Concerns rising over weakening manufacturing sector

By Kim Kyung-hoPublished : Oct. 1, 2018 - 16:39

Concerns are rising over the weakening of the country’s manufacturing industries, which are suffering the effects of deteriorating conditions at home and abroad.

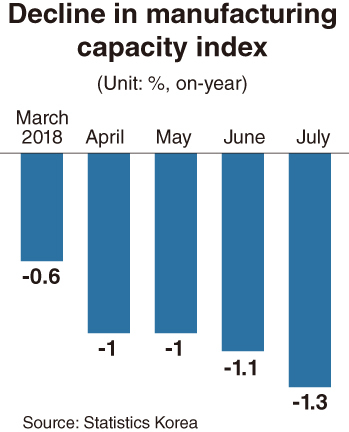

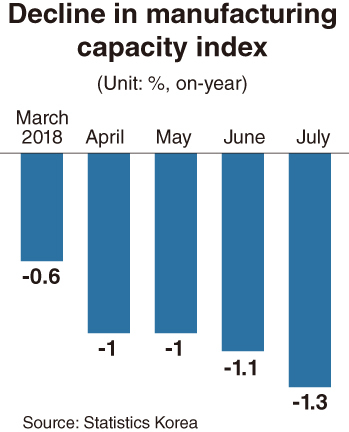

Data released last week by Statistics Korea showed that the manufacturing capacity index -- which measures the maximum possible level of production through the full use of manpower, facilities and other input factors -- had declined for five consecutive months as of July, from 102.9 to 102.6. The annual average figure for 2015 is set at 100.

The index reading for July represented a downward slide of 1.3 percent from a year earlier, the steepest on-year decline since 1971 when compilation of relevant data began. By comparison, the index dropped 0.6 percent on-year in March, 1 percent each in April and May, and 1.1 percent in June.

A rise in exports, mainly on the strength of outbound shipments of memory chips and petrochemical products, should not veil the weakening of other manufacturing industries, experts say. For instance, the capacity index for shipbuilding plummeted from 104.3 in January 2015 to 68.3 in July 2018.

The growing reliance on the equipment-focused semiconductor and petrochemical industries has reduced job creation as a result of exports. According to an analysis by the Bank of Korea, the number of jobs created for each additional 1 billion won ($899,685) increase in manufacturing exports fell from 59.9 in 1990 to 6.5 in 2014.

The weakening of the manufacturing sector is accompanied by falling employment levels. The number of workers hired by manufacturing companies in Korea declined from 4.48 million in 2016 to 4.42 million last year. Over the cited period, the US, Japan and Germany saw their manufacturing workforces expand from 12.35 million, 9.96 million and 7.9 million to 12.55 million, 10.06 million and 8.01 million, respectively.

Data from Statistics Korea showed an on-year decrease of 105,000 in the number of manufacturing employees for August, following an on-year reduction of 127,000 for the previous month.

What is also concerning is the rapid aging of the manufacturing workforce. As of May, workers aged 55-79 accounted for 19.2 percent of employees at manufacturing companies throughout the country, up 6.5 percentage points from five years earlier.

President Moon Jae-in’s administration has been criticized for making little effort to revive the country’s sagging manufacturing sector.

Since its launch in May last year, the Moon government has implemented a set of labor-friendly measures and raised corporate taxes, imposing an additional burden on companies. Its pledges to promote innovation-driven growth through deregulation have yet to be borne out in concrete action.

“The government’s role should be focused on forging the environment necessary for companies to increase investment and employment by easing regulations and offering tax incentives,” said Kwon Tae-shin, head of the Korea Economic Research Institute, a private think tank.

He stated that if additional burdens were placed on companies in the absence of any such policy efforts, their competitiveness as a whole would continue to grow weaker.

The Moon administration has recently shown signs of shifting its focus toward the revitalization of manufacturing industries.

Sung Yun-mo, the new minister of trade, industry and energy, told reporters last week that President Moon had asked him to push actively for industrial policies that would bring vitality back into the faltering manufacturing sector.

Sung said he would try to establish the necessary conditions to tap and enhance the potential of the country’s manufacturing industries, hoping that such efforts would also attract more foreign investors and encourage local companies operating abroad to return home.

In an earlier speech delivered during his swearing-in ceremony, Sung said the government would play the role of support base -- connecting companies, research institutes and universities to promote synergy among them.

The Moon administration recently undertook work to overhaul the country’s industrial structure with the aim of strengthening manufacturing competitiveness. Officials say a draft plan will be drawn up by the end of the year, and that it will take into account voices from industrial groups and local governments.

Data released last week by Statistics Korea showed that the manufacturing capacity index -- which measures the maximum possible level of production through the full use of manpower, facilities and other input factors -- had declined for five consecutive months as of July, from 102.9 to 102.6. The annual average figure for 2015 is set at 100.

The index reading for July represented a downward slide of 1.3 percent from a year earlier, the steepest on-year decline since 1971 when compilation of relevant data began. By comparison, the index dropped 0.6 percent on-year in March, 1 percent each in April and May, and 1.1 percent in June.

