Are joint couple bank accounts the best way to share dating expenses?

By Song Jung-hyunPublished : April 29, 2023 - 16:00

"Am I the one who has to pay this time?" is a question that often troubles many South Korean couples whenever they are about to pay the bill at a restaurant.

Traditionally, people believed that men should pay most of the dating expenses, but such rigid gender norms no longer hold water as more couples have started to value fairness.

Indeed, a staggering 83.2 percent of those with dating experiences reported having argued with their partner over “how to split bills,” according to a 2019 survey by the matchmaking agency Duo, which surveyed 422 single men and women.

To avoid squabbles altogether, a growing number of young couples have turned to a “joint couple bank account” -- an account into which both parties deposit a certain sum of money on a designated day each month to help finance their dating costs.

“Even when eating a luxury meal with my girlfriend, I couldn’t entirely focus on the moment because, in my head, I was thinking about the cost of the bill,” a man in his thirties wrote in an online community. “But after opening a joint bank account, I no longer had to worry.”

The joint account is also touted as a method of encouraging more efficient money use as transaction details are shared between holders of the account. This can help couples identify and prevent unnecessary expenses.

Many banks have also released products targeting couples for this purpose.

For example, the South Korean internet-only bank, KakaoBank Corp., allows its users to easily set up a joint couple account on its app without any documents needed. The owner of the account simply needs to invite his/her partner from KakaoTalk, the country’s most common messenger app, for both users to manage the account.

The account also has an alarm function which sends an automated reminder message on the decided deposit day to all its users.

Does a joint couple bank account create more problems down the line?

