Income-based lending rules to be toughened amid snowballing household debt

By Choi Jae-heePublished : Oct. 26, 2021 - 14:51

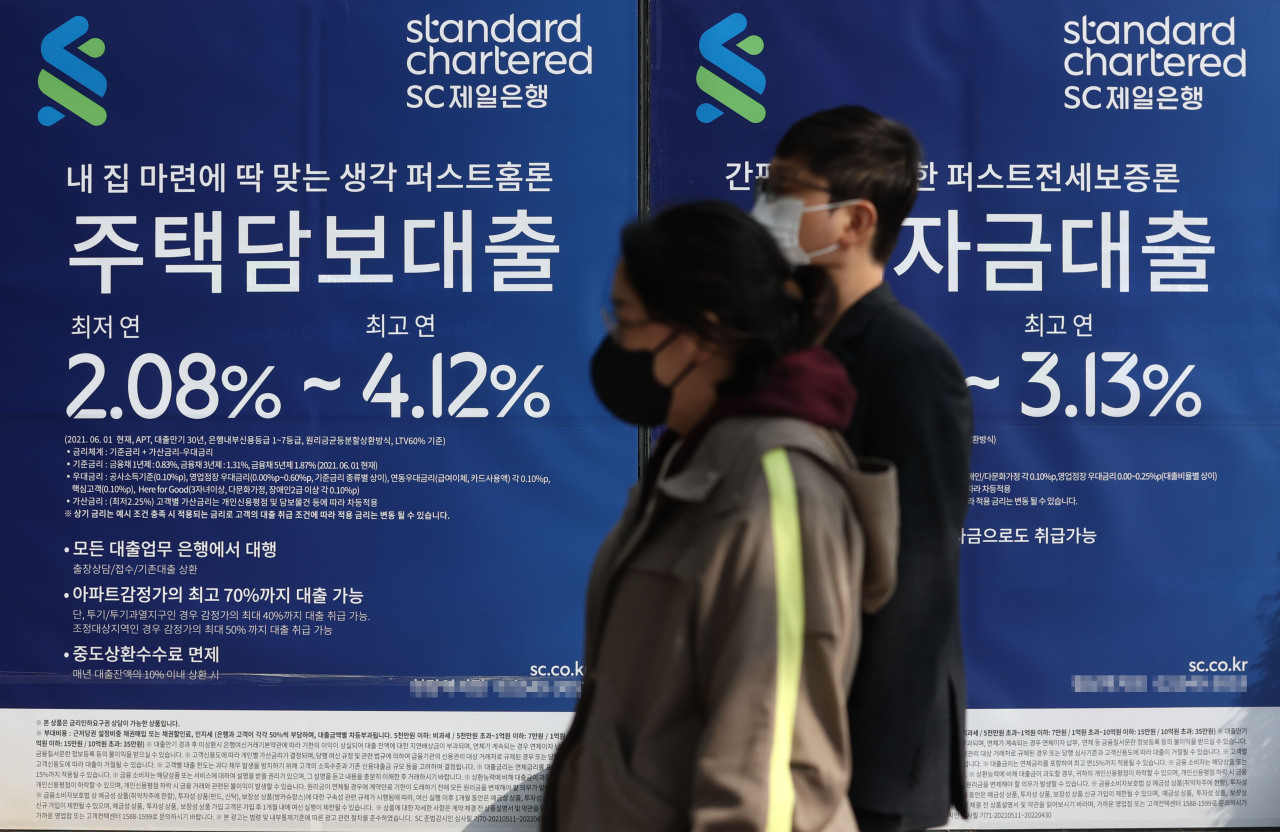

South Korea’s top financial regulator on Tuesday said it will implement stricter lending calculations for mortgage loans, called the “debt-service ratio,” or DSR, months earlier than expected as part of additional debt control measures.

The DSR gauges how much borrowers pay for principal and interest in proportion to yearly income.

