With assessment of NFTs done, financial companies actively seek opportunites

By Park Ga-youngPublished : Nov. 6, 2021 - 22:51

Rather than discussing the question of whether non-fungible tokens are a fad, traditional financial institutions are instead asking how they can be incorporated within their business models, according to speakers from major financial firms who gathered at a three-day conference on NFTs.

The tokens are digital counterparts of real-world assets, largely visual art and music. More importantly, each NFT is unique, with ownership being traced and protected through blockchain technology. Given that the NFT market more than doubled in size between the second and third quarter of this year alone, it has now become “too big to ignore.”

Indeed, this sentiment was echoed by officials from Shinhan Bank, Hanwha Asset Management and Ground X, a blockchain arm of Kakao Corp. who spoke during Thursday sessions of NFT Busan 2021, a conference hosted by Busan Metropolitan City.

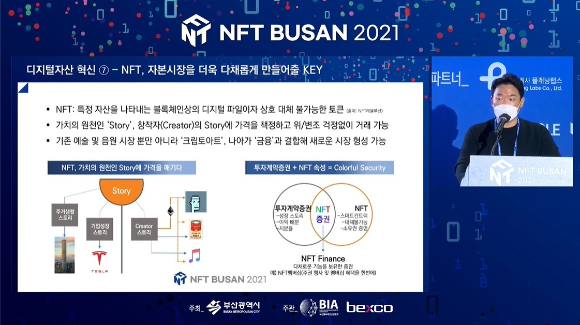

“Mirae Asset Securities has reached the conclusion that digital assets, including NFTs, possess great potential, with digital asset innovation representing an unprecedented combination of radical, discontinuous and disruptive innovations,” claimed Lee Young-jae, a senior manager at Mirae Asset Securities.

Lee flagged the collaboration between traditional financial companies and blockchain companies as a potential future trend, stating that “traditional companies are very good at business development, while lacking on the blockchain technology front.”

Given that the digital asset market will undoubtedly continue to grow and evolve, the synergy of these two radically different company types could well result in a killer application, he said.

Lee added that many institutional investors will likely jump into the digital asset markets, which in turn will prompt the creation of further blockchain services to support the increased demand of these new institutional investors.

“We are not just talking about institutional investors buying bitcoin as part of their own portfolios, but rather the purchasing of cryptocurrencies and other digital assets as part of client portfolios as well.”

Beyond his predictions about the future of digital assets, Lee also shared his thoughts on the future of cryptocurrency, indicating that more countries will move to adopt cryptocurrency as legal tender, just as El Salvador did earlier this year.

Kim Won-sang of Ground X also discussed the future of cryptocurrencies, stating that “digital banks, regardless of the efforts they make, are still just banks. The financial industry will remain limited, unless these banks can find a way of not only having a slice of the pie, but rather making the whole pie bigger.”

“At the moment, the cryptocurrency market, which is a fungible market, outscales the NFT market, but the cryptocurrency market still falls within the realm of conventional finance. On the other hand, NFTs present an unlimited potential to expand beyond existing conceptions of financial assets,” Kim noted.

The tokens are digital counterparts of real-world assets, largely visual art and music. More importantly, each NFT is unique, with ownership being traced and protected through blockchain technology. Given that the NFT market more than doubled in size between the second and third quarter of this year alone, it has now become “too big to ignore.”

Indeed, this sentiment was echoed by officials from Shinhan Bank, Hanwha Asset Management and Ground X, a blockchain arm of Kakao Corp. who spoke during Thursday sessions of NFT Busan 2021, a conference hosted by Busan Metropolitan City.

“Mirae Asset Securities has reached the conclusion that digital assets, including NFTs, possess great potential, with digital asset innovation representing an unprecedented combination of radical, discontinuous and disruptive innovations,” claimed Lee Young-jae, a senior manager at Mirae Asset Securities.

Lee flagged the collaboration between traditional financial companies and blockchain companies as a potential future trend, stating that “traditional companies are very good at business development, while lacking on the blockchain technology front.”

Given that the digital asset market will undoubtedly continue to grow and evolve, the synergy of these two radically different company types could well result in a killer application, he said.

Lee added that many institutional investors will likely jump into the digital asset markets, which in turn will prompt the creation of further blockchain services to support the increased demand of these new institutional investors.

“We are not just talking about institutional investors buying bitcoin as part of their own portfolios, but rather the purchasing of cryptocurrencies and other digital assets as part of client portfolios as well.”

Beyond his predictions about the future of digital assets, Lee also shared his thoughts on the future of cryptocurrency, indicating that more countries will move to adopt cryptocurrency as legal tender, just as El Salvador did earlier this year.

Kim Won-sang of Ground X also discussed the future of cryptocurrencies, stating that “digital banks, regardless of the efforts they make, are still just banks. The financial industry will remain limited, unless these banks can find a way of not only having a slice of the pie, but rather making the whole pie bigger.”

“At the moment, the cryptocurrency market, which is a fungible market, outscales the NFT market, but the cryptocurrency market still falls within the realm of conventional finance. On the other hand, NFTs present an unlimited potential to expand beyond existing conceptions of financial assets,” Kim noted.

![[KH Explains] Hyundai's full hybrid edge to pay off amid slow transition to pure EVs](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/04/18/20240418050645_0.jpg&u=20240419100350)