Disputes over optimum level may resurface

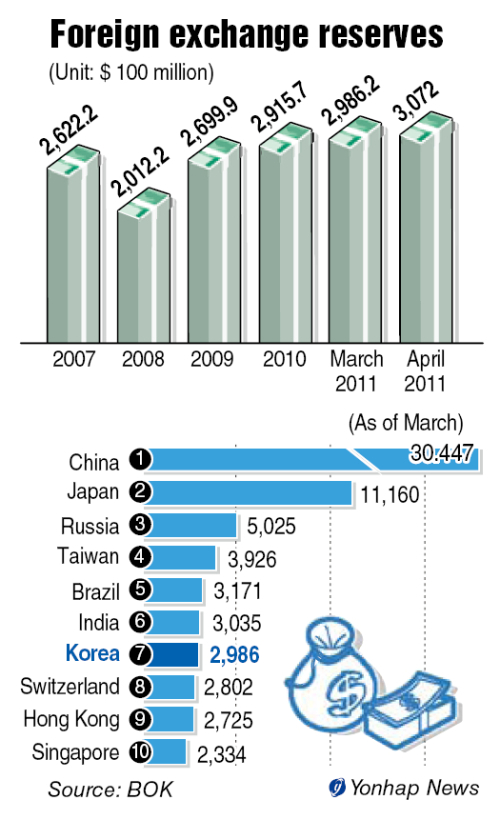

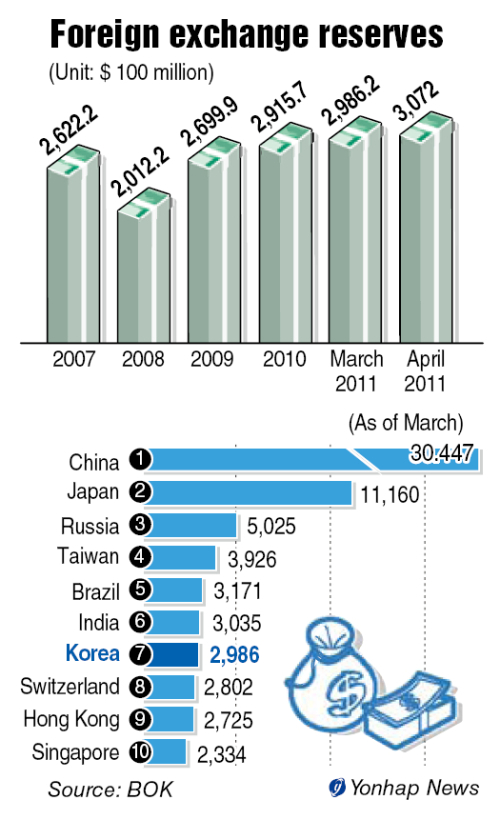

South Korea’s foreign exchange reserves have surpassed $300 billion for the first time, up more than 50 percent from 2008 global financial crisis.

The Bank of Korea reported Tuesday that foreign reserves reached a new high of $307.2 billion at the end of April, up $8.58 billion from a month earlier.

The amount also posted growth of 52.6 percent compared to $201.12 billion at the end of 2008.

After recording a heavy drop of more than $60 billion from 2007 to 2008, the foreign exchange reserves continued to surge ― $269.99 billion in 2009 and $291.57 billion in 2010.

The high amount of provisions was attributable to the recent situation under which cheap U.S. dollar boosted the conversion value of assets in other currencies, such as the euro and the pound, held by the central bank, BOK officials said.

As of March, Korea ranked seventh in holding of foreign exchange reserves in the world, behind China (the largest holder with $3.04 trillion), Japan, Russia, Taiwan, Brazil and India.

But over the past few years, there have been growing calls from some economists claiming the country has acumulated to much in currency reserves.

Critics have said excessive currency reserves are not always good for the economy, citing side effects such as the BOK having to issue large-scale monetary stabilization bonds to raise funds to purchase dollars to block the Korean won’s rapid appreciation.

