[Herald Interview] BOK likely to turn attention to growth: SC Bank strategist

Banking giant's Asia research head predicts end of rate hikes in Korea, urges central bank to focus more on boosting economy

By Song Seung-hyunPublished : Jan. 17, 2023 - 17:23

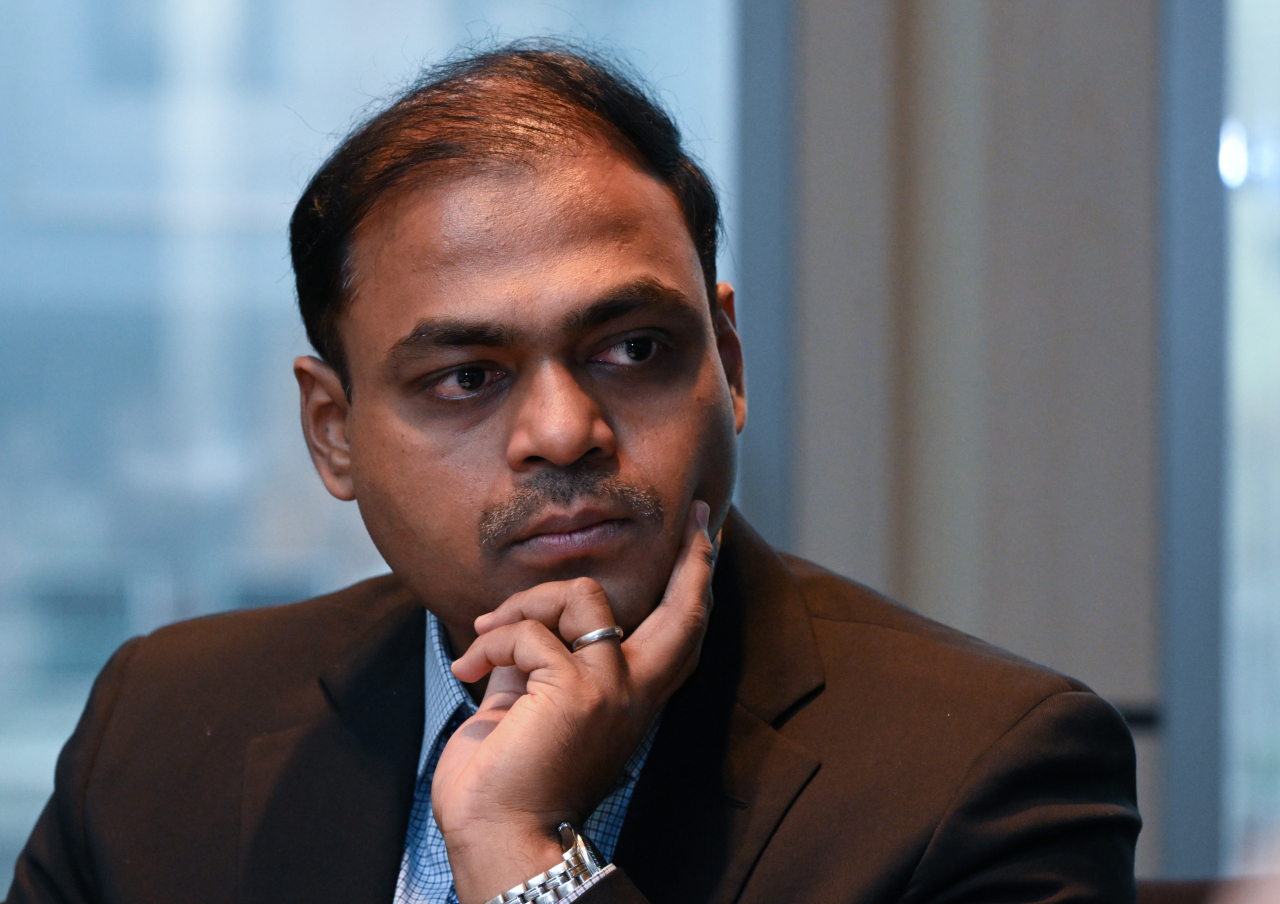

Arup Ghosh, Standard Chartered Bank’s co-head of Asia (excluding China) rates research and global research, sees that the Bank of Korea now has room to pause its rate hike and focus more on reviving the Korean economy.

