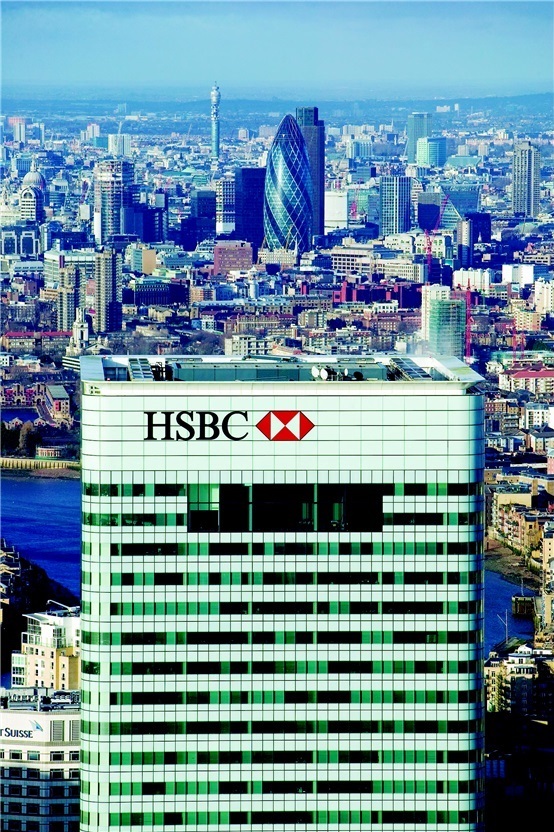

The National Pension Service, South Korea’s pension manager, said Sunday that it sold the HSBC headquarters building in Canary Wharf, London, U.K. to Qatar Investment Authority, Qatar’s sovereign wealth fund last week.

The NPS, which acquired the real estate asset in 2009, gained 960 billion won ($900 million), including dividends of 419 billion won, from the sale.

The Korean pension operator was able to reap 1.65 times the investment it made in the building five years ago with the net internal rate of return of 12 percent, it noted.

“The sale of the HSBC building will be a good example of how the NPS was able to gain stable returns in the mid-to-long term by spreading potential risks through investment diversification overseas,” NPS CEO Choi Kwang said in a statement.

“Although the competition to invest in alternative assets will further increase, the NPS will expand its overseas investments to gain stable and sustainable returns,” he added.

The Korean pension manager acquired the 45-story HSBC tower located in Canary Wharf, one of London’s three lucrative office markets, when the value of the asset decreased 30 percent amid the global financial crisis.

The NPS noted that it grabbed the opportunity to purchase the building when there were not many potential bidders in the market as the crisis made most investors turn to safe-haven assets.

“The opportunity to buy the HSBC tower could only have been offered to funds in Singapore or the Middle East if it was on sale before the financial crisis,” said an official of the NPS.

“The time was ripe for the NPS to jump into the London (office building market) when the real estate assets were facing corrections.”

The NPS began seeking alternative infrastructure assets in 2005 as part of its efforts to diversify the investment portfolio, which used to heavily focus on fixed-income securities, as it needed to gain higher returns to finance the growing population of pension receivers.

The pension was able to gain a 6.08 percent return, or 206.3 trillion won, on its investments between 1988 and October 2014, with total assets under its management at 568.2 trillion won.

It has invested 97.2 trillion won overseas, including stocks, bonds and alternative assets, as of the end of October this year.

By Park Hyong-ki (hkp@heraldcorp.com)

The NPS, which acquired the real estate asset in 2009, gained 960 billion won ($900 million), including dividends of 419 billion won, from the sale.

The Korean pension operator was able to reap 1.65 times the investment it made in the building five years ago with the net internal rate of return of 12 percent, it noted.

“The sale of the HSBC building will be a good example of how the NPS was able to gain stable returns in the mid-to-long term by spreading potential risks through investment diversification overseas,” NPS CEO Choi Kwang said in a statement.

“Although the competition to invest in alternative assets will further increase, the NPS will expand its overseas investments to gain stable and sustainable returns,” he added.

The Korean pension manager acquired the 45-story HSBC tower located in Canary Wharf, one of London’s three lucrative office markets, when the value of the asset decreased 30 percent amid the global financial crisis.

The NPS noted that it grabbed the opportunity to purchase the building when there were not many potential bidders in the market as the crisis made most investors turn to safe-haven assets.

“The opportunity to buy the HSBC tower could only have been offered to funds in Singapore or the Middle East if it was on sale before the financial crisis,” said an official of the NPS.

“The time was ripe for the NPS to jump into the London (office building market) when the real estate assets were facing corrections.”

The NPS began seeking alternative infrastructure assets in 2005 as part of its efforts to diversify the investment portfolio, which used to heavily focus on fixed-income securities, as it needed to gain higher returns to finance the growing population of pension receivers.

The pension was able to gain a 6.08 percent return, or 206.3 trillion won, on its investments between 1988 and October 2014, with total assets under its management at 568.2 trillion won.

It has invested 97.2 trillion won overseas, including stocks, bonds and alternative assets, as of the end of October this year.

By Park Hyong-ki (hkp@heraldcorp.com)

![[Herald Interview] 'Amid aging population, Korea to invite more young professionals from overseas'](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/24/20240424050844_0.jpg&u=20240424200058)

![[KH Explains] Korean shipbuilding stocks rally: Real growth or bubble?](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/04/25/20240425050656_0.jpg&u=)