[Noah Smith] Developing nations are dealt a one-two hit to growth

By BloombergPublished : Aug. 6, 2020 - 00:01

Starting in about 1990, poor countries started catching up to rich ones. South Korea, Taiwan and some countries in Europe reached a fully developed state. China has powered ahead with one of the most impressive and rapid industrializations in world history. And countries such as Malaysia, Turkey, Poland, Romania and Thailand have also reached the cusp of developed status.

Other nations like Bangladesh, Ethiopia and Vietnam are starting out on the path to industrialization, while poor countries that mainly export natural resources have benefited from a boom in demand. This worldwide growth has coincided with a wave of migrant remittances. Together, growth and remittances have cut global extreme poverty dramatically, lowering global inequality

Unfortunately, this happy trend is in big danger. In the short term, the biggest threat by far is the coronavirus pandemic. The virus has sent the world into an economic tailspin; the International Monetary Fund expects global economic output to fall 4.9 percent in 2020, the largest drop since before World War II. And with many migrants out of work, remittances have plunged.

Although the IMF predicts a rapid return to growth in 2021, there are many reasons that might not happen. For one thing, even if an effective vaccine arrives in early 2021 -- the most optimistic scenario -- it will take a long time to get it to everyone in the world who wants it. That means some countries will continue to see their economies hobbled by social distancing. International travel will be difficult and dangerous, crimping trade relationships further. And once those trade relationships deteriorate, it could take a while for them to build back up again, especially with much of the world edging toward protectionism. The pivotal relationship between the US and China has already partially unwound since 2016. The World Trade Organization predicts a 32 percent fall in global trade in 2020, with only an incomplete rebound next year.

Disrupted trade relationships will make it hard for industrializing countries like Malaysia, Turkey, and Thailand to continue their strategy of export-led growth. These countries now export a lot of electronics, vehicles and other manufactured goods, often to developed markets. In addition to depressing sales, crimping production and inhibiting travel, coronavirus may cause those developed countries to reevaluate their supply-chain strategies. Already, US presidential candidate Joe Biden is promising to consolidate supply chains within the country to protect against national security threats. If this becomes the norm, it could make it more difficult for industrializing nations to promote exports to grow and raise productivity levels. A general retreat of world trade could end up looking like the Great Depression, with protectionist policies and economic stagnation reinforcing each other for years to come.

But whether in one year or five, eventually economies will recover from coronavirus. As confidence returns and the memory of the pandemic fades, nations and companies will once more look toward expanding global trade. The problem is that at that point, developing countries will face a new problem -- the diminished global role of the US.

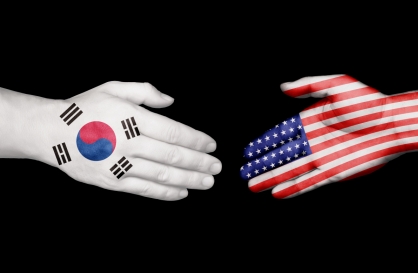

The US has traditionally functioned as a buyer of last resort for countries that wanted to engage in export-led growth. It bought large amounts of manufactured products from Germany, Japan, South Korea and Taiwan, helping those countries grow. The US maintained open capital markets, allowing the dollar to become the reserve currency, even though this contributed to domestic trade deficits. And it pushed for free-trade agreements, including China’s entry into the WTO. Recently, countries such as Malaysia and Vietnam have had currencies that were cheap against the dollar, helping their businesses sell to the US. Furthermore, the US’s openness has allowed developing nations to absorb first-world technology and management practices via joint ventures, overseas study and supply chains, thus boosting those countries’ productivity.

But the US is a nation in decline. It has had the worst coronavirus response among developed nations, exposing deep institutional decay. It’s also suffering from bitter divisions and continued unrest. And it continues to lose economic ground to China in terms of economic size, exports and high-tech export industries. The dollar’s status as the reserve currency also may be on shaky ground.

That could pose a huge problem for developing nations. China, with its government-dominated economy, capital controls and mercantilist instincts, is unlikely to be willing to let upstart rivals sell freely into its markets. Nor will China be as eager to allow its technology to leak through its national borders.

The replacement of a US-centric global economy with a China-centric one thus spells trouble for the happy trend of global development that has prevailed for the past three decades. In a newly closed-off, competitive world, it probably will be harder for the underdogs to catch up.

Noah Smith

Noah Smith is a Bloomberg Opinion columnist. -- Ed.

(Bloomberg)

![[AtoZ into Korean mind] Humor in Korea: Navigating the line between what's funny and not](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/22/20240422050642_0.jpg&u=)

![[Herald Interview] Why Toss invited hackers to penetrate its system](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/22/20240422050569_0.jpg&u=20240422150649)

![[Graphic News] 77% of young Koreans still financially dependent](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/22/20240422050762_0.gif&u=)

![[Exclusive] Korean military to ban iPhones over security issues](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/04/23/20240423050599_0.jpg&u=20240423171347)

![[Today’s K-pop] Ateez confirms US tour details](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=642&simg=/content/image/2024/04/23/20240423050700_0.jpg&u=)