[Herald Interview] Dayli Marketplace opens doors to youth money management

By Son Ji-hyoungPublished : Nov. 19, 2017 - 15:23

The Korea Herald is publishing a series of interviews on promising startups in the fintech industry. This is the 4th installment. -- Ed.

For young adults at the beginning stage of their financial achievements, finding and holding on to cash is a new challenge and a constant battle.

They often face cost thresholds of private banking services by conventional banks, or find it challenging to seek alternatives, especially amid the record-low interest rate.

Moreover, tech-savvy youths often find it troublesome to use multiple mobile apps provided by each bank and securities firm.

One alternative could be the mobile app Broccoli, according to Chang Won-tae, chief operating officer of the startup Dayli Marketplace, which operates Broccoli.

For young adults at the beginning stage of their financial achievements, finding and holding on to cash is a new challenge and a constant battle.

They often face cost thresholds of private banking services by conventional banks, or find it challenging to seek alternatives, especially amid the record-low interest rate.

Moreover, tech-savvy youths often find it troublesome to use multiple mobile apps provided by each bank and securities firm.

One alternative could be the mobile app Broccoli, according to Chang Won-tae, chief operating officer of the startup Dayli Marketplace, which operates Broccoli.

“Digitization will not only cut costs and lower the entry barrier of personalized wealth management services, but will also meet growing demand for it,” Chang told The Korea Herald in a recent interview.

The 37-year-old former in-house financial consultant also pointed to young Koreans’ dependency on bank deposits to get cash returns, despite persistently low interest rates.

“(Dayli Marketplace) hopes more people will see higher yields through financial management tools suggested by (Broccoli),” he said.

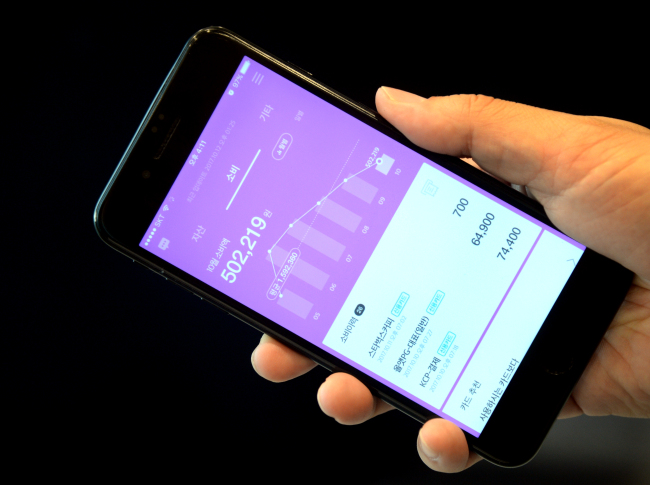

Launched in April 2016 for Android phones and in October last year for Apple devices, Broccoli shows users’ aggregate amount of money scattered around -- or possibly dormant -- in accounts of different banks and brokerages created for deposit, savings, equity trading and cash management.

Based on the total volume of cash a user holds, Broccoli -- Korea’s equivalent of online financial service providers like Mint or Personal Capital -- recommends ways to increase one’s money through banking, stock investments, equity fund purchases, as well as credit card discounts or cashbacks, and even air miles redemptions.

Broccoli also visualizes a user’s goal of saving for a certain event or purpose, like a wedding or home purchase, and the degree of attainment.

“(Dayli Marketplace) specifically targets youths who use more than two financial institutions or cards from more than two different credit firms, while feeling restrained to become private banking clients,” Chang said.

The 37-year-old former in-house financial consultant also pointed to young Koreans’ dependency on bank deposits to get cash returns, despite persistently low interest rates.

“(Dayli Marketplace) hopes more people will see higher yields through financial management tools suggested by (Broccoli),” he said.

Launched in April 2016 for Android phones and in October last year for Apple devices, Broccoli shows users’ aggregate amount of money scattered around -- or possibly dormant -- in accounts of different banks and brokerages created for deposit, savings, equity trading and cash management.

Based on the total volume of cash a user holds, Broccoli -- Korea’s equivalent of online financial service providers like Mint or Personal Capital -- recommends ways to increase one’s money through banking, stock investments, equity fund purchases, as well as credit card discounts or cashbacks, and even air miles redemptions.

Broccoli also visualizes a user’s goal of saving for a certain event or purpose, like a wedding or home purchase, and the degree of attainment.

“(Dayli Marketplace) specifically targets youths who use more than two financial institutions or cards from more than two different credit firms, while feeling restrained to become private banking clients,” Chang said.

