[ANALYST REPORT] Construction: Government moves to stabilize presales market

By Korea HeraldPublished : June 30, 2016 - 13:38

WHAT’S THE STORY?

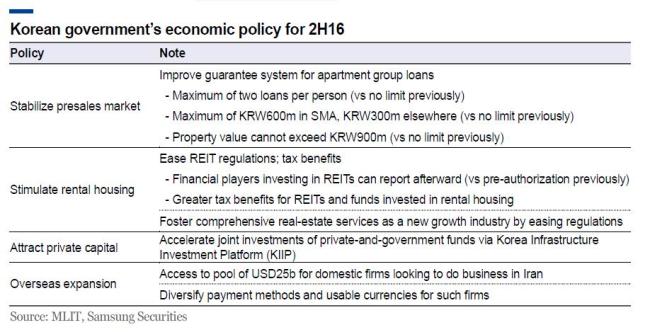

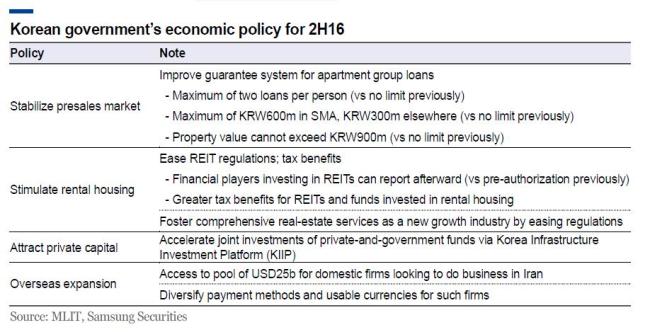

2H policy includes plan to stabilize presales market: Korea’s Ministry of Strategy and Finance yesterday released its 2H economic policy, with a KRW20t financial improvement plan (including a KRW10t supplementary budget), while policies related to housing and construction comprise measures to: 1) stabilize the nation’s overheated presales market; 2) stimulate rentals via REITs; 3) expand the infrastructure for publicprivate partnerships [PPPs]; and 4) support overseas orders. We see the first measure as the most meaningful and detailed, and expect Korea’s Housing & Urban Guarantee Corporation (HUG) to start limiting apartment group loan guarantees to two per person— with a maximum combined value of KRW600m in the Seoul Metropolitan Area (SMA) and six other major cities and KRW300m elsewhere—for properties valued at no more than KRW900m. Officials say the move is meant to support home buyers, not speculators.

Regional divergence to widen; constructors flush with cash to stand out Construction shares started underperforming in Oct 2015 as officials contemplated the introduction of new mortgage-review guidelines, but they rebounded in mid-December after presales market and group loans were excluded from the regulation.

Even though the guarantee-related regulation is unlikely to dampen the overall presales market, it should widen regional divergence and might serve as share-price catalysts for players with abundant cash. HDC and Hyundai E&C both have positive net cash and less exposure than Daelim Industrial, Daewoo E&C, and GS E&C to presales volume outside the SMA.

Limiting HUG-guaranteed group loans for apartments valued at KRW900m or less should cool overheated presale prices in the Gangnam area of Seoul, but it is unlikely to hit real housing demand, since: 1) Seoul apartments sized at 85 sqm have an average presales price of KRW660m; 2) only 1.7% of HUG-guaranteed group loans over January-May exceeded the KRW900 threshold; and 3) there is the two loan ceiling of KRW600m.

Group loans for apartments priced over KRW900m will have to be guaranteed by constructors and not HUG, which will likely bring bank loan interest-rate hikes of 0.5-1.0%. Constructors that cannot afford to guarantee group loans may have difficulty obtaining loans, so bidding competitiveness should be dictated by their financials.

If the stricter group-loan regulations are implemented, we would expect it to slash presales transactions, especially outside of the SMA—as presales there accounted for 40% of related apartment transactions over January-May—as such areas were already hit by tighter mortgage-review guidelines enacted last month that caused apartment prices and transaction volume to both fall. In contrast, the SMA housing market remains solid, thanks to apartment redevelopment projects, with data released on Jun 27 showing that the area’s unsold inventory fell 6.5% last month as it rose 9.8% elsewhere—the latter due in part to Ulsan, where such inventories soared 171.3% for the month amid industrial restructurings. Such disparities are bound to widen more rapidly going forward.

Source: Samsung Securities

2H policy includes plan to stabilize presales market: Korea’s Ministry of Strategy and Finance yesterday released its 2H economic policy, with a KRW20t financial improvement plan (including a KRW10t supplementary budget), while policies related to housing and construction comprise measures to: 1) stabilize the nation’s overheated presales market; 2) stimulate rentals via REITs; 3) expand the infrastructure for publicprivate partnerships [PPPs]; and 4) support overseas orders. We see the first measure as the most meaningful and detailed, and expect Korea’s Housing & Urban Guarantee Corporation (HUG) to start limiting apartment group loan guarantees to two per person— with a maximum combined value of KRW600m in the Seoul Metropolitan Area (SMA) and six other major cities and KRW300m elsewhere—for properties valued at no more than KRW900m. Officials say the move is meant to support home buyers, not speculators.

Regional divergence to widen; constructors flush with cash to stand out Construction shares started underperforming in Oct 2015 as officials contemplated the introduction of new mortgage-review guidelines, but they rebounded in mid-December after presales market and group loans were excluded from the regulation.

Even though the guarantee-related regulation is unlikely to dampen the overall presales market, it should widen regional divergence and might serve as share-price catalysts for players with abundant cash. HDC and Hyundai E&C both have positive net cash and less exposure than Daelim Industrial, Daewoo E&C, and GS E&C to presales volume outside the SMA.

Limiting HUG-guaranteed group loans for apartments valued at KRW900m or less should cool overheated presale prices in the Gangnam area of Seoul, but it is unlikely to hit real housing demand, since: 1) Seoul apartments sized at 85 sqm have an average presales price of KRW660m; 2) only 1.7% of HUG-guaranteed group loans over January-May exceeded the KRW900 threshold; and 3) there is the two loan ceiling of KRW600m.

Group loans for apartments priced over KRW900m will have to be guaranteed by constructors and not HUG, which will likely bring bank loan interest-rate hikes of 0.5-1.0%. Constructors that cannot afford to guarantee group loans may have difficulty obtaining loans, so bidding competitiveness should be dictated by their financials.

If the stricter group-loan regulations are implemented, we would expect it to slash presales transactions, especially outside of the SMA—as presales there accounted for 40% of related apartment transactions over January-May—as such areas were already hit by tighter mortgage-review guidelines enacted last month that caused apartment prices and transaction volume to both fall. In contrast, the SMA housing market remains solid, thanks to apartment redevelopment projects, with data released on Jun 27 showing that the area’s unsold inventory fell 6.5% last month as it rose 9.8% elsewhere—the latter due in part to Ulsan, where such inventories soared 171.3% for the month amid industrial restructurings. Such disparities are bound to widen more rapidly going forward.

Source: Samsung Securities

-

Articles by Korea Herald

![[Herald Interview] 'Amid aging population, Korea to invite more young professionals from overseas'](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/24/20240424050844_0.jpg&u=20240424200058)

![[KH Explains] Korean shipbuilding stocks rally: Real growth or bubble?](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/04/25/20240425050656_0.jpg&u=)