Fake meat, or meat analogues are becoming more familiar in the South Korea’s food scene, with fast food franchises rolling out items that use plant-based meat alternatives.

It was just February last year when Lotte GRS’ burger chain Lotteria became the first fast food franchise to roll out a meat analogue option. The Miracle Burger uses a specially developed patty made of wheat and beans.

Since then, more fast food franchises have added options with meat alternatives to their menus, offering the faux meat experience to a wider range of consumers.

“I have heard about fake meat, but I simply thought it was for vegans and did not think I would actually purchase a product on my own,” an office worker surnamed Lee told The Korea Herald. He was having a plant-based meat patty burger at a Burger King store here.

“I was just curious what the plant-based burger would taste like. I am surprised that it tastes pretty similar to a real burger (with meat), with the sauce and the bun,” Lee said.

Interest in plant-based protein has been growing globally and in Korea, as diet preferences diversify and more consumers become concerned about the environment, animal welfare and their health.

According to a survey by Consumers Korea, a consumer organization here, about 72.6 percent of 500 respondents believed consuming meat analogues supports the environment, and 50 percent said they believed the fake meat was healthy.

Over 60 percent of the respondents had tried meat analogue products, and 34.6 percent of them were satisfied with the taste, 41.2 percent said it was so so, and 24.2 percent were not satisfied, the data showed.

While plant-based eating is now a major trend affecting the whole food scene in US and more mature markets, in Korea, it has been primarily led by fast food chains.

No Brand Burger revealed last week that its latest meat analogue chicken nugget, No Chicken Nugget, has sold over 100,000 in just a month after its release on April 1.

Shinsegae Food, the firm behind the burger chain, said the chicken nuggets available at 90 of its stores across the country, sold three times faster than it had anticipated. Daily, about 3,000 nuggets were sold.

The company attributed the popularity to how No Chicken Nugget successfully recreated the taste and texture of chicken nuggets without using chicken meat, and how positive reviews on the taste have spread on social media.

No Chicken Nugget uses meat alternatives by Quorn, a British company that makes its products from mycoprotein. Mycoprotein is a protein source from fermenting a fungus found naturally in soil -- fusarium venenatum. According to Quorn, mycoprotein is rich in fiber, and its thin tissues are useful in recreating the chewing texture of chicken meat.

To meet the demand, No Brand Burger acquired ingredients enough to produce 200,000 more portions of its meat-free nuggets, and resumed selling them on May 4.

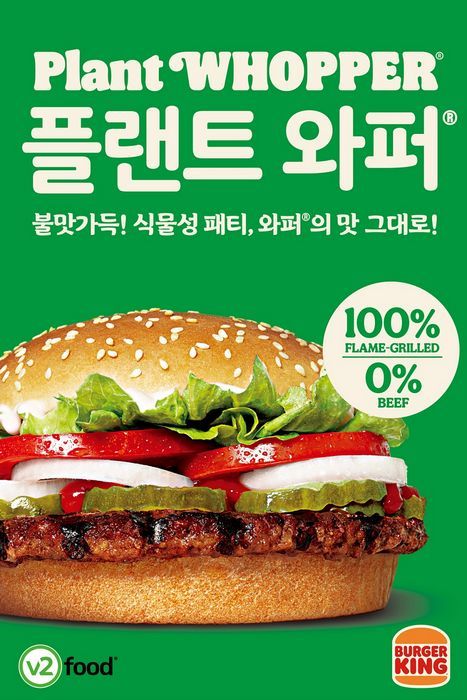

Burger King also introduced its first plant-based meat patty burger in two flavors in February. For Plant Whopper and Plant Barbeque Whopper, the burger franchise said it used plant-based patties it has jointly developed with v2food, a leading meat analogue producer in Australia.

Lotteria rolled out its second product, Sweet Awesome Burger, in November. For the burger, the company substitutes the animal meat patty with a plant-based one produced by Sweet Earth, a meat analogue brand launched by Nestle.

McDonald’s Korea has not yet introduced a faux meat burger. But the global chain has recently begun the test of its first meat alternative patty burger, McPlant Burger, in Denmark and Sweden. The patty has been co-developed with Beyond Meat, and is made from pea and rice protein, according to the websites of burger chain’s the European branches.

Other food companies are jumping into the race for meat alternatives.

In March, Pulmuone, a fresh food company, announced of its plans for plant-based food to challenge global meat analogue companies, such as Impossible Foods and Beyond Meat, releasing a lineup of products, such as plant-based yogurt, meat and tofu-derived protein items.

Retail behemoth Lotte Group also created a joint fund among its affiliates, Lotte Confectionery, Lotte Foods and Lotte Chilsung Beverage, to invest in “future” food items. The fund made its first investment in The PlantEat, a food tech startup company specializing in plant-based food items.

According to the Institute for International Trade under Korea International Trade Association, meat analogues will take about 30 percent of the world’s meat market in 2030, and the share will double by 2040.

“Meat analogue products presented by fast food franchises such as Burger King that are easily available, appear to be accurately fulfilling the diversifying preferences of the MZ generation and also offering the chance for consumers who do not pursue vegetarian diets to discard their prejudices against meat analogues,” Moon Jung-hoon, a professor of Information Management in Agriculture and Food Business in Seoul National University, said.

The popularity of plant-based food and meat alternatives would have “staying power” as top consumers of the items are Millennials and Gen Z, those born after 1980, NPD Group, a US-based research firm, said in its report in October.

NPD Group said the consumers’ choice for plant-based food items derives from their desires to “address their long-term health goals and animal treatment concerns.”

“It is not about rejecting traditional protein sources as about 90 percent of the users are neither vegetarian nor vegan,” the report said, noting that it shows consumers want options.

By Jo He-rim (herim@heraldcorp.com)

![[Herald Interview] 'Amid aging population, Korea to invite more young professionals from overseas'](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/24/20240424050844_0.jpg&u=20240424200058)

![[KH Explains] Korean shipbuilding stocks rally: Real growth or bubble?](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/04/25/20240425050656_0.jpg&u=)