[Meet the CEO] Sungho CEO sees R&D as a core competence

By Korea HeraldPublished : Nov. 3, 2011 - 19:23

Kosdaq-listed frontrunner in capacitor eyes future-oriented items for growth

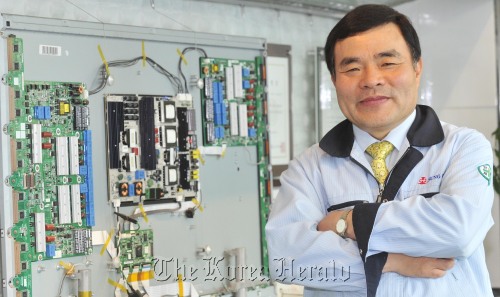

Park Hwan-woo, president and CEO of KOSDAQ-listed Sungho Electronics Co. (www.sungho.net) was quick to use a metaphor in explaining what the company’s core business is. And his metaphor of choice is a human heart.

Not that Sungho is making an artificial heart. The company’s specialty is producing capacitors, a component used extensively for a variety of electronic devices. So instead of blood, Park said the capacitors pump electricity in and out of such equipment.

“Capacitors, in short, control electricity flowing through a variety of devices including laptop computers, just like a human heart which drives the flow of blood in the body,” Park recently told The Korea Herald.

But the comparison should stop when it comes to the proportional size of capacitors versus hearts, as the electricity controllers come in much smaller sizes and wider varieties at Sungho’s factories in Korea and China, often a dozen for a single circuit board inserted to a computer.

Park said the business segment itself is largely settled and mature, so is the company’s leadership in the domestic market. Sungho’s key clients for its TV capacitors include Samsung Electronics and LG Electronics, which make up the lion share of the country’s display market.

“People call our company the top player in capacitors in Korea largely because they are built into Samsung and LG TVs, but their target segments are much larger,” Park said.

Park Hwan-woo, president and CEO of KOSDAQ-listed Sungho Electronics Co. (www.sungho.net) was quick to use a metaphor in explaining what the company’s core business is. And his metaphor of choice is a human heart.

Not that Sungho is making an artificial heart. The company’s specialty is producing capacitors, a component used extensively for a variety of electronic devices. So instead of blood, Park said the capacitors pump electricity in and out of such equipment.

“Capacitors, in short, control electricity flowing through a variety of devices including laptop computers, just like a human heart which drives the flow of blood in the body,” Park recently told The Korea Herald.

But the comparison should stop when it comes to the proportional size of capacitors versus hearts, as the electricity controllers come in much smaller sizes and wider varieties at Sungho’s factories in Korea and China, often a dozen for a single circuit board inserted to a computer.

Park said the business segment itself is largely settled and mature, so is the company’s leadership in the domestic market. Sungho’s key clients for its TV capacitors include Samsung Electronics and LG Electronics, which make up the lion share of the country’s display market.

“People call our company the top player in capacitors in Korea largely because they are built into Samsung and LG TVs, but their target segments are much larger,” Park said.

Capacitors are essential components for refrigerators, lighting devices and even automobiles. Future growth items such as solar devices are also related to a new generation of capacitors with advanced features.

Park said Sungho is at a technological crossroads.

“The overall trend is moving toward electric cars, solar inverters and medical devices,” he said. “To that end, the company is planning to upgrade the quality of products by investing more in its Chinese plants.”

Sungho entered the Chinese market about 10 years ago to cut costs and secure a solid production base for exports. It employs about 1,600 Chinese workers, and recently invested 15 billion won into an expansion project. Once the upgrade is completed in the first half of next year, the company’s Chinese factories will produce as many as the 100 million capacitors per month, up from the current 70 million units.

Nonetheless, Sungho faces the same problem that is increasingly befuddling other Korean firms that set up production bases in China: rapidly rising of wages.

“This year alone, wage-related costs went up about 20 percent,” Park said.

The slowing growth of the Korean economy, exacerbated by the deepening eurozone crisis and the recession fears for the U.S., is also a concern.

Reflecting the new risk factors, Park revealed that he revised down the earnings projection.

“We have lowered the estimated revenue for 2011 to 160 billion won,” Park said. Earlier, the company’s 2011 revenue target was 180 billion won.

Park said he also modified the mid-term revenue target: 180 billion won in 2012 and 220 billion won in 2013.

For all the challenges, Park seemed upbeat. After all, Sungho has proven its competence repeatedly over the past four decades. Established in 1973, the company has weathered a series of crises including the Asian financial crisis in 1997-98.

“The Asian financial crisis was tough, but the company survived and expanded,” said Park, who joined the company in 2002. “But another crisis hit the firm in 2005 as a major paradigm shift took place with LCD replacing CRT displays.”

Park said Sungho, whose business is essentially a production of components, is not as colorful and cutting-edge as other high-tech firms on KOSDAQ, but has secured its own position in the market by beefing up its research and development.

“Our strength, as demonstrated by our 40-year history, lies in constantly developing new technologies, and we believe this bolsters the company’s growth in the face of obstacles,” Park said.

Last year, the R &D budget was 2.8 percent of the company’s total revenue; this year, despite the gloomy outlook on the global market, the figure has been raised to 3 percent, he said.

By Yang Sung-jin (insight@heraldcorp.com)

-

Articles by Korea Herald

![[KH Explains] Hyundai's full hybrid edge to pay off amid slow transition to pure EVs](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/18/20240418050645_0.jpg&u=20240419100350)

![[From the Scene] Monks, Buddhists hail return of remains of Buddhas](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/04/19/20240419050617_0.jpg&u=20240419175937)

![[KH Explains] Hyundai's full hybrid edge to pay off amid slow transition to pure EVs](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/04/18/20240418050645_0.jpg&u=20240419100350)

![[Today’s K-pop] Illit drops debut single remix](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=642&simg=/content/image/2024/04/19/20240419050612_0.jpg&u=)