Since July, a 40 percent DSR has been applied to borrowers seeking to receive loans for buying properties valued at over 600 million won ($513,000), down from the previous 900 million won. Under the regulation, banks can extend loans only to an extent where borrowers’ annual repayment of principal and interest does not exceed 40 percent of annual disposable income.

The Financial Services Commission initially planned to extend the 40 percent DSR rule to borrowers with credit loans, including home-backed loans, of more than 200 million won in July next year.

The authority, however, decided to impose the loan regulation six months earlier in January amid rising concerns over the pace of household debt growth. South Korea’s household debt reached a record high of 1,805.9 trillion won in June, up 41.2 trillion won from three months earlier.

“With ample liquidity triggered by expansionary fiscal and monetary policies prevailing, growing risks tied to the snowballing household debt have grown sharply. Taking out loans as much as you can and paying them back little by little would be the starting point of household debt management,” Financial Services Commission Chairman Koh Seung-beom said in a statement.

“In order to make lending practices based on repayment capability take root in the financial market, (we are to) enhance the actual efficacy of the DSR system,” he added.

In July 2023, the lending cap will be applied to those with more than 100 million won in unsecured debt.

The FSC will also toughen up lending calculations for second-tier banks, by lowering the current 60 percent DSR rule to 40 percent.

Meanwhile, to protect people in actual need of borrowing, the FSC will not apply the 40 percent DSR rule to “jeonse” loans. Jeonse is a housing lease system unique to Korea whereby tenants pay a lump-sum deposit instead of monthly rent on a two-year contract.

The DSR gauges how much borrowers pay for principal and interest in proportion to yearly income.

Since July, a 40 percent DSR has been applied to borrowers seeking to receive loans for buying properties valued at over 600 million won ($513,000), down from the previous 900 million won. Under the regulation, banks can extend loans only to an extent where borrowers’ annual repayment of principal and interest does not exceed 40 percent of annual disposable income.

The Financial Services Commission initially planned to extend the 40 percent DSR rule to borrowers with credit loans, including home-backed loans, of more than 200 million won in July next year.

The authority, however, decided to impose the loan regulation six months earlier in January amid rising concerns over the pace of household debt growth. South Korea’s household debt reached a record high of 1,805.9 trillion won in June, up 41.2 trillion won from three months earlier.

“With ample liquidity triggered by expansionary fiscal and monetary policies prevailing, growing risks tied to the snowballing household debt have grown sharply. Taking out loans as much as you can and paying them back little by little would be the starting point of household debt management,” Financial Services Commission Chairman Koh Seung-beom said in a statement.

“In order to make lending practices based on repayment capability take root in the financial market, (we are to) enhance the actual efficacy of the DSR system,” he added.

In July 2023, the lending cap will be applied to those with more than 100 million won in unsecured debt.

The FSC will also toughen up lending calculations for second-tier banks, by lowering the current 60 percent DSR rule to 40 percent.

Meanwhile, to protect people in actual need of borrowing, the FSC will not apply the 40 percent DSR rule to “jeonse” loans. Jeonse is a housing lease system unique to Korea whereby tenants pay a lump-sum deposit instead of monthly rent on a two-year contract.

![[Graphic News] More Koreans say they plan long-distance trips this year](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/17/20240417050828_0.gif&u=)

![[KH Explains] Hyundai's full hybrid edge to pay off amid slow transition to pure EVs](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/18/20240418050645_0.jpg&u=20240419100350)

![[From the Scene] Monks, Buddhists hail return of remains of Buddhas](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/04/19/20240419050617_0.jpg&u=20240419175937)

![[KH Explains] Hyundai's full hybrid edge to pay off amid slow transition to pure EVs](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/04/18/20240418050645_0.jpg&u=20240419100350)

![[Today’s K-pop] Illit drops debut single remix](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=642&simg=/content/image/2024/04/19/20240419050612_0.jpg&u=)