PHILADELPHIA -- They‘re a tummy tuck and butt-lift in a bag. The new-millennium version of Grandma’s girdle, minus the bruising engineering. And each garment has a name so tart, so clever, that even hippy women feel hip when they squirm into a sheet of Spandex the size of a body condom.

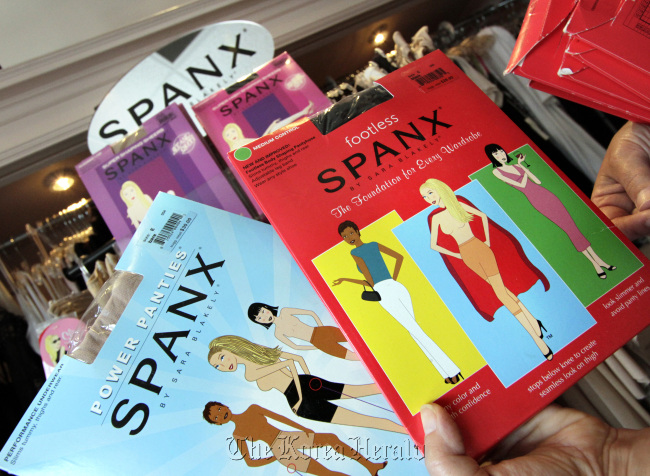

They are, of course, Spanx, the figure-slimming shapewear that has revolutionized how women dress by convincing ladies to shun comfort over compression. The brand has disinterred the dead-and-gone girdle by eliminating painful and visible seams and packaging its promises with sleek tags and Hollywood cachet.

And the Spanx empire is nowhere near satisfied.

Just months after 41-year-old founder Sara Blakely was named the world‘s youngest female self-made billionaire by Forbes, Spanx’s bun-slimming ambitions continue to grow with plans for its own line of stores.

They are, of course, Spanx, the figure-slimming shapewear that has revolutionized how women dress by convincing ladies to shun comfort over compression. The brand has disinterred the dead-and-gone girdle by eliminating painful and visible seams and packaging its promises with sleek tags and Hollywood cachet.

And the Spanx empire is nowhere near satisfied.

Just months after 41-year-old founder Sara Blakely was named the world‘s youngest female self-made billionaire by Forbes, Spanx’s bun-slimming ambitions continue to grow with plans for its own line of stores.

The Atlanta company, privately owned since its founding in 2000, has chosen three deluxe malls on the East Coast for its first stores. The trio are scheduled to open in October in King of Prussia, Pennsylvania.; McLean, Virginia.; and Paramus, New Jersey.

Why, you ask, would a company whose garments already occupy prime shelf space at Neiman Marcus, Nordstrom and high-end lingerie boutiques -- and that offers more affordable assortments elsewhere, and even sells tummy-tightening shapewear for men -- want its own stores?

Spanx declined to comment, even staying mum to trade bible Women‘s Wear Daily, despite its reputation for being anything but publicity-shy.

Follow the money, however, and the puzzle comes together.

The market for shapewear, as hip-hugging sheaths of stretchy nylon armor are known in the industry, rang up what the NPD Group estimated to be $725 million in sales during the 12-month period that ended June 30, according to a spokeswoman for the market-research firm.

That’s whopping. The segment had all but vanished by the 1990s, when baby boomers stopped wearing the girdles and corsets popularized during the Mad Men era.

Consider also that Blakely founded the company on little more than $5,000. She stumbled onto genius as a twentysomething by clipping the feet off a pair of stockings to improve her look in a new pair of pants. A decade later, she‘s a Forbes phenom.

“I often wonder what women did before Spanx,” said Donna Goetz, a lingerie retailer since 1984, first in Philadelphia and then from an exclusive spot in Haverford, Pennsylvania, where her relocated Hope Chest has done business for seven years. “I don’t have a good answer for you.”

The fashion world followed Spanx‘s lead. Today, Spanx and its emerging competitors are must-haves for cocktail parties and red-carpet events across the globe. The Spanx craze has spawned racks of copycats, whose competing shapewear is cutting into the company’s once-unchallenged hegemony.

“Everyone gets their Spanx on for the weddings,” said Goetz, who credits Blakely for savvy marketing and tip-top quality and service from the start, helping make the product an instant hit with retailers and customers.

“She definitely packaged it, marketed it, and made it OK for the 20- and 30-year-olds who would probably never get into a girdle,” Goetz said of the trademark bright-red boxes dreamed up by Blakely, and the snappy product names that have the touch of a Madison Avenue copy-writing pro.

Longtime retail expert Marshal Cohen has seen prototypes of the planned Spanx stores and says they will be full-service boutiques. But rather than selling only Spanx‘s core products, these stores will serve as laboratory and showcase for new merchandise, too.

“They’re not looking at the initial outset to be Victoria‘s Secret,” said Cohen, chief retail analyst at NPD Group, which does not count Spanx as a client. “They’re looking to be a very specialized and niche business that caters to a loyal clientele and inquisitive clientele.”

The King of Prussia store, to be located across from Tiffany‘s, occupies only 904 square feet, said mall marketing director Kathy Smith.

“They’ll carry lines of lingerie, activewear, hosiery, slimwear,” Smith said. “They could have some fragrance, bath and body, and beauty items and accessories. The majority of their floor space will be devoted to their core brand product.”

At its own stores, the company will have more latitude in defining itself to customers, Cohen said. In department stores, a brand‘s products are spread all over the place. And mounting a store-within-a-store display for an entire brand’s offerings is costly there, requiring lease agreements.

“As they roll it out and they become successful in other brand-extension areas like sportswear and accessories,” Cohen said, “they can expand with bigger space.”

He suspects modern design techniques will help the sector avoid the grim fate of the girdle. So will this:

“Until we come up with a diet pill that works,” he said, “shapewear is gonna be around.”

By Maria Panaritis

(The Philadelphia Inquirer)

(MCT Information Services)

-

Articles by Korea Herald

![[Graphic News] More Koreans say they plan long-distance trips this year](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/17/20240417050828_0.gif&u=)

![[KH Explains] Hyundai's full hybrid edge to pay off amid slow transition to pure EVs](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/18/20240418050645_0.jpg&u=20240419100350)

![[From the Scene] Monks, Buddhists hail return of remains of Buddhas](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/04/19/20240419050617_0.jpg&u=20240419175937)

![[KH Explains] Hyundai's full hybrid edge to pay off amid slow transition to pure EVs](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/04/18/20240418050645_0.jpg&u=20240419100350)

![[Today’s K-pop] Illit drops debut single remix](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=642&simg=/content/image/2024/04/19/20240419050612_0.jpg&u=)