NEW YORK (AP) ― Netflix is trying to boost business by chopping its services into two separate parts. Unfortunately for investors, the company’s stock price is what’s really been cleaved.

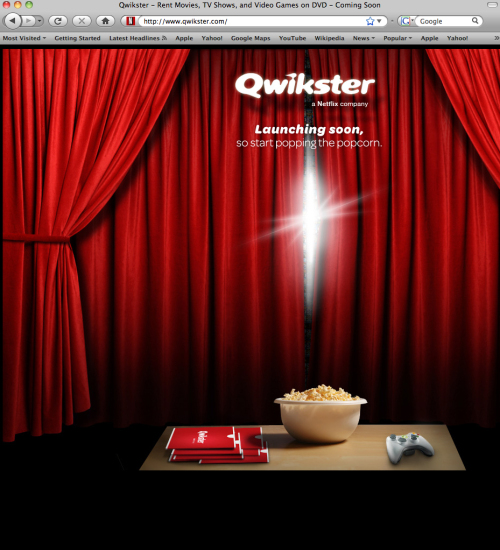

The company that once seemed like it could do no wrong has seen its stock lose half its value in the last two months. Netflix tumbled another 7.4 percent to $143.75 on Monday, on the same day that chief executive Reed Hastings sent an email to Netflix customers, announcing that the DVD-by-mail business that defined the company for much of its history will become a separate, renamed service called Qwikster.

Customers who subscribe to both streaming and DVDs will soon see two separate charges on their credit card statements and have to log on to two different websites.

It’s a hard landing for a company that made many investors rich while remaking the way that households watch movies. It was only ten months ago that Netflix’s success prompted Standard and Poor’s to add the company to its S&P 500 index, a broad measure of the stock market that is the basis for most U.S. mutual funds.

Since then, Netflix shares have dropped 26 percent. Some analysts now think the stock’s best days are behind it, beset by increased competition and its recent corporate blunders.

The company that once seemed like it could do no wrong has seen its stock lose half its value in the last two months. Netflix tumbled another 7.4 percent to $143.75 on Monday, on the same day that chief executive Reed Hastings sent an email to Netflix customers, announcing that the DVD-by-mail business that defined the company for much of its history will become a separate, renamed service called Qwikster.

Customers who subscribe to both streaming and DVDs will soon see two separate charges on their credit card statements and have to log on to two different websites.

It’s a hard landing for a company that made many investors rich while remaking the way that households watch movies. It was only ten months ago that Netflix’s success prompted Standard and Poor’s to add the company to its S&P 500 index, a broad measure of the stock market that is the basis for most U.S. mutual funds.

Since then, Netflix shares have dropped 26 percent. Some analysts now think the stock’s best days are behind it, beset by increased competition and its recent corporate blunders.

“Clearly the company is not going to grow at the rate that it has in the past few years,” said Michael Corty, an analyst at Morningstar who covers Netflix.

Two years ago, the company traded at around $45 a share. Its subscriber base was swelling at a rate of 25 percent a year as customers were drawn by the value of rental plans that included no late fees for DVDs and unlimited streaming of movies and television shows. The company was so successful at adding new customers that some analysts predicted it wouldn’t be long until consumers cut their cable cords and relied on Netflix alone for content.

Rising profits and a booming subscriber base helped lift Netflix’s stock price 219 percent last year to $175.70. As recently as February, investors were willing to pay $93 for $1 in the company’s profits.

The broad S&P 500 index, meanwhile, traded at a price to earnings ratio of 16.

But the last two months have upended those rosy growth scenarios. Since announcing higher prices on July 12, the company’s stock has plunged 51 percent from a high of $298.73.

Netflix announced on September 15 that its subscribers will fall to 24 million U.S. households at the end of the month ― only the second time in the company’s history that its subscriber base has dropped from one quarter to the next.

And the company faces increased competition from Amazon, Apple and a host of others, which will likely drive its costs higher.

“Netflix was basically a monopoly in the streaming business until about six months ago, and the effect was that content providers were underpricing their products,” said Charlie Wolf, an analyst who covers the company at Needham. On February 22nd, Amazon announced that it would stream 5,000 movies and television shows at no additional charge to customers who signed up for a Prime membership, which costs $79 a year.

Wolf said that increased competition among streaming companies meant that the balance of power was tipping back to the movie studios and networks that produce entertainment. These companies can now play Netflix and its competitors off of one another, creating higher profits for themselves and forcing streaming companies to raise their prices or cut into their margins. Netflix recently lost its license to stream popular movies from Starz Entertainment over a dispute over fees.

Streaming isn’t the only aspect of Netflix’s business that is coming under fire. Its traditional DVD business is also being challenged by Redbox, a division of Coinstar Inc. that rents DVDs at 33,330 kiosks in supermarkets and other retailers. Coinstar’s stock is up 6 percent over the last six months, compared with a 32 percent drop for Netflix.

Wolf thinks Netflix shares should trade at a fair value of $130 ―a 10 percent drop from Monday’s closing price.

Other analysts believe Netflix is bungling Qwikster’s rollout. “Netflix has built such a strong brand name, so to switch the name of the website now doesn’t make a lot of sense to me,” said Corty, the analyst at Morningstar.

He said any marketing or executive missteps could come back to hurt the company as its business faces more competition and potentially higher costs. Corty said, the new emphasis on streaming means Netflix will have to constantly renegotiate its licenses to stream movies, giving the companies that produce entertainment more leverage.

Corty says that he wouldn’t recommend buying Netflix until its shares fall to $90 ―a 37 percent drop from its current price.

But even amid the gloom about Netflix’s future direction, there are some investors sitting on gains and holding onto the stock because they assume more are to come. Jeanie Wyatt, the chief investment officer for South Texas Money Management, a firm with $1.9 billion in assets under management, began buying Netflix when it was trading at $120.

Her investment was once up 150 percent. Now it’s up just 25 percent. Even so, she attributed the company’s recent tumbles to growing pains. She believes the company will continue to perform better than the overall stock market over the next several years, in part because Qwikster will also rent video games by mail ― a first for the company.

![[KH Explains] Hyundai's full hybrid edge to pay off amid slow transition to pure EVs](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/18/20240418050645_0.jpg&u=20240419100350)

![[From the Scene] Monks, Buddhists hail return of remains of Buddhas](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/04/19/20240419050617_0.jpg&u=20240419175937)

![[KH Explains] Hyundai's full hybrid edge to pay off amid slow transition to pure EVs](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/04/18/20240418050645_0.jpg&u=20240419100350)

![[Today’s K-pop] Illit drops debut single remix](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=642&simg=/content/image/2024/04/19/20240419050612_0.jpg&u=)