[SUPER RICH] Aekyung Group gains big as Jeju Air goes public

By Korea HeraldPublished : Nov. 17, 2015 - 18:31

Aekyung Group’s low-cost carrier Jeju Air went public on Nov. 6, 10 years after its establishment, increasing the assets of the the midsize retailer and household goods conglomerate’s controlling family.

Jeju Air debuted on the nation’s main bourse KOSPI at 48,100 won ($41.16) per share.

Affiliates of Aekyung Group own a combined stake of 67.5 percent in Jeju Air -- with AK Holdings having 57.2 percent and Aekyung Co. 10.26 percent.

As regards AK Holdings, group family members and its affiliates control a combined 64.73 percent stake in the company. Group chairwoman Chang Young-shin holds 8.18 percent, and her children Chae Hyeong-seok and Chae Dong-seok hold 16.14 percent and 9.34 percent, respectively. Her other two children, Chae Seung-seok and Chae Eun-jeong, own 8.30 percent and 3.85 percent stakes, respectively. A total of 9.73 percent stake of AK Holdings is held by Aekyung Co. and 9.19 percent by Aekyung Development Co., taking the overall stake of the family and affiliate companies to 64.73 percent.

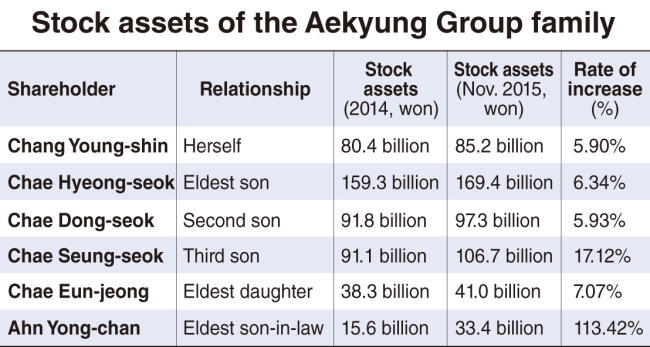

After the successful initial public offering, the market value of the combined assets of the family rose substantially. As of Nov. 9, vice chairman Chae Hyeong-seok’s stock value rose to 169.4 billion won, a 6.34 percent increase from the previous year, and vice president Chae Dong-seok’s shares rose 5.93 percent to 97.3 billion won.

Aekyung Development Co. president Chae Seung-seok saw the value of shares rise up to 106.7 billion won, a 17.12 percent increase from last year.

Aekyung Industrial vice president Chae Eun-jeong’s shares rose to 41.0 billion won, a 7.07 increase on-year. Chae’s husband Ahn Yong-chan, vice chairman of Aekyung Group and Jeju Air, saw his shares grow 113 percent this year to 33.4 billion won.

In Ahn’s case, his assets have increased not only because of Jeju Air, but also because the estimated market value of NeoPharm -- of which he owns 65.33 percent -- rose substantially. The shares of NeoPharm have been trading at around the 30,000 won mark this week.

Meanwhile, chairwoman Chang Young-shin saw her shares rise 5.9 percent over the past year to 85.2 billion won. She officially retired from company management in 2004.

Jeju Air, the largest low-cost carrier in the country, was the third Korean airline -- and the first Korean low-cost airline -- to go public, after Korean Air and Asiana Airlines.

It grew steadily with the backing of Aekyung Group. Founded in 2005, the airline recorded losses for the first five years, but the group continued on, expanding air routes and using well-known stars to promote Jeju Air. As a result, the carrier saw its first profit in 2011 and has been in the black since then.

On the first day of its IPO, its market valuation rose to 1.2 trillion won, surpassing that of Asiana Airlines, whose market valuation is 971.6 billion won.

Though Asiana Airlines saw 5.8 trillion won in sales last year -- ten times that of Jeju Air at 510.6 billion won -- the market viewed Jeju Air positively.

Analysts expect Jeju Air to improve its performance compared to Asiana Airlines, as it continues to grow with the expanded air routes and additional sales.

By The Korea Herald Superrich Team (sangyj@heraldcorp.com)

Hong Seung-wan, Cheon Ye-seon, Bae Ji-sook, Yoon Hyun-jong, Min Sang-seek, Kim Hyun-il, Sang Youn-joo

-

Articles by Korea Herald

![[Kim Seong-kon] Democracy and the future of South Korea](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/16/20240416050802_0.jpg&u=)

![[KH Explains] Hyundai's full hybrid edge to pay off amid slow transition to pure EVs](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/04/18/20240418050645_0.jpg&u=20240418181020)

![[Today’s K-pop] Zico drops snippet of collaboration with Jennie](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=642&simg=/content/image/2024/04/18/20240418050702_0.jpg&u=)