This is the fifth in a series of articles to mark the 20th anniversary of diplomatic ties between South Korea and China. ― Ed.

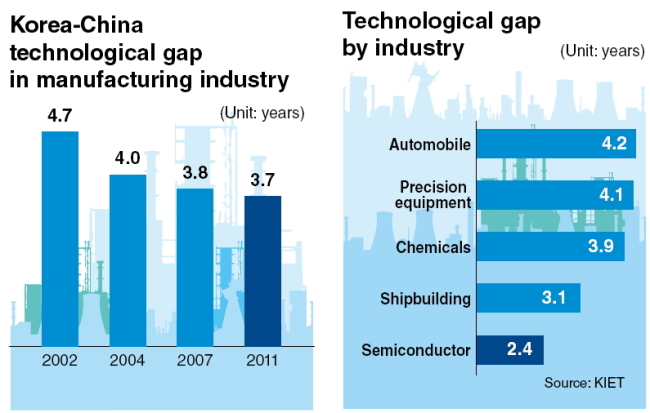

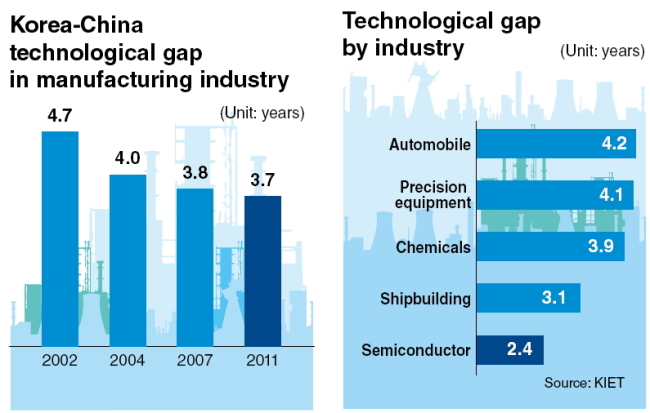

The technology gap between Korea and China has narrowed over the past decade in the manufacturing industry.

According to data from the Korea Institute for Industrial Economics & Trade, the technology gap in the manufacturing industry between the two countries narrowed to 3.7 years in 2011 on average, from 4.7 years in 2002.

In terms of the countries’ technological levels as of 2011, China needs 4.2 years to reach the level that was reached by Korea’s auto industry, about 3.1 years in shipbuilding and 2.4 years in semiconductors, the report said.

The report is mainly based on a survey of about 600 major companies in 10 core industries such as automobile, electronics, shipbuilding and semiconductors.

“With Chinese firms developing at a frightful speed by means of imitating products of industrially advanced nations, industrial spying or theft of key technologies, the technology gap between the enterprises of Korea and China was found to be narrowing at a fast rate,” said a KIET researcher.

The Korea Automobile Manufacturers Association said that South Korea has been sandwiched between its neighbors.

It observed that China has rapidly caught up with Korea’s output while also striving to narrow the automotive technology gap with Japan.

“China has gained advanced technologies in recent years based on its robust economic growth and a strategy to open up its markets,” a KAMA official said. “We expect China, which is about four years behind Korea, to further narrow the gap with us.”

The Chinese government is carrying out an automobile import promotion strategy. The project is focused on imports of advanced general automobile technologies and equipment and key technologies and parts for energy-saving and new-energy vehicles.

KAMA said in a report that Chinese carmakers, such as Geely Holding Group Co. and BYD Co., could threaten local firms’ exports.

The report said that Chinese carmakers’ increasing exports and technological capabilities are likely to present significant challenges to Korean firms’ sales in foreign markets where they continue to rely on low prices to drive sales.

Chinese firms are still mainly exporting to developing nations in Africa and the Middle East.

“But when Chinese carmakers enter the U.S. and European markets their price competitiveness could put Korean brands at risk of being stranded between cheap Chinese brands and high quality brands from developed nations, unless local firms can establish a more up-market brand image,” the report warned.

The majority of Chinese automobile exports are accounted for by small cars whose prices are more than 20 percent lower than comparable models from established carmakers.

Meanwhile, a Korean executive in the local automotive industry downplayed Chinese firms’ challenge, stressing that “mass production of low-priced cars does not guarantee customer confidence in the global market.”

About 10 years ago, Korea was recognized as a country that makes its living by just selling cheaper-made products in the global electronics and technology markets.

There was no way for Korean tech companies to catch up with Japanese leading tech giants should the country continue to promote itself as a less-innovative, inexpensive manufacturer.

