[ANALYST REPORT] Hana Financial Group: Foreigners are buying for good reasons

By Korea HeraldPublished : June 20, 2016 - 18:19

BUY and 6M TP of W33,000 maintained

- The target price is derived by applying the target P/B of 0.4x to the 2016E BPS of W77,857.

- Over the last three months, Hana Financial Group’s foreign ownership gained nearly 0.9%p. This compares with most of its peer banks (other than Woori Bank), which saw their foreign ownership decline considerably.

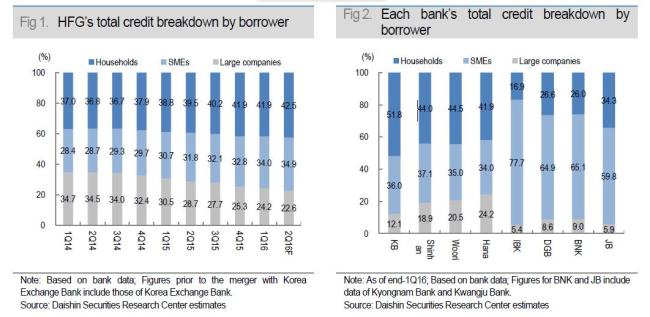

-There are two reasons why foreign investors are buying Hana Financial Group. First, its exposure to large company loans is forecast to decrease a whopping 7.0% in 2Q16. The high level of such exposure in the past, one of Hana Financial Group’s weaknesses, diminished as much as 36.7% in the recent two years, significantly reducing its risk related to large companies. The large company loans-to-total credits ratio has fallen about 12%p during the past two years and dropped to 22.6% in 2Q16, which is similar to that of other commercial banks.

-Second, the ratio of Common Equity Tier-1 capital to risk-weighted assets is likely to rise in 2Q16, hovering above 10.5%. Hana Financial Group has aggressively controlled its risk-weighted assets through the “Return on Risk-Weighted Assets” analysis. With the capital adequacy concerns having disappeared, Hana Financial Group will be offering even stronger dividend merit. Given that earnings are likely to substantially rise yoy this year and assuming the payout ratio remains unchanged yoy at 21-22%, 2016 per-share dividend is forecast at W900, which translates into a dividend yield of 3.9%. In other words, Hana Financial Group could be highlighted as a dividend play. With the total dividends likely to increase this year, the interim dividend is forecast at W250 or higher (up from W150 in previous years).

- Hana Financial Group is likely to report weak 2Q16 earnings, as it has to set up additional provisions for Daewoo Shipbuilding & Marine Engineering and Dlive. But 2Q16 earnings are likely to come in better than feared, given that 1) recurring provisions are likely to fall; 2) non-interest income (such as gains related to bond investments) could increase amid falling interest rates; and 3) selling & administrative expense is predicted to diminish.

- Profitability is low, with ROA hovering below 0.4%, but the current P/B of 0.30x (P/E of 5.5x) is the lowest among banks.

2Q16E NP of W282.0bn slightly below consensus, but better than feared

- 2Q16 NP is forecast to fall 35.6% qoq to W282.0bn, slightly missing the market consensus of W325.0bn, but coming in higher than feared in the market.

- Total loans are forecast to decrease 0.5% qoq as large company loans decrease more than 7%. Despite the key rate cut announced in June, Hana Bank’s 2Q16 NIM is forecast to remain flat qoq at 1.40%. Accordingly, NP is predicted to go up qoq, as the second quarter has more business days than the first quarter.

- Hana Financial Group is projected to incur about W180bn in additional expenses (W55.0bn in additional provision for DSME whose loans will be reclassified as “precautionary loans;” either an impairment loss or W100bn in provisions, resulting from the debt-to-equity conversion for the loans extended to Dlive; and W30bn in additional provision for Hanjin Shipping). But 2Q16 bad debt expense is forecast at only W320bn owing to the reversal of some provisions for the companies that begin restructuring as well as the reduction in recurring provisions.

- Post-merger integration cost of W210bn (for IT system upgrade and corporate identity management) will be depreciated over the next 3-5 years. Furthermore, it will be offset by the post-merger reduction in IT maintenance cost. As such, 2Q16 selling & administrative expense is forecast to decrease about 2.0% yoy to less than W1tn.

- The won-dollar exchange rate has risen from the end of March, creating concerns over potential foreign exchange translation losses, but the exchange rate is likely to rise only by W20-30 from the current level. Furthermore, non-interest income is likely to come in strong, as bond investments produce large gains owing to the recent key rate cut and the subsequent decline in market rates. Hana Financial Group generates a large share of earnings from currency and bond trading compared to its peers, and thus its non-interest income tends to rise significantly when interest rates decline.

Potential risk factors lurking (FTC ruling on CD rate collusion charge, Brexit referendum); In favorable turn of events, shares to rebound most significantly

- At its June 22 plenary session, the Fair Trade Commission will make a ruling on the charge of Hana Financial Group colluding on CD interest rates. On June 23 will be the British referendum on the country’s membership in the EU. Depending on the FTC ruling, banks could be fined with W100-200bn. And if the UK leaves the EU, financial markets will be disrupted, dampening the overall investor sentiment towards financial stocks (short-term risk factor).

- The situation still hangs in the balance, but developments of the events favorable to banking stocks will trigger Hana Financial Group to rebound most significantly.

Source: Daishin Securities (www.daishin.co.kr)

-

Articles by Korea Herald

![[Graphic News] More Koreans say they plan long-distance trips this year](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/17/20240417050828_0.gif&u=)

![[KH Explains] Hyundai's full hybrid edge to pay off amid slow transition to pure EVs](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/18/20240418050645_0.jpg&u=20240419100350)

![[From the Scene] Monks, Buddhists hail return of remains of Buddhas](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/04/19/20240419050617_0.jpg&u=20240419175937)

![[KH Explains] Hyundai's full hybrid edge to pay off amid slow transition to pure EVs](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/04/18/20240418050645_0.jpg&u=20240419100350)

![[Today’s K-pop] Illit drops debut single remix](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=642&simg=/content/image/2024/04/19/20240419050612_0.jpg&u=)