[News Focus] Self-employed in S. Korea face strong headwinds

By Kim Yon-sePublished : Dec. 16, 2019 - 11:36

SEJONG -- The sluggish domestic economy and a spike in statutory minimum wage in South Korea in recent years have dealt a severe blow to the self-employed.

Most have been forced to close shop or have been saddled with huge debts amid cutthroat competition, but they are getting back on their feet by starting new microbusinesses, although not very successfully.

This reflects the tough job market here, as self-employment is still considered the most viable option for many people to make a living.

Most have been forced to close shop or have been saddled with huge debts amid cutthroat competition, but they are getting back on their feet by starting new microbusinesses, although not very successfully.

This reflects the tough job market here, as self-employment is still considered the most viable option for many people to make a living.

According to Statistics Korea, the number of self-employed people still posted 6.66 million as of November 2019, accounting for 23.4 percent of the economically active population of 23.38 million.

Self-employment includes unpaid family workers as well as people who work for themselves, according to global labor standards.

Analysts say the percentage is high compared to major countries, pointing out that the high number of microbusinesses could be the main risk factor for the national economy when the economy stumbles.

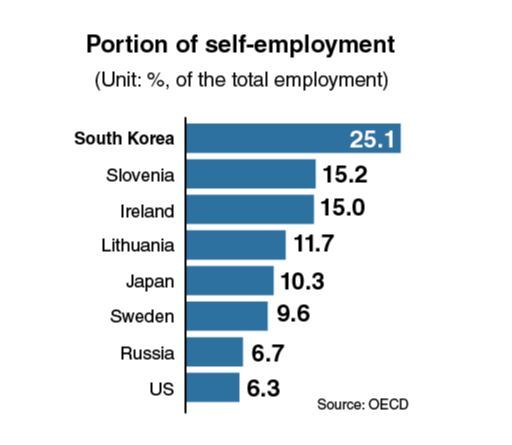

As per the latest data released by the Organization for Economic Cooperation and Development, among 38 major economies -- 34 out of its 36 members plus four nonmembers: Costa Rica, Colombia, Brazil and Russia – Korea has a relatively high proportion of self-employed people.

The country recorded 25.1 percent in the portion of self-employed people among the total employed as of 2018, marking the eighth-highest among these economies.

The figure far goes beyond the average (15.3 percent) of the 28-member European Union and the average (14.7 percent) of 19 eurozone countries for the corresponding year.

Most emerging economies posted figures lower than that of Korea. Poland (10th highest) recorded 20.3 percent, trailed by the Czech Republic (12th) at 16.9 percent, Slovenia (16th) at 15.2 percent, Lithuania (26th) at 11.7 percent, Latvia (27th) at 11.5 percent, Hungary (28th) with 10.4 percent and Russia (36th) at 6.7 percent.

Among countries posting under 15 percent were Finland (22nd) at 13.2 percent, France (25th) with 11.7 percent, Japan (29th) with 10.3 percent, Germany (30th) with 9.9 percent, Sweden (32nd) at 9.6 percent, Canada (34th) with 8.3 percent and Demark (35th) with 8.1 percent.

The figures for the US (the lowest among the 38) and Norway (second lowest) stood at 6.3 percent and 6.5 percent, respectively.

Only seven recorded higher self-employed percentages than Korea. Those were Costa Rica, Chile, Mexico, Turkey, Brazil, Greece and Colombia.

Meanwhile, the financial difficulties of Korea’s microbusiness owners -- in line with a higher burden of labor costs and weak consumer sentiments -- is seen from the lending data of commercial banks.

Apart from the first-tier financial firms, a large portion of the self-employed were found to have borrowed from second-tier lenders.

The outstanding loans issued by commercial banks to the self-employed came to 313.8 trillion won ($267.7 billion) as of the end of 2018, up 8.7 percent (or 25 trillion won) from the previous year, Bank of Korea data showed.

The 2017-2018 comparison indicates that loans to the self-employed snowballed by 2 trillion won a month on average throughout last year.

Furthermore, the lending figure for the self-employed exceeded the on-year growth of mortgage loans (up 6.6 percent) issued to the household sector.

According to Nice Investors Service, the number of defaulters among the self-employed -- those who failed to repay their debt within 90 days -- came to 27,917 as of end-2018. This marked a 29 percent, or 6,249 individuals, increase in four years.

Data showed that the delinquency growth was sharpest -- by 0.24 percentage point -- among those in their 40s, followed by those in their 30s. Payment defaults also snowballed among those with low credit scores.

The proportion of self-employed delinquents has continued to increase over the past year -- 1.36 percent in March 2018, 1.39 percent in June, 1.41 percent in September and 1.43 percent in December.

By Kim Yon-se (kys@heraldcorp.com)

![[KH Explains] Hyundai's full hybrid edge to pay off amid slow transition to pure EVs](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/18/20240418050645_0.jpg&u=20240419100350)

![[From the Scene] Monks, Buddhists hail return of remains of Buddhas](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/04/19/20240419050617_0.jpg&u=20240419175937)

![[KH Explains] Hyundai's full hybrid edge to pay off amid slow transition to pure EVs](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/04/18/20240418050645_0.jpg&u=20240419100350)

![[Today’s K-pop] Illit drops debut single remix](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=642&simg=/content/image/2024/04/19/20240419050612_0.jpg&u=)