South Korea and Canada clinched a standing bilateral currency swap deal that will help expand financial exchanges between the two countries, Seoul's central bank said Thursday.

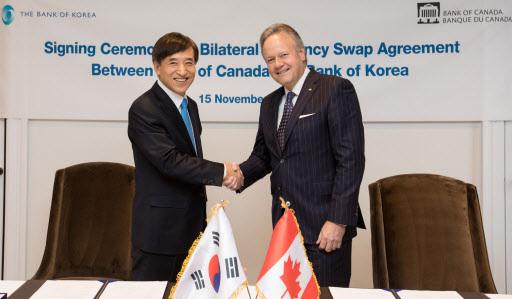

Bank of Korea Governor Lee Ju-yeol and his Canadian counterpart Stephen S. Poloz signed the agreement at a ceremony at the Bank of Canada's head office in Ottawa, on Wednesday, according to the BOK.

Bank of Korea Governor Lee Ju-yeol and his Canadian counterpart Stephen S. Poloz signed the agreement at a ceremony at the Bank of Canada's head office in Ottawa, on Wednesday, according to the BOK.

The liquidity swap arrangement does not stipulate any ceilings. "The arrangement allows for the provision of liquidity in each jurisdiction to support domestic financial stability should market conditions warrant," the BOK said in a statement.

"This effectively enables the Bank of Canada to provide Canadian dollars to the Bank of Korea and to provide liquidity in Korean Won to financial institutions in Canada, should the need arise. Likewise, the Bank of Korea can provide Korean Won to the Bank of Canada, as well as provide liquidity in Canadian dollars to financial institutions in Korea."

Finance Minister Kim Dong-yeon said the liquidity swap arrangement means South Korea has secured a powerful "safety net" that can be used in case of a crisis.

"The deal could help improve South Korea's overseas credibility and further deepen economic and financial cooperation between the two countries," Kim said in a briefing in central Seoul.

Market watchers said the agreement will add to South Korea's financial stability, as Canada is one of the most credible countries around the globe. Last month, Seoul also agreed to extend a currency swap deal with Beijing.

Kim also said South Korea will expand currency swap deals with other major countries to bolster financial safety net, though he did not go into details.

A currency swap is a tool for defending against financial turmoil by allowing a country beset by a liquidity crunch to borrow money from others with its own currency. (Yonhap)

![[KH Explains] Hyundai's full hybrid edge to pay off amid slow transition to pure EVs](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/18/20240418050645_0.jpg&u=20240419100350)

![[From the Scene] Monks, Buddhists hail return of remains of Buddhas](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/04/19/20240419050617_0.jpg&u=20240419175937)

![[KH Explains] Hyundai's full hybrid edge to pay off amid slow transition to pure EVs](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/04/18/20240418050645_0.jpg&u=20240419100350)

![[Today’s K-pop] Illit drops debut single remix](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=642&simg=/content/image/2024/04/19/20240419050612_0.jpg&u=)