The backbone of Broccoli’s operation is web-scraping technology, which harvests the financial records of banks and brokerages.

Through web scraping, the app tracks digital signature certificates needed for additional security in online financial services, extracts underlying codes and data, and replicates the content on users’ smartphones.

Broccoli’s scraper is run on E-Spider, an engine provided by Seoul-based Dayli Marketplace’s sister startup Heenam, both under Dayli Financial Group.

Calling the technology “labor-intensive,” Chang said Broccoli’s developers are in the process of expanding the number available for access, “within the startup’s capacity.”

Currently its scraper can gain access to digital signature certificates of all commercial, provincial and state-led banks, but among brokerages, eight out of 56 allow the scraper to track. The firm also partners eight card companies for its card recommendation function.

Meanwhile, the app is not currently serviceable for Kakao Bank, as Korea’s second online-only bank has adopted a blockchain-based security platform for user authentication, instead of digital signature certificates.

The scraping technology had been open exclusively to banks and other financial businesses after it first arrived in Korea in the late 1990s. However, Broccoli has begun to spearhead efforts to allow customers to benefit from the formerly business-to-business technology, Chang said.

Moreover, Broccoli’s neutrality gives it an edge over other high-tech banking apps, most of which also use scraping technology, added Chang.

“Broccoli does not sell any particular banking service, unlike conventional banking firms, allowing its users to stay neutral in their choice that suits best to them,” he said. “That’s one of the strengths of a fintech startup.”

As of October, Broccoli has seen some 550,000 downloads and some 100,000 monthly active users. Among its users, nearly 90 percent were either in their 20s or 30s. This shows the “awareness” of customers in the Korean market, says Chang.

Founded in 2015, Dayli Marketplace, formerly known as Yello Marketplace, only operates Broccoli, as it has suspended operations of other apps such as the financial comparison platform Mopic. The firm acquired the ISO 27001 information security standard on Oct. 26, which shows its security is at the level of conventional financial players.

By Son Ji-hyoung

(consnow@heraldcorp.com)

Through web scraping, the app tracks digital signature certificates needed for additional security in online financial services, extracts underlying codes and data, and replicates the content on users’ smartphones.

Broccoli’s scraper is run on E-Spider, an engine provided by Seoul-based Dayli Marketplace’s sister startup Heenam, both under Dayli Financial Group.

Calling the technology “labor-intensive,” Chang said Broccoli’s developers are in the process of expanding the number available for access, “within the startup’s capacity.”

Currently its scraper can gain access to digital signature certificates of all commercial, provincial and state-led banks, but among brokerages, eight out of 56 allow the scraper to track. The firm also partners eight card companies for its card recommendation function.

Meanwhile, the app is not currently serviceable for Kakao Bank, as Korea’s second online-only bank has adopted a blockchain-based security platform for user authentication, instead of digital signature certificates.

The scraping technology had been open exclusively to banks and other financial businesses after it first arrived in Korea in the late 1990s. However, Broccoli has begun to spearhead efforts to allow customers to benefit from the formerly business-to-business technology, Chang said.

Moreover, Broccoli’s neutrality gives it an edge over other high-tech banking apps, most of which also use scraping technology, added Chang.

“Broccoli does not sell any particular banking service, unlike conventional banking firms, allowing its users to stay neutral in their choice that suits best to them,” he said. “That’s one of the strengths of a fintech startup.”

As of October, Broccoli has seen some 550,000 downloads and some 100,000 monthly active users. Among its users, nearly 90 percent were either in their 20s or 30s. This shows the “awareness” of customers in the Korean market, says Chang.

Founded in 2015, Dayli Marketplace, formerly known as Yello Marketplace, only operates Broccoli, as it has suspended operations of other apps such as the financial comparison platform Mopic. The firm acquired the ISO 27001 information security standard on Oct. 26, which shows its security is at the level of conventional financial players.

By Son Ji-hyoung

(consnow@heraldcorp.com)

![[Graphic News] More Koreans say they plan long-distance trips this year](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/17/20240417050828_0.gif&u=)

![[KH Explains] Hyundai's full hybrid edge to pay off amid slow transition to pure EVs](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/18/20240418050645_0.jpg&u=20240419100350)

![[From the Scene] Monks, Buddhists hail return of remains of Buddhas](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/04/19/20240419050617_0.jpg&u=20240419175937)

![[KH Explains] Hyundai's full hybrid edge to pay off amid slow transition to pure EVs](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/04/18/20240418050645_0.jpg&u=20240419100350)

![[Today’s K-pop] Illit drops debut single remix](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=642&simg=/content/image/2024/04/19/20240419050612_0.jpg&u=)