[News Focus] In growth of corporate tax, Korea No. 2 in OECD

Of 35 member nations studied, Korea’s personal income tax grew seventh-fastest

By Kim Yon-sePublished : Dec. 29, 2020 - 16:19

SEJONG -- In a recent comparison of 35 members of the Organization for Economic Cooperation and Development, South Korea’s corporate tax rate grew second-fastest over the five years ending in 2019.

During the same time frame, Korea ranked seventh in personal income tax growth. Of the total 37 OECD members, Australia and Greece were excluded from the comparison.

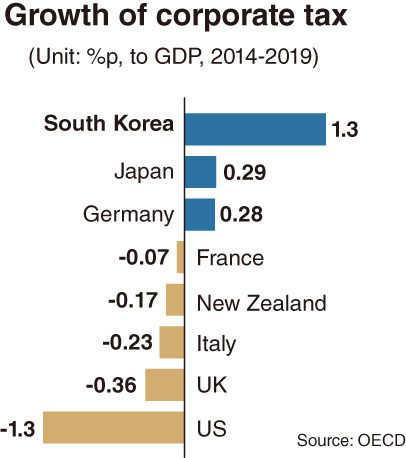

According to the Paris-based organization, Korea’s tax on corporate profit was equivalent to 4.3 percent of the nation’s gross domestic product in 2019. It climbed by 1.3 percentage points, from 3 percent of the GDP in 2014.

The figure marked the second-highest in the comparison. Luxembourg, which saw growth of 1.63 percentage points, was at the top of the list.

The OECD defined taxes on corporate profit as taxes levied on the net profit of enterprises, adding that it also covered capital gains taxes.

Though the OECD has yet to compile the average rate of tax on corporate profit for all its members, Korea’s figure was well above the 0.29 percentage point growth seen in Japan, the 0.28 percentage point growth seen in Germany, the 0.23 percentage point growth seen in Sweden and the 0.08 percentage point growth seen in Spain.

Further, some countries posted negative growth figures. These included the US with minus 1.3 percentage points, the UK with minus 0.36 percentage point, Italy with minus 0.23 percentage point and France with minus 0.07 percentage point.

Among the others whose enterprises’ tax burden was eased nominally were Latvia at minus 1.38 percentage point growth, Iceland at minus 1.08, Norway at minus 0.9, Colombia at minus 0.48, New Zealand at minus 0.17, Israel at minus 0.07 and the Czech Republic at minus 0.05.

This comparison could suggest that the Moon Jae-in administration, which took office in May 2017, has been active in raising corporate taxes.

The administration’s taxation policy was similar in terms of taxes imposed on households.

OECD data showed that Korea’s tax on personal income was equivalent to 4.792 percent of the GDP in 2019, posting growth of 0.988 percentage point from 3.804 percent of the GDP in 2014. This was the seventh-fastest growth among the 35 OECD members included in the analysis.

Tax on personal income is defined as the tax levied on individuals’ net income (gross income minus deductions) and capital gains.

The figures for the US and Japan respectively stood at 0.025 percentage point and 0.343 percentage point.

Other countries that posted negative growth in this category included Ireland with minus 2.312 percentage points, Denmark with minus 2.077, Belgium with minus 1.486, Portugal with minus 1.303, Finland with minus 1.08, Austria with minus 0.454 and Italy with minus 0.268.

A fiscal researcher in Seoul said that “the arithmetic level of corporate and personal income taxes in Korea is relatively low compared when ordinary OECD members.” But he said the high rankings in terms of growth indicate that the Moon administration has been more active in collecting taxes than the previous Park Geun-hye administration.

Evidence of that can be found in the fact that Korea topped the list of OECD members in the growth of tax revenue during the 2017-2019 period.

By Kim Yon-se (kys@heraldcorp.com)

![[Graphic News] More Koreans say they plan long-distance trips this year](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/17/20240417050828_0.gif&u=)

![[KH Explains] Hyundai's full hybrid edge to pay off amid slow transition to pure EVs](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/18/20240418050645_0.jpg&u=20240419100350)

![[KH Explains] Hyundai's full hybrid edge to pay off amid slow transition to pure EVs](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/04/18/20240418050645_0.jpg&u=20240419100350)

![[Today’s K-pop] Illit drops debut single remix](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=642&simg=/content/image/2024/04/19/20240419050612_0.jpg&u=)