But now the tides have turned. Through rigorous investment in research and development, Korea is now home to tech giants such as Samsung Electronics and LG Electronics, producing and supplying the world with the largest amount of displays, mobile phones, semiconductors and home electronic goods such as washing machines and refrigerators. Samsung, for instance, has edged over Sony, once the world’s leading consumer electronics maker, and Apple and Nokia in mobile phones.

However, analysts say that Korea cannot rest assured just because it has technologically caught up with Japan.

Korea, as Samsung Chairman Lee Kun-hee once expressed out of concern, is still sandwiched between Japan and China. Korea still depends on Japanese high-tech parts for final product assembly, leading the former to post a trade deficit with the world’s third-largest economy.

Meanwhile, China, the world’s fastest economy and Korea’s largest export destination, is rapidly catching up with Korea by doing what Korea used to do ten years ago ― selling cheaper products and at the same time increasing investment in research and development.

“Continuous technological innovation, research and development as well as mergers and acquisitions will sharply upgrade China’s manufacturing over the next 10 years,” said Kwon Hyuk-jae, research fellow at Samsung Economic Research Institute.

“Chinese companies are already pressuring their Korean counterparts in home electronics, telecommunication devices and petrochemicals. This will intensify further.”

China’s IT manufacturing was valued at $523 billion in 2011, accounting for 29 percent of the total in the world, compared to Korea’s $126 billion.

The shipbuilding sector is one industrial area in which Korean companies have maintained the No. 1 position globally, though their Chinese rivals are quickly catching up.

The global shipbuilding industry has suffered from slowing orders since the financial crisis erupted in the U.S. in 2008, coupled with a recent debt crisis in Europe.

In the first half of this year, global shipbuilding orders amounted to 8.77 million tons, down 60 percent from the same period last year.

Korea’s big three ship makers ― Hyundai Heavy Industries, Samsung Heavy Industries and Daewoo Shipbuilding & Marine Engineering ― saw their orders decline about 60 percent this year as well.

Their operating profits also dropped as many of the high-margin orders that used to be made before 2008 have been replaced with those for low-cost ships since 2009.

In the meantime, China, armed with strong price competitiveness, outpaced Korea in terms of shipbuilding orders. However, because Chinese firms focus more on relatively cheaper bulk carriers, their profits still lag behind Korean companies.

With the gap between Korean and Chinese shipbuilders narrowing, the two countries now share global shipbuilding orders almost equally.

In a new development plan for 2015 published recently, the Chinese government pledged it would elevate the country’s market share up by to 70 percent within five years.

Industry watchers say it is unavoidable that cheaper deals from Chinese shipbuilders would affect the business of Korean companies, especially small and medium-sized ones.

But they also pointed out that the China factor would not be greater than that of the sluggish global economy.

“The Korean big three, in particular, will continue to maintain their competitiveness based on their years of experience and new technology,” said a spokesperson of Hyundai Heavy Industries, the world’s largest shipbuilder.

“Amid high-flying oil prices, the market for offshore plants and gas development is newly emerging. But Chinese shipbuilders have yet to acquire know-how in the field.”

By Korea Herald staff

The technology gap between Korea and China has narrowed over the past decade in the manufacturing industry.

According to data from the Korea Institute for Industrial Economics & Trade, the technology gap in the manufacturing industry between the two countries narrowed to 3.7 years in 2011 on average, from 4.7 years in 2002.

In terms of the countries’ technological levels as of 2011, China needs 4.2 years to reach the level that was reached by Korea’s auto industry, about 3.1 years in shipbuilding and 2.4 years in semiconductors, the report said.

The report is mainly based on a survey of about 600 major companies in 10 core industries such as automobile, electronics, shipbuilding and semiconductors.

“With Chinese firms developing at a frightful speed by means of imitating products of industrially advanced nations, industrial spying or theft of key technologies, the technology gap between the enterprises of Korea and China was found to be narrowing at a fast rate,” said a KIET researcher.

The Korea Automobile Manufacturers Association said that South Korea has been sandwiched between its neighbors.

It observed that China has rapidly caught up with Korea’s output while also striving to narrow the automotive technology gap with Japan.

“China has gained advanced technologies in recent years based on its robust economic growth and a strategy to open up its markets,” a KAMA official said. “We expect China, which is about four years behind Korea, to further narrow the gap with us.”

The Chinese government is carrying out an automobile import promotion strategy. The project is focused on imports of advanced general automobile technologies and equipment and key technologies and parts for energy-saving and new-energy vehicles.

KAMA said in a report that Chinese carmakers, such as Geely Holding Group Co. and BYD Co., could threaten local firms’ exports.

The report said that Chinese carmakers’ increasing exports and technological capabilities are likely to present significant challenges to Korean firms’ sales in foreign markets where they continue to rely on low prices to drive sales.