A rise in exports, mainly on the strength of outbound shipments of memory chips and petrochemical products, should not veil the weakening of other manufacturing industries, experts say. For instance, the capacity index for shipbuilding plummeted from 104.3 in January 2015 to 68.3 in July 2018.

The growing reliance on the equipment-focused semiconductor and petrochemical industries has reduced job creation as a result of exports. According to an analysis by the Bank of Korea, the number of jobs created for each additional 1 billion won ($899,685) increase in manufacturing exports fell from 59.9 in 1990 to 6.5 in 2014.

The weakening of the manufacturing sector is accompanied by falling employment levels. The number of workers hired by manufacturing companies in Korea declined from 4.48 million in 2016 to 4.42 million last year. Over the cited period, the US, Japan and Germany saw their manufacturing workforces expand from 12.35 million, 9.96 million and 7.9 million to 12.55 million, 10.06 million and 8.01 million, respectively.

Data from Statistics Korea showed an on-year decrease of 105,000 in the number of manufacturing employees for August, following an on-year reduction of 127,000 for the previous month.

What is also concerning is the rapid aging of the manufacturing workforce. As of May, workers aged 55-79 accounted for 19.2 percent of employees at manufacturing companies throughout the country, up 6.5 percentage points from five years earlier.

President Moon Jae-in’s administration has been criticized for making little effort to revive the country’s sagging manufacturing sector.

Since its launch in May last year, the Moon government has implemented a set of labor-friendly measures and raised corporate taxes, imposing an additional burden on companies. Its pledges to promote innovation-driven growth through deregulation have yet to be borne out in concrete action.

“The government’s role should be focused on forging the environment necessary for companies to increase investment and employment by easing regulations and offering tax incentives,” said Kwon Tae-shin, head of the Korea Economic Research Institute, a private think tank.

He stated that if additional burdens were placed on companies in the absence of any such policy efforts, their competitiveness as a whole would continue to grow weaker.

The Moon administration has recently shown signs of shifting its focus toward the revitalization of manufacturing industries.

Sung Yun-mo, the new minister of trade, industry and energy, told reporters last week that President Moon had asked him to push actively for industrial policies that would bring vitality back into the faltering manufacturing sector.

Sung said he would try to establish the necessary conditions to tap and enhance the potential of the country’s manufacturing industries, hoping that such efforts would also attract more foreign investors and encourage local companies operating abroad to return home.

In an earlier speech delivered during his swearing-in ceremony, Sung said the government would play the role of support base -- connecting companies, research institutes and universities to promote synergy among them.

The Moon administration recently undertook work to overhaul the country’s industrial structure with the aim of strengthening manufacturing competitiveness. Officials say a draft plan will be drawn up by the end of the year, and that it will take into account voices from industrial groups and local governments.

Experts call on the government to pursue a farsighted vision for industrial restructuring -- one that goes beyond efforts to restore the competitiveness of traditional manufacturing industries, which are being overtaken by Chinese rivals amid rising protectionism triggered by US President Donald Trump’s administration.

They emphasized the need for a comprehensive plan to link traditional manufacturing industries to innovative technologies such as big-data marketing and artificial intelligence. Regulatory and labor reforms should be accelerated, they say, to advance new industries and bring in more young workers.

Some large manufacturers, including Hyundai Heavy Industries, Samsung Heavy Industries and LG Display, were among the 525 local listed nonfinancial firms that saw their operating profits fall short of debt-service costs in the first half of the year.

The number of underperforming companies increased from 451 in 2015 to 463 in 2016 and 506 last year, according to Chaebol.com, an online provider of corporate information.

By Kim Kyung-ho

(khkim@heraldcorp.com)

They emphasized the need for a comprehensive plan to link traditional manufacturing industries to innovative technologies such as big-data marketing and artificial intelligence. Regulatory and labor reforms should be accelerated, they say, to advance new industries and bring in more young workers.

Some large manufacturers, including Hyundai Heavy Industries, Samsung Heavy Industries and LG Display, were among the 525 local listed nonfinancial firms that saw their operating profits fall short of debt-service costs in the first half of the year.

The number of underperforming companies increased from 451 in 2015 to 463 in 2016 and 506 last year, according to Chaebol.com, an online provider of corporate information.

By Kim Kyung-ho

(khkim@heraldcorp.com)

![[KH Explains] Hyundai's full hybrid edge to pay off amid slow transition to pure EVs](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/18/20240418050645_0.jpg&u=20240419100350)

![[From the Scene] Monks, Buddhists hail return of remains of Buddhas](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/04/19/20240419050617_0.jpg&u=20240419175937)

![[KH Explains] Hyundai's full hybrid edge to pay off amid slow transition to pure EVs](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/04/18/20240418050645_0.jpg&u=20240419100350)

![[Today’s K-pop] Illit drops debut single remix](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=642&simg=/content/image/2024/04/19/20240419050612_0.jpg&u=)