“In turn, the central bank has to pay interest on the bonds later,” an economist at the Korea Institute of Finance said.

“Of course, it’s good to have larger reserves, but it may be time for the central bank to reconsider its moves to keep increasing its reserves,” he said. “The problem is costs for the accumulation of foreign reserves.”

The issue has also come under the spotlight during parliamentary audits on the central bank.

An opposition lawmaker has said the BOK may not be able to avoid recording losses, given the rising interest costs.

“While the country has the seventh largest reserves, it may suffer the world’s seventh biggest damage from the dollar’s losing ground,” he said.

On the contrary, proponents of the high reserves argue that they are desirable if the country is to be able to brace for possible external shocks.

While BOK officials declined to give their views on appropriate size of foreign reserves, they said the reserves tend to be on the rise in accordance with economic growth.

“Whether or not the reserve will rise would depend on how much non-dollar assets appreciate to the dollar,” a BOK official said.

By Kim Yon-se (kys@heraldcorp.com)

South Korea’s foreign exchange reserves have surpassed $300 billion for the first time, up more than 50 percent from 2008 global financial crisis.

The Bank of Korea reported Tuesday that foreign reserves reached a new high of $307.2 billion at the end of April, up $8.58 billion from a month earlier.

The amount also posted growth of 52.6 percent compared to $201.12 billion at the end of 2008.

After recording a heavy drop of more than $60 billion from 2007 to 2008, the foreign exchange reserves continued to surge ― $269.99 billion in 2009 and $291.57 billion in 2010.

The high amount of provisions was attributable to the recent situation under which cheap U.S. dollar boosted the conversion value of assets in other currencies, such as the euro and the pound, held by the central bank, BOK officials said.

As of March, Korea ranked seventh in holding of foreign exchange reserves in the world, behind China (the largest holder with $3.04 trillion), Japan, Russia, Taiwan, Brazil and India.

But over the past few years, there have been growing calls from some economists claiming the country has acumulated to much in currency reserves.

Critics have said excessive currency reserves are not always good for the economy, citing side effects such as the BOK having to issue large-scale monetary stabilization bonds to raise funds to purchase dollars to block the Korean won’s rapid appreciation.

“In turn, the central bank has to pay interest on the bonds later,” an economist at the Korea Institute of Finance said.

“Of course, it’s good to have larger reserves, but it may be time for the central bank to reconsider its moves to keep increasing its reserves,” he said. “The problem is costs for the accumulation of foreign reserves.”

The issue has also come under the spotlight during parliamentary audits on the central bank.

An opposition lawmaker has said the BOK may not be able to avoid recording losses, given the rising interest costs.

“While the country has the seventh largest reserves, it may suffer the world’s seventh biggest damage from the dollar’s losing ground,” he said.

On the contrary, proponents of the high reserves argue that they are desirable if the country is to be able to brace for possible external shocks.

While BOK officials declined to give their views on appropriate size of foreign reserves, they said the reserves tend to be on the rise in accordance with economic growth.

“Whether or not the reserve will rise would depend on how much non-dollar assets appreciate to the dollar,” a BOK official said.

By Kim Yon-se (kys@heraldcorp.com)

![[Graphic News] More Koreans say they plan long-distance trips this year](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/17/20240417050828_0.gif&u=)

![[KH Explains] Hyundai's full hybrid edge to pay off amid slow transition to pure EVs](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/18/20240418050645_0.jpg&u=20240419100350)

![[From the Scene] Monks, Buddhists hail return of remains of Buddhas](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/04/19/20240419050617_0.jpg&u=20240419175937)

![[KH Explains] Hyundai's full hybrid edge to pay off amid slow transition to pure EVs](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/04/18/20240418050645_0.jpg&u=20240419100350)

![[Today’s K-pop] Illit drops debut single remix](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=642&simg=/content/image/2024/04/19/20240419050612_0.jpg&u=)