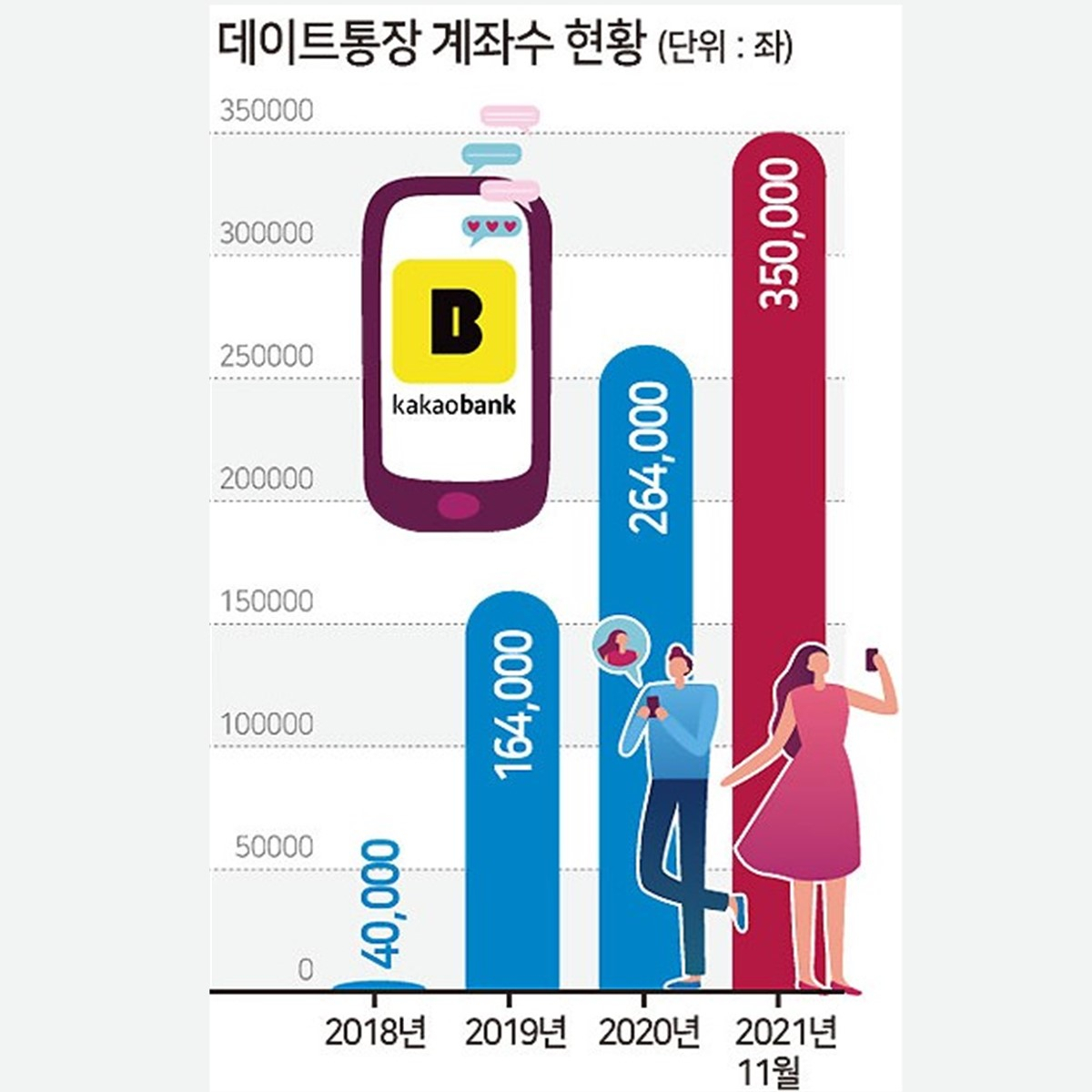

Over recent years, the number of joint couple bank account users has surged. However, despite its growing popularity, having such an account is not without problems.

While a joint bank account is often intended to ensure fairness in sharing dating expenses, many times, one party ends up depositing more money. Even worse, some often don't deposit funds on the decided payment day.

“Then you have to keep reminding your partner to deposit the money, which can create tension,” explained a woman, surnamed Lee, on condition of anonymity in an interview with The Korea Herald as she recalled her experience with such accounts.

“I felt very uncomfortable and annoyed by constantly having to remind my forgetful boyfriend. And at some point, he also got annoyed.”

However, even more serious problems are faced by couples in the aftermath of a breakup.

As most couple bank accounts customarily allow only one account holder, the other partner is unable to withdraw money. This leads to being unable to reclaim money should an ex who is the account holder disappear or refuse to return the remaining balance, which is not a rare occurence.

Additionally, many people, mostly men, feel reluctant to approach their ex to ask for their money back.

“I couldn’t bring myself to ask her to send me my share of the money,” said Choi Kyun-tae, a 38-year-old man whose ex-girlfriend managed the couple's bank account.

“I let her have all the remaining balance. So it was a loss for me in the end since I had been depositing more money every month,” Choi added.

However, even in the case where both partners are account holders, they are required to visit the bank together to cancel the account after breaking up, which poses another set of problems.

Due to the awkwardness of such a situation, many couples leave the accounts open without collecting the remaining balance for an indefinite period of time.

Meanwhile, some also question the necessity of joint couple bank accounts.

“My girlfriend just sends me her share of the expenses to my bank account or via KakaoPay (a Korean mobile payment service) after I pick up the tab and it works out perfectly well,” said Kim Yong-hyun, a 29-year-old man who works at a bar in Seoul.

“Instead of reminding your partner to deposit money and keeping track of how much they contributed every month, it is much better to take turns picking up the tab or to have the person with a higher income cover more for their partner when necessary,” Kim explained, highlighting the importance of flexibility between couples.

“So I wonder if having a designated couple account is actually necessary, especially considering the problems down the line when couples break up,” Kim added.

![[AtoZ into Korean mind] Humor in Korea: Navigating the line between what's funny and not](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/22/20240422050642_0.jpg&u=)

![[Exclusive] Korean military set to ban iPhones over 'security' concerns](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/23/20240423050599_0.jpg&u=20240423183955)

![[Graphic News] 77% of young Koreans still financially dependent](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/22/20240422050762_0.gif&u=)

![[Herald Interview] Why Toss invited hackers to penetrate its system](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/22/20240422050569_0.jpg&u=20240422150649)

![[Exclusive] Korean military to ban iPhones over security issues](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/04/23/20240423050599_0.jpg&u=20240423183955)

![[Today’s K-pop] Ateez confirms US tour details](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=642&simg=/content/image/2024/04/23/20240423050700_0.jpg&u=)