PEFs, Shinsegae, Hoban join competition to buy Kumho Industrial

Kumho Asiana chairman seeks financial investors to buy back controlling stake in holding firm

By Seo Jee-yeonPublished : Feb. 25, 2015 - 19:08

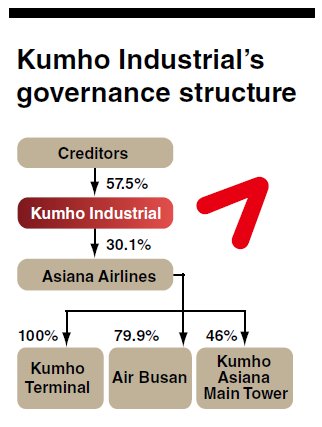

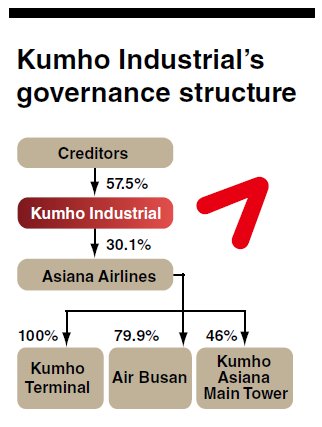

The heated race to take a 57.48 percent stake in Kumho Industrial, the de facto holding company of Kumho Asiana Group, started Wednesday among private equity funds, Shinsegae Group, and a domestic builder.

Four domestic private equity funds, retail giant Shinsegae, and Hoban Construction, a mid-tier local builder, have joined the bid by submitting a letter of intent to underwriters.

According to sources, the confirmed PEF bidders are MBK Partners, IMM Investment Corp., IBK Securities-Keistone Partners and Jabez Partners.

The bid for Kumho Industrial has emerged as one of the hottest issues in the Korean M&A market as the winner will be able to control two airlines ― Asiana Airlines, the nation’s second-largest flag carrier, and Air Busan, Asiana’s low-budget affiliate.

Kumho Industrial holds a 30.1 percent stake in Asiana Airlines, and Asiana holds a 46 percent stake in Air Busan.

Despite the heated competition, market analysts said the strongest candidate for the deal is still Kumho Asiana Group chairman Park Sam-koo, as he has the right to buy back shares of Kumho Industrial ahead of the preferred bidder. He also has a 10 percent stake in Kumho Industrial.

Park has expressed a strong will to retake the group’s holding company and recover group owner status. The chairman had to hand his control over the firm to creditors in 2010 due to soaring debts after a failed takeover deal with Daewoo Engineering and Construction.

“However, chairman Park seems to need more cash to achieve his five-year-awaited dream,’’ an insider close to the matter said.

The tight bid for Kumho Industrial is highly likely to lift the deal amount. The firm’s market value as of Wednesday was hovering around 517.5 billion won ($500 million). The firm’s share price has doubled over the past year.

“Given the premium on control over Asiana Airlines, the cost of acquisition is expected to soar to 1 trillion won,’’ said Jin Dae-chon, a stock analyst from Daeshin Securities.

Market watchers said Park is currently estimated to have around 200 billion won in cash.

“He will step up his efforts to look for the right partners to raise enough funds to cope with challenges by other bidders,’’ the insider said.

One possible scenario is to team up with Hoban Construction, one of bidders. The builder, which owns a 4.95 percent stake in Kumho Industrial, reportedly has huge cash reserves and its chairman Kim Sang-yeol has built a close relationship with Park.

Kumho Asiana declined to comment on the fundraising plan for the deal.

The preferred bidder will be announced in April, according to Korea Development Bank, Kumho Industrial’s main creditor.

By Seo Jee-yeon & Park Han-na

(jyseo@heraldcorp.com) (hnpark@heraldcorp.com)

Four domestic private equity funds, retail giant Shinsegae, and Hoban Construction, a mid-tier local builder, have joined the bid by submitting a letter of intent to underwriters.

According to sources, the confirmed PEF bidders are MBK Partners, IMM Investment Corp., IBK Securities-Keistone Partners and Jabez Partners.

The bid for Kumho Industrial has emerged as one of the hottest issues in the Korean M&A market as the winner will be able to control two airlines ― Asiana Airlines, the nation’s second-largest flag carrier, and Air Busan, Asiana’s low-budget affiliate.

Kumho Industrial holds a 30.1 percent stake in Asiana Airlines, and Asiana holds a 46 percent stake in Air Busan.

Despite the heated competition, market analysts said the strongest candidate for the deal is still Kumho Asiana Group chairman Park Sam-koo, as he has the right to buy back shares of Kumho Industrial ahead of the preferred bidder. He also has a 10 percent stake in Kumho Industrial.

Park has expressed a strong will to retake the group’s holding company and recover group owner status. The chairman had to hand his control over the firm to creditors in 2010 due to soaring debts after a failed takeover deal with Daewoo Engineering and Construction.

“However, chairman Park seems to need more cash to achieve his five-year-awaited dream,’’ an insider close to the matter said.

The tight bid for Kumho Industrial is highly likely to lift the deal amount. The firm’s market value as of Wednesday was hovering around 517.5 billion won ($500 million). The firm’s share price has doubled over the past year.

“Given the premium on control over Asiana Airlines, the cost of acquisition is expected to soar to 1 trillion won,’’ said Jin Dae-chon, a stock analyst from Daeshin Securities.

Market watchers said Park is currently estimated to have around 200 billion won in cash.

“He will step up his efforts to look for the right partners to raise enough funds to cope with challenges by other bidders,’’ the insider said.

One possible scenario is to team up with Hoban Construction, one of bidders. The builder, which owns a 4.95 percent stake in Kumho Industrial, reportedly has huge cash reserves and its chairman Kim Sang-yeol has built a close relationship with Park.

Kumho Asiana declined to comment on the fundraising plan for the deal.

The preferred bidder will be announced in April, according to Korea Development Bank, Kumho Industrial’s main creditor.

By Seo Jee-yeon & Park Han-na

(jyseo@heraldcorp.com) (hnpark@heraldcorp.com)

![[Herald Interview] 'Amid aging population, Korea to invite more young professionals from overseas'](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/24/20240424050844_0.jpg&u=20240424200058)

![[Hello India] Hyundai Motor vows to boost 'clean mobility' in India](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/25/20240425050672_0.jpg&u=)