Storms brew for export-driven industries

Smartphone industry expects continued boom, but other sectors’ exports to remain slow

By Korea HeraldPublished : Dec. 30, 2012 - 20:53

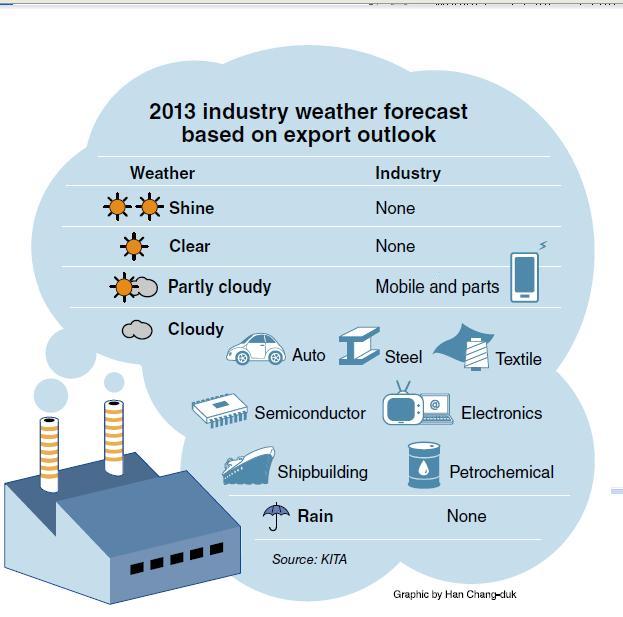

KITA forecast that the smartphone and related-parts industry was likely to be the sole sector to have a good year, enjoying double-digit sales growth in and out of Korea.

New models of flagship smartphone brands like Samsung’s Galaxy 3 and Galaxy Note 2 will strengthen its market leadership in and out of Korea backed by the expansion of the long-term evolution, or LTE, network in the global market. Strategy Analytics, a global market research firm, predicted that about 275 million LTE smart phones would be sold worldwide in 2013, three times more than 2012.

Industry watchers said one of the trends to watch would be how much Samsung strengthens its market leadership in fierce competition with Apple. According to Strategy Analytics, Samsung’s market share in the global smartphone market almost doubled to 35.2 percent, compared to 16.6 percent for Apple, in the third quarter of 2012.

But other IT industries, including semiconductors and PCs, are likely to remain slow due to excessive supply, the KITA report said.

The outlook for the auto industry in 2013 is mixed. The Korea Automobile Manufacturers Association, or KAMA, said demand for Korean cars overseas would continue to grow, but domestic demand would stagnate.

Despite the expected appreciation of the won, KAMA said car exports would hit a record high of 3.3 million units in 2013, growing 3.1 percent compared to the previous year thanks to tariff-reduction by Korea-EU Free Trade Agreement, product capacity expansion and rising brand value of Korean cars.

The steel industry will have another difficult year in 2013, hit by weak domestic demand from steel-consuming construction and shipbuilding industries and a hike in electricity prices. In addition, oversupply caused by Chinese steel makers will put downward pressure on steel product prices, which will lead to deteriorated operating profits for steelmakers. POSCO Research Institute said even steel giants like POSCO are likely to face a bigger challenges in 2013 due to weakening domestic demand in auto, construction and shipbuilding industries.

The shipbuilding industry, which suffered from a lack of orders in 2012, particularly in Europe, is expected to remain in the doldrums this year. KITA said the amount of ship-building orders is forecast to fall 28.4 percent to $40.5 billion in 2012.

Most of all, the prolonged depression will deteriorate operating profit of the nation’s leading ship builders, including Hyundai Heavy Industries and Daewoo Shipbuilding and Marine Engineering, as a buyer’s market demands cheaper ships.

Industry watchers said a small improvement demand in 2013 would increase shipbuilders’ sales, but operating profits will take more time to pick up. As part of efforts to offset a loss in ship-building, market leaders will step up attempts to tap the offshore plant market.

The refinery industry, which topped in the export ranking in 2012 by overtaking the shipbuilding industry, will continue to focus on exports this year. However, its profitability will depend on the trend of international oil prices.

Construction companies will also put more resources on the overseas market amid the continued weak demand in the real estate market, industry sources said.

By Seo Jee-yeon (jyseo@heraldcorp.com)

-

Articles by Korea Herald

![[K-pop’s dilemma] Time, profit pressures work against originality](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/05/08/20240508050705_0.jpg&u=20240508171126)

![[K-pop's dilemma] Is Hybe-Ador conflict a case of growing pains?](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/05/07/20240507050746_0.jpg&u=)

![[Today’s K-pop] Stray Kids to drop new album in July: report](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=642&simg=/content/image/2024/05/09/20240509050659_0.jpg&u=)