Chinese firms are still mainly exporting to developing nations in Africa and the Middle East.

“But when Chinese carmakers enter the U.S. and European markets their price competitiveness could put Korean brands at risk of being stranded between cheap Chinese brands and high quality brands from developed nations, unless local firms can establish a more up-market brand image,” the report warned.

The majority of Chinese automobile exports are accounted for by small cars whose prices are more than 20 percent lower than comparable models from established carmakers.

Meanwhile, a Korean executive in the local automotive industry downplayed Chinese firms’ challenge, stressing that “mass production of low-priced cars does not guarantee customer confidence in the global market.”

About 10 years ago, Korea was recognized as a country that makes its living by just selling cheaper-made products in the global electronics and technology markets.

There was no way for Korean tech companies to catch up with Japanese leading tech giants should the country continue to promote itself as a less-innovative, inexpensive manufacturer.

But now the tides have turned. Through rigorous investment in research and development, Korea is now home to tech giants such as Samsung Electronics and LG Electronics, producing and supplying the world with the largest amount of displays, mobile phones, semiconductors and home electronic goods such as washing machines and refrigerators. Samsung, for instance, has edged over Sony, once the world’s leading consumer electronics maker, and Apple and Nokia in mobile phones.

However, analysts say that Korea cannot rest assured just because it has technologically caught up with Japan.

Korea, as Samsung Chairman Lee Kun-hee once expressed out of concern, is still sandwiched between Japan and China. Korea still depends on Japanese high-tech parts for final product assembly, leading the former to post a trade deficit with the world’s third-largest economy.

Meanwhile, China, the world’s fastest economy and Korea’s largest export destination, is rapidly catching up with Korea by doing what Korea used to do ten years ago ― selling cheaper products and at the same time increasing investment in research and development.

“Continuous technological innovation, research and development as well as mergers and acquisitions will sharply upgrade China’s manufacturing over the next 10 years,” said Kwon Hyuk-jae, research fellow at Samsung Economic Research Institute.

“Chinese companies are already pressuring their Korean counterparts in home electronics, telecommunication devices and petrochemicals. This will intensify further.”

China’s IT manufacturing was valued at $523 billion in 2011, accounting for 29 percent of the total in the world, compared to Korea’s $126 billion.

The shipbuilding sector is one industrial area in which Korean companies have maintained the No. 1 position globally, though their Chinese rivals are quickly catching up.

The global shipbuilding industry has suffered from slowing orders since the financial crisis erupted in the U.S. in 2008, coupled with a recent debt crisis in Europe.

In the first half of this year, global shipbuilding orders amounted to 8.77 million tons, down 60 percent from the same period last year.

Korea’s big three ship makers ― Hyundai Heavy Industries, Samsung Heavy Industries and Daewoo Shipbuilding & Marine Engineering ― saw their orders decline about 60 percent this year as well.

Their operating profits also dropped as many of the high-margin orders that used to be made before 2008 have been replaced with those for low-cost ships since 2009.

In the meantime, China, armed with strong price competitiveness, outpaced Korea in terms of shipbuilding orders. However, because Chinese firms focus more on relatively cheaper bulk carriers, their profits still lag behind Korean companies.

With the gap between Korean and Chinese shipbuilders narrowing, the two countries now share global shipbuilding orders almost equally.

In a new development plan for 2015 published recently, the Chinese government pledged it would elevate the country’s market share up by to 70 percent within five years.

Industry watchers say it is unavoidable that cheaper deals from Chinese shipbuilders would affect the business of Korean companies, especially small and medium-sized ones.

But they also pointed out that the China factor would not be greater than that of the sluggish global economy.

“The Korean big three, in particular, will continue to maintain their competitiveness based on their years of experience and new technology,” said a spokesperson of Hyundai Heavy Industries, the world’s largest shipbuilder.

“Amid high-flying oil prices, the market for offshore plants and gas development is newly emerging. But Chinese shipbuilders have yet to acquire know-how in the field.”

By Korea Herald staff

![[Graphic News] More Koreans say they plan long-distance trips this year](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/17/20240417050828_0.gif&u=)

![[KH Explains] Hyundai's full hybrid edge to pay off amid slow transition to pure EVs](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/18/20240418050645_0.jpg&u=20240419100350)

![[KH Explains] Hyundai's full hybrid edge to pay off amid slow transition to pure EVs](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/04/18/20240418050645_0.jpg&u=20240419100350)

![[Today’s K-pop] Illit drops debut single remix](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=642&simg=/content/image/2024/04/19/20240419050612_0.jpg&u=)