Korea’s National Pension Service, which manages the world’s third-largest public pension fund after Japan and Norway, said it decided to increase the fund’s allocation in global investments in its mid-to-long-term fund investment portfolio.

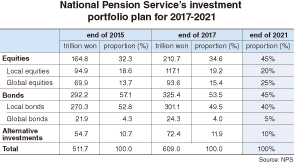

According to the plan finalized at the health minister-led fund management committee Monday, the combined proportion of investment in global equities, bonds and alternatives will increase to more than 35 percent of the total fund by 2021 from 24.3 percent as of the end of 2015. The proportion of local stocks and bonds will be reduced to less than 65 percent by 2021 from 75.7 percent as of the end of 2015, NPS said.

According to the plan finalized at the health minister-led fund management committee Monday, the combined proportion of investment in global equities, bonds and alternatives will increase to more than 35 percent of the total fund by 2021 from 24.3 percent as of the end of 2015. The proportion of local stocks and bonds will be reduced to less than 65 percent by 2021 from 75.7 percent as of the end of 2015, NPS said.

Under the plan for the period of 2017-21, the investment proportion of global stocks will rise to around 25 percent of the fund in 2021 from 13.7 percent in 2015. The overseas bond portfolio will also increase to 5 percent from 4.3 percent during the cited period.

“The investment plan aims to improve the fund’s long-term profitability and stability, diversifying portfolio in global investments,” said Paek Jin-ju, an official at the division of national pension finance at NPS.

The NPS said it aims to reap 5 percent average return from the fund investment in 2017-21, though the pension fund’s average return stood at 4.6 percent in 2015. During the period 2006-15, the average return was 5.5 percent.

The fund’s investment in local equities will be slashed to less than 20 percent and the local bond portfolio will be also cut to 40 percent in 2021 from 52.8 percent in 2015, the NPS said.

It is the first time the pension fund’s allocation in local stocks has fallen below 20 percent since the NPS adopted the mid-to-long-term investment planning system in 2006.

The nation’s largest institutional investor’s reduction of the local stock portfolio will not immediately affect the Korean stock market, said Oh Hyun-seok, an analyst at Samsung Securities.

“I assume the NPS will not start selling local stocks immediately. The reduction will be gradual, which will have little impact on the local bourse,” Oh said.

The NPS allocated a total of 94.9 trillion won ($80.5 billion) in local stocks as of the end of 2015, according to the NPS.

Among listed Korean firms, construction materials maker LG Hausys had the largest NPS share, at 13.42 percent as of the end of March.

Korea Electric Terminal, an electric connectors-maker, and SK Chemicals had the second and third highest NPS stakes with 13.13 percent and 12.96 percent, respectively. Drugmaker LG Life Sciences and retailer Hyundai Green Food trailed at 12.95 percent and 12.89 percent, respectively, as of the end of March.

The fund managed by the NPS is expected to grow from 511.7 trillion won in 2015 to 609 trillion won in 2017 and peak at 2,561 trillion won in 2043, the NPS said.

By Kim Yoon-mi (yoonmi@heraldcorp.com)

-

Articles by Korea Herald

![[Herald Interview] 'Amid aging population, Korea to invite more young professionals from overseas'](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/24/20240424050844_0.jpg&u=20240424200058)

![[Pressure points] Leggings in public: Fashion statement or social faux pas?](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/23/20240423050669_0.jpg&u=)