Korean enterprises remitted about 2 trillion won ($1.6 billion) to tax havens such as Ireland, Luxembourg and Delaware state in the U.S. last year, data from the Bank of Korea showed Monday.

A BOK official noted that the nation’s 30 major business groups including Samsung operate a combined 250 subsidiaries in tax havens.

Several of the overseas units in such areas providing tax benefits are reportedly known as bogus firms with no business activities, allegedly established to raise offshore funding at lower costs.

In its report to policymakers, the central bank stated that the problematic 2 trillion won translates into about 40 percent of the country’s entire overseas investment.

Overseas remittances in 2012 increased by about 56 percent from the previous year, as the government kept up the tax bases to set aside more social welfare reserves.

But the amount can be much larger, considering the rest of the money that the firms may have carried out undeclared, observers said.

In tax havens, firms are imposed infinitesimal or no tax rates on certain categories. These tax paradises accordingly attract a huge influx of overseas remittances from domestic firms. It is common for large financial firms to establish nominal paper companies in tax havens to secure funds, a BOK official noted.

The Cayman Islands were the most frequented tax haven by domestic firms this year.

In 2012 alone, Korean firms hoarded $1.23 billion there, almost double the previous year’s some $650 million.

Fourteen financial and nonfinancial subsidiary companies of large firms ― including Samsung, Hyundai Motor Group, Lotte, Hanwha and Hyosung ― were in operation on the islands as of the end of 2011.

Bermuda, the British Virgin Islands and Labuan, a small East Malaysian island, were the next most frequented tax havens, the BOK said.

The money transfer by local firms into the British Virgin Islands tallied to $51 million in 2012, slightly up from $48.6 million from a year earlier, BOK’s data showed.

The low interest rate here had its part in driving fund remittance to tax havens, BOK officials said.

By Chung Joo-won (joowonc@heraldcorp.com)

A BOK official noted that the nation’s 30 major business groups including Samsung operate a combined 250 subsidiaries in tax havens.

Several of the overseas units in such areas providing tax benefits are reportedly known as bogus firms with no business activities, allegedly established to raise offshore funding at lower costs.

In its report to policymakers, the central bank stated that the problematic 2 trillion won translates into about 40 percent of the country’s entire overseas investment.

Overseas remittances in 2012 increased by about 56 percent from the previous year, as the government kept up the tax bases to set aside more social welfare reserves.

But the amount can be much larger, considering the rest of the money that the firms may have carried out undeclared, observers said.

In tax havens, firms are imposed infinitesimal or no tax rates on certain categories. These tax paradises accordingly attract a huge influx of overseas remittances from domestic firms. It is common for large financial firms to establish nominal paper companies in tax havens to secure funds, a BOK official noted.

The Cayman Islands were the most frequented tax haven by domestic firms this year.

In 2012 alone, Korean firms hoarded $1.23 billion there, almost double the previous year’s some $650 million.

Fourteen financial and nonfinancial subsidiary companies of large firms ― including Samsung, Hyundai Motor Group, Lotte, Hanwha and Hyosung ― were in operation on the islands as of the end of 2011.

Bermuda, the British Virgin Islands and Labuan, a small East Malaysian island, were the next most frequented tax havens, the BOK said.

The money transfer by local firms into the British Virgin Islands tallied to $51 million in 2012, slightly up from $48.6 million from a year earlier, BOK’s data showed.

The low interest rate here had its part in driving fund remittance to tax havens, BOK officials said.

By Chung Joo-won (joowonc@heraldcorp.com)

![[New faces of Assembly] Architect behind ‘audacious initiative’ believes in denuclearized North Korea](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/05/01/20240501050627_0.jpg&u=20240502093000)

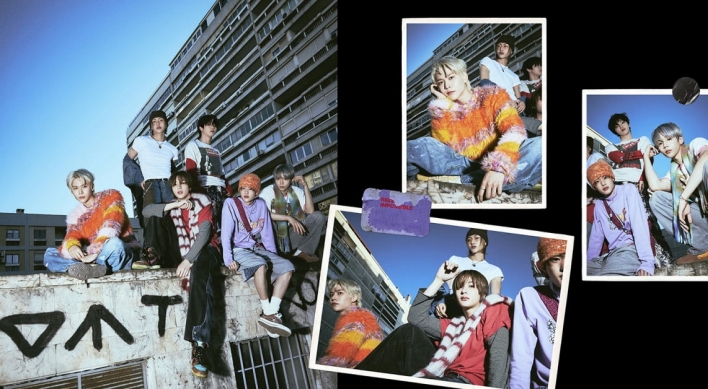

![[Today’s K-pop] Sunmi to drop single next month](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=642&simg=/content/image/2024/05/03/20240503050545_0.jpg&u=)