“Now, the domestic economy -- particularly the housing market, private consumption and falling exports -- matters more to the BOK,” Ghosh said during an interview with The Korea Herald on Friday.

The Singapore-based researcher was in Korea to take part in the Global Research Briefing, an event organized by SC Bank, in Seoul last week.

Ghosh joined the bank in 2015 from Dymon Asia Capital. He also previously worked at Citibank, Lehman Brothers, Bear Stearns and Bank of America Merrill Lynch.

He explained that the BOK's focus shift is likely to occur mainly due to the US Federal Reserve indicating a slowdown in the pace of its rate hikes. He says this has eased the burden on the BOK, which has been hiking rates to stop the Korean won from weakening.

The head researcher also said he already noticed the BOK’s somewhat dovish stance during Friday's policy announcement.

“The BOK indicated that some members prefer rates at 3.5 percent, which is where it is now. So no more rate hikes. And some other members are calling for one more hike to 3.75 percent, which also means it's pretty close to the end of the rate hiking cycle,” he said.

When sharing his thoughts on the further impact of the Legoland crisis on the Korean market, he said that “the worst is possibly behind us.”

The crisis, which began with a default in project financing for the construction of Legoland Korea in Gangwon Province, later spilled over to the market as South Korea’s bond market lost credibility. This caused many local companies to face difficulties when raising money in 2022.

“In terms of whether it will spill into the wider financial markets, it did spill in the beginning, but subsequently we are seeing an easing of liquidity pressures in the market,” he said.

Ghosh said that various indicators like commercial paper yields, corporate bond spreads, financial debenture rates, and certificate of deposit rates show that liquidity in the local market is slowly stabilizing.

"We think this is likely to continue," he said.

Nonetheless, Ghosh stressed that there still has to be support for those with lower credit.

“It's quite clear that some of the lower-rated companies and property developers are facing credit issues,” he said. “So, the government has to provide more targeted liquidity because a lot of these lower-rated corporates don't have access to long-term capital markets.”

During his interview, he also touched on some of the unique features and problems of the Korean real estate market.

The researcher especially highlighted the housing market affordability issue in Korea, saying that it was one of the worst in the world.

“It's particularly difficult for the younger generation to buy houses in Korea,” he said.

Therefore, Ghosh noted that government should come up with policies for the younger generation.

“When it comes to policies like easing loan-to-value and debt-to-income ratios … I think Singapore is a good example to follow, where housing ownership across income segments is one of the highest in the world,” he said.

Toward the end of the interview, Ghosh warned future real estate investors that it’s “too early to call” on whether the housing market has bottomed, and said he does not recommend purchasing housing now.

“Demand to supply has to move in favor of demand, but we are currently seeing supply far outstripping demand,” he explained.

On top of having sufficient demand, credit market stabilization and the BOK’s rate cut must be accompanied for the Korean real estate market to revive, which could take several quarters or even a few years, he said.

![[KH Explains] Hyundai's full hybrid edge to pay off amid slow transition to pure EVs](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/18/20240418050645_0.jpg&u=20240419100350)

![[From the Scene] Monks, Buddhists hail return of remains of Buddhas](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/04/19/20240419050617_0.jpg&u=20240419175937)

![[KH Explains] Hyundai's full hybrid edge to pay off amid slow transition to pure EVs](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/04/18/20240418050645_0.jpg&u=20240419100350)

![[Today’s K-pop] Illit drops debut single remix](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=642&simg=/content/image/2024/04/19/20240419050612_0.jpg&u=)