Samsung Electronics shares rally amid Lee’s health woes

By Park Hyung-kiPublished : May 13, 2014 - 20:53

Samsung Electronics shares have been rallying over the past two days despite its owner and chairman remaining in the hospital after a heart treatment.

Analysts said expectations of Korea’s largest conglomerate improving its corporate governance through equity restructuring efforts since last year have boosted investors’ sentiment toward Korea’s most liquid stock.

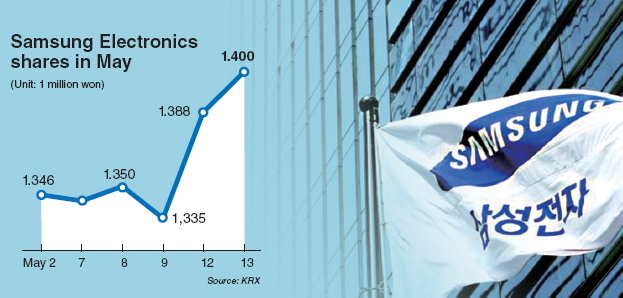

Samsung Electronics rose 0.86 percent to 1.4 million won on Tuesday.

Investors see that Samsung will not likely face a management vacuum as the group has already begun its leadership transition to Lee’s only son Jay-yong.

Samsung SDS’ recent announcement that it would launch an initial public offering was part of the plan that offered a clearer picture, signaling an expected change in ownership and governance as the market hopes Jay-yong will bring innovation and adopt new management approaches for Samsung.

This has alleviated concerns over the future path of Korea’s biggest company, turning foreign investors into net buyers of Samsung stocks, especially for shares of Samsung Electronics.

“Expectations of changes in governance following the IPO plan will boost the value of Samsung (shares),” said Lee Kyung-ja, an analyst at Korea Investment & Securities.

Given that Samsung Electronics is undervalued despite sustaining high profits from its smartphone sales, analysts forecast Samsung Electronics shares to continue their bullish run.

“The market can expect Samsung Electronics shares to further increase as uncertainty over its governance has waned,” said a local asset manager.

Samsung Group, Korea’s largest family-run conglomerate, has been restructuring its key affiliates through mergers and acquisitions since last year, in an apparent move in line with chairman Lee’s inheritance plan for Jay-yong and his two daughters ― Boo-jin and Seo-hyun.

Samsung SDS merged with SNS, Samsung SDI merged with Cheil Industries and Samsung General Chemicals with Samsung Petrochemical. Samsung SDS’ IPO had been viewed as a way for the Lee family to raise further capital for the inheritance process.

It has been said that Lee’s son Jay-yong could use the capital raised from SDS’ public offering to take over the critical Samsung Life Insurance’s 20.76 percent stake owned by the chairman. It is the share, as analysts said, that would help Jay-yong maintain future control over the group of electronics and financial companies.

Samsung Medical Center, meanwhile, said Tuesday that although chairman Lee’s health has become stable, it may take some time for him to gain full consciousness.

By Park Hyong-ki and Oh Kyu-wook

(hkp@heraldcorp.com)

Analysts said expectations of Korea’s largest conglomerate improving its corporate governance through equity restructuring efforts since last year have boosted investors’ sentiment toward Korea’s most liquid stock.

Samsung Electronics rose 0.86 percent to 1.4 million won on Tuesday.

Investors see that Samsung will not likely face a management vacuum as the group has already begun its leadership transition to Lee’s only son Jay-yong.

Samsung SDS’ recent announcement that it would launch an initial public offering was part of the plan that offered a clearer picture, signaling an expected change in ownership and governance as the market hopes Jay-yong will bring innovation and adopt new management approaches for Samsung.

This has alleviated concerns over the future path of Korea’s biggest company, turning foreign investors into net buyers of Samsung stocks, especially for shares of Samsung Electronics.

“Expectations of changes in governance following the IPO plan will boost the value of Samsung (shares),” said Lee Kyung-ja, an analyst at Korea Investment & Securities.

Given that Samsung Electronics is undervalued despite sustaining high profits from its smartphone sales, analysts forecast Samsung Electronics shares to continue their bullish run.

“The market can expect Samsung Electronics shares to further increase as uncertainty over its governance has waned,” said a local asset manager.

Samsung Group, Korea’s largest family-run conglomerate, has been restructuring its key affiliates through mergers and acquisitions since last year, in an apparent move in line with chairman Lee’s inheritance plan for Jay-yong and his two daughters ― Boo-jin and Seo-hyun.

Samsung SDS merged with SNS, Samsung SDI merged with Cheil Industries and Samsung General Chemicals with Samsung Petrochemical. Samsung SDS’ IPO had been viewed as a way for the Lee family to raise further capital for the inheritance process.

It has been said that Lee’s son Jay-yong could use the capital raised from SDS’ public offering to take over the critical Samsung Life Insurance’s 20.76 percent stake owned by the chairman. It is the share, as analysts said, that would help Jay-yong maintain future control over the group of electronics and financial companies.

Samsung Medical Center, meanwhile, said Tuesday that although chairman Lee’s health has become stable, it may take some time for him to gain full consciousness.

By Park Hyong-ki and Oh Kyu-wook

(hkp@heraldcorp.com)

![[AtoZ into Korean mind] Humor in Korea: Navigating the line between what's funny and not](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/22/20240422050642_0.jpg&u=)

![[Exclusive] Korean military set to ban iPhones over 'security' concerns](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/23/20240423050599_0.jpg&u=20240423183955)

![[Graphic News] 77% of young Koreans still financially dependent](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/22/20240422050762_0.gif&u=)

![[Herald Interview] Why Toss invited hackers to penetrate its system](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/22/20240422050569_0.jpg&u=20240422150649)

![[Exclusive] Korean military to ban iPhones over security issues](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/04/23/20240423050599_0.jpg&u=20240423183955)

![[Today’s K-pop] Ateez confirms US tour details](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=642&simg=/content/image/2024/04/23/20240423050700_0.jpg&u=)