to developing good medicine. In 2014, Hanmi made profits of 34.5 billion but spent 135.4 billion won in R&D, choosing to develop new technologies over marketing.

Lim is also able to sell his medicine technology for a good price. He has shown several times that he would cease negotiations altogether if the drug export conditions did not meet his standards. As a result, the four mega deals that Hanmi Pharmaceuticals made with foreign pharmaceutical companies this year have been worth a total 7.5 trillion won.

Despite the record-breaking pharmaceutical deals, Hanmi Pharmaceutical and Lim do not yet have a firm hold on their assets. Although the market is estimating the target stock price to be as much as 1 million won, the company’s business profits are very low in relation to its current market capitalization. It is more accurate to say that the company valuation has increased rapidly as investors poured in a lot of money looking for fresh investment.

However, it is clear Lim’s sudden rise to billionaire status is driven by the market and investors. Although South Korea grew on the strength of its heavy industries such as automobiles, steel, electronics and chemicals, there is now a demand for new industries befitting a more powerful 21st century South Korea.

Just as there have been hopeful eyes on AmorePacific chairman Suh Kyung-bae who became superrich through the cosmetics industry, there are many expectations of the Korean pharmaceutical king.

By The Korea Herald Superrich Team (sangyj@heraldcorp.com)

Hong Seung-wan, Cheon Ye-seon, Bae Ji-sook, Yoon Hyun-jong, Min Sang-seek, Kim Hyun-il, Sang Youn-joo

-

Articles by Korea Herald

![[Hello India] Hyundai Motor vows to boost 'clean mobility' in India](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/25/20240425050672_0.jpg&u=)